Losing a loved one can be a difficult and emotional experience, and navigating the complex process of filing a claim for an annuity beneficiary can add to the stress. Prudential, one of the largest insurance companies in the world, offers a range of annuity products that can provide financial security for beneficiaries in the event of the policyholder's passing. In this article, we will guide you through the process of filing a Prudential annuity beneficiary claim form, providing you with the necessary information and steps to ensure a smooth and efficient claim process.

Understanding Prudential Annuity Beneficiary Claims

Before we dive into the claim process, it's essential to understand what an annuity beneficiary is and how it works. An annuity is a financial product that provides a guaranteed income stream for a set period or for life in exchange for a lump sum payment or series of payments. When you purchase an annuity, you can designate one or more beneficiaries to receive the annuity payments in the event of your passing.

Prudential offers various types of annuities, including fixed, variable, and indexed annuities. Each type of annuity has its unique features, benefits, and claim process. As a beneficiary, you will need to understand the specific type of annuity and the claim process involved.

Prudential Annuity Beneficiary Claim Form Process

To file a claim for a Prudential annuity beneficiary, you will need to follow these steps:

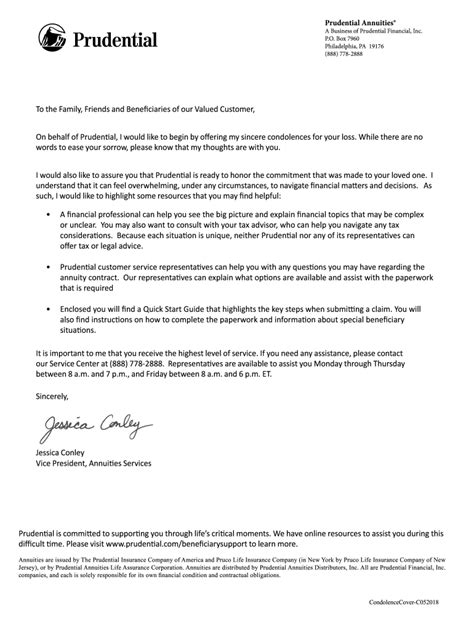

- Notify Prudential: Inform Prudential of the policyholder's passing by calling their customer service number or submitting a notification form on their website. You will need to provide the policyholder's name, policy number, and date of passing.

- Gather Required Documents: Collect the necessary documents, including:

- The policyholder's death certificate

- The annuity contract or policy documents

- Proof of your identity and beneficiary status

- Any other documents requested by Prudential

- Complete the Claim Form: Download and complete the Prudential annuity beneficiary claim form, which can be found on their website or obtained by contacting their customer service. The form will require you to provide personal and policy information, as well as documentation to support your claim.

- Submit the Claim Form: Submit the completed claim form and supporting documents to Prudential via mail, fax, or email.

Tips and Reminders

- Ensure you have all the necessary documents and information before submitting the claim form to avoid delays or rejection.

- Keep a copy of the claim form and supporting documents for your records.

- If you have any questions or concerns, don't hesitate to contact Prudential's customer service for assistance.

- Be aware of the claim processing timeline, which may vary depending on the complexity of the claim and the documentation required.

Common Challenges and Solutions

- Lost or Missing Policy Documents: If you cannot find the policy documents, contact Prudential's customer service, and they will guide you through the process of obtaining replacement documents.

- Incomplete or Incorrect Claim Form: Ensure you complete the claim form accurately and thoroughly. If you're unsure about any section, contact Prudential's customer service for clarification.

- Delays in Claim Processing: If you experience delays in claim processing, contact Prudential's customer service to inquire about the status of your claim.

Prudential Annuity Beneficiary Claim Form FAQs

- What is the typical processing time for a Prudential annuity beneficiary claim? The processing time may vary depending on the complexity of the claim and the documentation required. However, Prudential typically processes claims within 30-60 days.

- Can I submit a claim online? Currently, Prudential does not offer online claim submission. However, you can download and complete the claim form on their website and submit it via mail, fax, or email.

- How do I know if I am eligible to receive annuity payments as a beneficiary? Check the policy documents or contact Prudential's customer service to confirm your beneficiary status and eligibility for annuity payments.

What documents do I need to provide to support my claim?

+You will need to provide the policyholder's death certificate, the annuity contract or policy documents, proof of your identity and beneficiary status, and any other documents requested by Prudential.

Can I appoint multiple beneficiaries for my annuity policy?

+Yes, you can appoint multiple beneficiaries for your annuity policy. However, you will need to specify the percentage of the annuity payments each beneficiary will receive.

How do I contact Prudential's customer service for assistance with my claim?

+You can contact Prudential's customer service by calling their toll-free number, submitting a request on their website, or emailing them directly.

We hope this comprehensive guide has provided you with the necessary information and steps to file a Prudential annuity beneficiary claim form. If you have any further questions or concerns, don't hesitate to reach out to Prudential's customer service for assistance.