The state of Georgia has implemented a new tax form, known as Form G-1003, to streamline the process of filing taxes for individuals and businesses. As a taxpayer in Georgia, it is essential to understand the purpose, benefits, and requirements of this form to ensure a smooth and accurate tax filing experience. In this article, we will delve into five essential facts about Georgia Form G-1003, providing you with a comprehensive overview of this critical tax document.

What is Georgia Form G-1003?

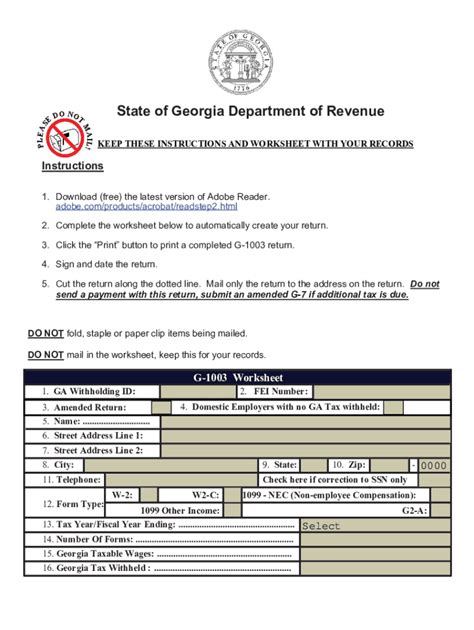

Georgia Form G-1003 is a tax form used by the state of Georgia to report and pay individual income tax withholdings. This form is also known as the "Georgia Withholding Tax Adjustment" form. It is designed to help taxpayers adjust their withholding amounts to ensure they are not overpaying or underpaying their taxes throughout the year.

Who Needs to File Georgia Form G-1003?

Form G-1003 is required for individuals and businesses that have a tax liability in the state of Georgia. This includes:

- Employers who withhold income taxes from employee wages

- Self-employed individuals who are required to make estimated tax payments

- Businesses that have a tax liability, such as corporations and partnerships

- Individuals who have a tax liability, including those who are self-employed or have income from investments

Benefits of Filing Georgia Form G-1003

Filing Form G-1003 provides several benefits to taxpayers, including:

- Accurate tax withholding: By filing Form G-1003, taxpayers can ensure that their withholding amounts are accurate, reducing the risk of overpaying or underpaying taxes.

- Reduced tax liability: By adjusting withholding amounts, taxpayers can reduce their tax liability, resulting in a lower tax bill.

- Avoid penalties: Filing Form G-1003 can help taxpayers avoid penalties and interest associated with underpayment or overpayment of taxes.

- Simplified tax filing: Form G-1003 simplifies the tax filing process by providing a single form for reporting and paying individual income tax withholdings.

How to File Georgia Form G-1003

Filing Form G-1003 is a straightforward process that can be completed online or by mail. To file online, taxpayers can use the Georgia Department of Revenue's online filing system, which is available on their website. To file by mail, taxpayers can download the form from the Georgia Department of Revenue's website and mail it to the address listed on the form.

Requirements for Filing Georgia Form G-1003

To file Form G-1003, taxpayers must meet the following requirements:

- Have a tax liability in the state of Georgia

- Have a valid Georgia tax account number

- Provide accurate and complete information on the form

- Pay any required tax withholding amounts

- File the form by the required deadline

Common Mistakes to Avoid When Filing Georgia Form G-1003

When filing Form G-1003, taxpayers should avoid the following common mistakes:

- Failing to provide accurate and complete information

- Failing to pay required tax withholding amounts

- Filing the form late or missing the deadline

- Not keeping accurate records of tax withholdings and payments

Conclusion

In conclusion, Georgia Form G-1003 is an essential tax form for individuals and businesses in the state of Georgia. By understanding the purpose, benefits, and requirements of this form, taxpayers can ensure a smooth and accurate tax filing experience. By avoiding common mistakes and filing the form correctly, taxpayers can reduce their tax liability, avoid penalties, and simplify the tax filing process.

We encourage you to share your thoughts and experiences with Georgia Form G-1003 in the comments below. If you have any questions or need further clarification on this topic, please don't hesitate to ask.

What is the purpose of Georgia Form G-1003?

+The purpose of Georgia Form G-1003 is to report and pay individual income tax withholdings.

Who needs to file Georgia Form G-1003?

+Individuals and businesses with a tax liability in the state of Georgia need to file Form G-1003.

What are the benefits of filing Georgia Form G-1003?

+The benefits of filing Form G-1003 include accurate tax withholding, reduced tax liability, avoided penalties, and simplified tax filing.