New Jersey, with its beautiful beaches, vibrant cities, and strong economy, attracts people from all over the world. If you're a non-resident who has earned income in New Jersey, you're required to file a tax return with the state. The NJ 1040NR form is specifically designed for non-residents, and in this article, we'll guide you through the process of completing and filing this form.

As a non-resident, it's essential to understand your tax obligations in New Jersey. Failure to file the NJ 1040NR form can result in penalties and fines. In this article, we'll cover the who, what, when, where, and how of filing the NJ 1040NR form.

Who Needs to File the NJ 1040NR Form?

You need to file the NJ 1040NR form if you're a non-resident who has earned income in New Jersey. This includes:

- Individuals who are not residents of New Jersey but have income from a New Jersey source

- Individuals who are residents of New Jersey for only part of the year

- Estates and trusts that have income from a New Jersey source

- Non-resident partners and shareholders of New Jersey partnerships and S corporations

What is Considered New Jersey Source Income?

New Jersey source income includes:

- Wages and salaries earned in New Jersey

- Income from a business or profession conducted in New Jersey

- Rent and royalty income from New Jersey property

- Interest and dividends from New Jersey sources

- Capital gains from the sale of New Jersey property

What is the NJ 1040NR Form?

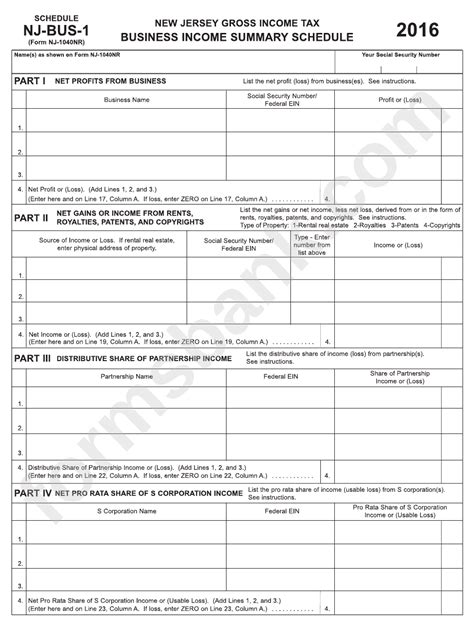

The NJ 1040NR form is the non-resident income tax return for the state of New Jersey. It's used to report income earned in New Jersey by non-residents and to calculate the amount of tax owed to the state. The form is similar to the federal income tax return, but it's specific to New Jersey and requires information about New Jersey source income.

What Information is Required on the NJ 1040NR Form?

The NJ 1040NR form requires the following information:

- Personal and contact information

- Income from New Jersey sources

- Deductions and exemptions

- Tax credits

- Payment information

How to Complete the NJ 1040NR Form

To complete the NJ 1040NR form, follow these steps:

- Gather all necessary documents, including W-2s, 1099s, and receipts for deductions and credits.

- Fill out the form accurately and completely, using black ink and printing clearly.

- Calculate your total income from New Jersey sources.

- Claim deductions and exemptions, such as the standard deduction or itemized deductions.

- Calculate your tax liability and any tax credits.

- Make a payment, if necessary, using a check or money order.

Where to File the NJ 1040NR Form

The NJ 1040NR form can be filed electronically or by mail.

- Electronic filing: Use the New Jersey Division of Taxation's online filing system, NJ WebFile, to file your return electronically.

- Mail filing: Send your completed return to:

New Jersey Division of Taxation P.O. Box 110 Trenton, NJ 08695-0110

When to File the NJ 1040NR Form

The NJ 1040NR form is due on April 15th of each year. If you need an extension, you can file Form NJ-630, Application for Extension of Time to File, by April 15th.

Penalties for Not Filing the NJ 1040NR Form

Failure to file the NJ 1040NR form can result in penalties and fines, including:

- Late filing penalty: 5% of the unpaid tax per month, up to 25%

- Late payment penalty: 0.5% of the unpaid tax per month, up to 25%

- Interest on unpaid tax

Additional Resources

For more information on the NJ 1040NR form, including instructions and forms, visit the New Jersey Division of Taxation's website at .

In conclusion, the NJ 1040NR form is an essential document for non-residents who have earned income in New Jersey. By understanding who needs to file, what information is required, and how to complete the form, you can ensure compliance with New Jersey tax laws and avoid penalties and fines. If you have any questions or concerns, don't hesitate to reach out to the New Jersey Division of Taxation or a tax professional.

We hope this guide has been helpful in understanding the NJ 1040NR form. If you have any further questions or comments, please don't hesitate to share them below.

Who needs to file the NJ 1040NR form?

+Non-residents who have earned income in New Jersey need to file the NJ 1040NR form.

What is considered New Jersey source income?

+New Jersey source income includes wages and salaries earned in New Jersey, income from a business or profession conducted in New Jersey, rent and royalty income from New Jersey property, interest and dividends from New Jersey sources, and capital gains from the sale of New Jersey property.

Where can I find the NJ 1040NR form?

+The NJ 1040NR form can be downloaded from the New Jersey Division of Taxation's website at .