As a Missourian, filing your taxes can be a daunting task, especially when it comes to navigating the complexities of Form 1040. However, with the right guidance, you can ensure a smooth and stress-free filing experience. In this article, we'll provide you with a comprehensive guide on how to file Form 1040 with ease, specifically tailored to the needs of Missouri residents.

The Importance of Accurate Tax Filing

Filing your taxes accurately is crucial to avoid any potential penalties, fines, or even audits. The IRS takes tax compliance seriously, and even minor mistakes can lead to significant consequences. By following the correct procedures and taking advantage of available tax credits and deductions, you can minimize your tax liability and maximize your refund.

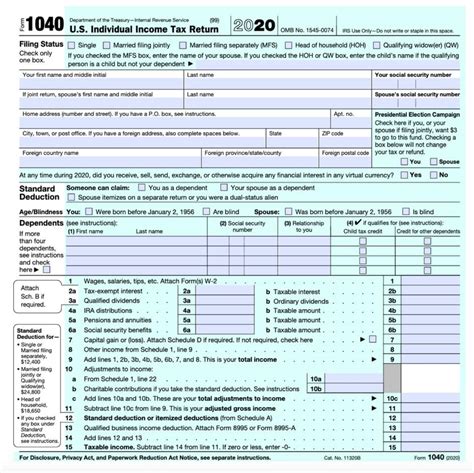

Understanding Form 1040

Form 1040 is the standard form used for personal income tax returns in the United States. It's used to report your income, claim deductions and credits, and calculate your tax liability. The form is divided into several sections, including:

- Personal Information: Your name, address, Social Security number, and filing status.

- Income: Your employment income, self-employment income, interest, dividends, and capital gains.

- Deductions and Credits: Your deductions for mortgage interest, charitable donations, and medical expenses, as well as credits for education expenses, child care, and retirement savings.

- Tax Liability: Your total tax liability, including any additional taxes owed or refunds due.

Gathering Necessary Documents

Before starting your tax return, make sure you have all the necessary documents. These include:

- W-2 Forms: From your employer, showing your income and taxes withheld.

- 1099 Forms: For self-employment income, freelance work, or other sources of income.

- Interest Statements: From banks, credit unions, or other financial institutions.

- Dividend Statements: From investments, such as stocks or mutual funds.

- Charitable Donation Receipts: For donations made to qualified organizations.

- Medical Expense Records: For medical expenses, including prescriptions, doctor visits, and hospital stays.

Filing Status and Dependents

Your filing status and dependents can significantly impact your tax liability. Make sure to choose the correct filing status:

- Single: Unmarried or separated individuals.

- Married Filing Jointly: Married couples filing together.

- Married Filing Separately: Married couples filing separately.

- Head of Household: Unmarried individuals with dependents.

- Qualifying Widow(er): Recently widowed individuals with dependents.

Claiming dependents can also reduce your tax liability. You may claim dependents if:

- They are related to you: By blood, marriage, or adoption.

- They live with you: For more than six months of the tax year.

- You provide more than half their support: For the tax year.

Missouri State Taxes

As a Missouri resident, you're required to file a state tax return in addition to your federal return. Missouri state taxes are relatively straightforward, with a few key considerations:

- State Income Tax: Missouri has a progressive income tax system, with rates ranging from 1.5% to 5.2%.

- State Deductions: Missouri allows deductions for mortgage interest, charitable donations, and medical expenses.

- State Credits: Missouri offers credits for education expenses, child care, and retirement savings.

Tax Credits and Deductions

Tax credits and deductions can significantly reduce your tax liability. Some popular credits and deductions for Missourians include:

- Earned Income Tax Credit (EITC): For low-income working individuals and families.

- Child Tax Credit: For families with qualifying children under the age of 17.

- Mortgage Interest Deduction: For mortgage interest paid on your primary residence.

- Charitable Donation Deduction: For donations made to qualified organizations.

Filing Your Tax Return

Now that you've gathered your documents and understand the basics of Form 1040, it's time to file your tax return. You can file your return:

- Electronically: Through the IRS website or tax software, such as TurboTax or H&R Block.

- By Mail: By mailing your return to the IRS address listed in the instructions.

Tips and Reminders

- File on time: Avoid late-filing penalties by submitting your return by the deadline.

- Double-check your return: Review your return for errors and inaccuracies before submitting.

- Take advantage of tax credits and deductions: Claim all eligible credits and deductions to minimize your tax liability.

Conclusion

Filing your taxes can seem daunting, but with the right guidance, you can ensure a smooth and stress-free experience. By following the tips and guidelines outlined in this article, you'll be well on your way to filing your Form 1040 with ease. Remember to take advantage of available tax credits and deductions, and don't hesitate to seek professional help if needed.

What is the deadline for filing Form 1040?

+The deadline for filing Form 1040 is typically April 15th of each year. However, this deadline may be extended if you file for an automatic six-month extension.

Can I file my tax return electronically?

+What is the Earned Income Tax Credit (EITC)?

+The Earned Income Tax Credit (EITC) is a tax credit for low-income working individuals and families. The credit amount varies based on income, family size, and other factors.