The Internal Revenue Service (IRS) requires certain businesses and organizations to file various tax forms to report their income, expenses, and other financial activities. One such form is Form 7004, which is used to request an automatic extension of time to file certain business income tax returns. In this article, we will discuss how to file Form 7004 by mail, including the necessary IRS mailing addresses.

What is Form 7004?

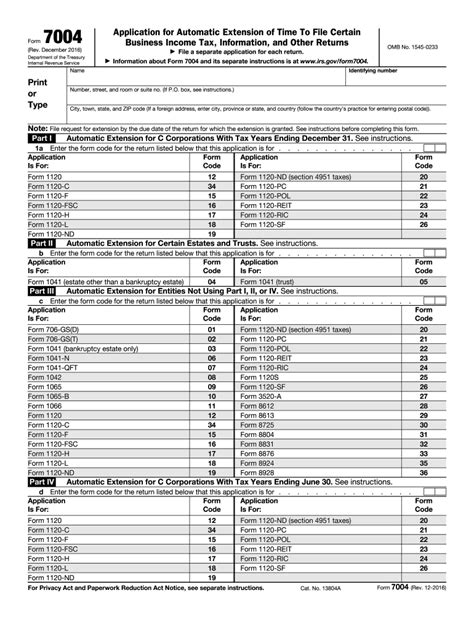

Form 7004 is an application for automatic extension of time to file certain business income tax, information, and other returns. It is used by businesses and organizations that need more time to file their tax returns, such as partnerships, corporations, and estates. The form is typically filed by the original deadline of the tax return, which varies depending on the type of return.

Benefits of Filing Form 7004

Filing Form 7004 provides several benefits to businesses and organizations, including:

- Automatic extension of time to file: By filing Form 7004, businesses can automatically extend the time to file their tax returns by 5 to 6 months, depending on the type of return.

- Avoidance of penalties: Filing Form 7004 can help businesses avoid penalties and interest on late-filed tax returns.

- More time to gather information: The extra time provided by filing Form 7004 can help businesses gather all necessary information and documentation to accurately complete their tax returns.

Who Needs to File Form 7004?

The following types of businesses and organizations need to file Form 7004:

- Partnerships: Partnerships that need more time to file their Form 1065, U.S. Return of Partnership Income.

- Corporations: Corporations that need more time to file their Form 1120, U.S. Corporation Income Tax Return.

- Estates: Estates that need more time to file their Form 1041, U.S. Income Tax Return for Estates and Trusts.

- Other returns: Other types of returns, such as Form 1065-B, U.S. Return of Income for Electing Large Partnerships, and Form 1120S, U.S. Income Tax Return for an S Corporation.

How to File Form 7004 by Mail

To file Form 7004 by mail, businesses and organizations need to follow these steps:

- Download and complete Form 7004: Businesses can download Form 7004 from the IRS website or obtain it from their tax professional. They need to complete the form accurately and provide all required information.

- Determine the correct mailing address: Businesses need to determine the correct IRS mailing address based on their location and the type of return they are filing.

- Attach a check or money order: Businesses need to attach a check or money order for the estimated tax payment, if applicable.

- Mail the form: Businesses need to mail the completed Form 7004 to the correct IRS mailing address.

IRS Mailing Addresses for Form 7004

The IRS mailing addresses for Form 7004 vary depending on the location and the type of return. Here are some of the common mailing addresses:

- Internal Revenue Service

- Center where you filed your original return

- Internal Revenue Service

- 1160 W 700 S

- Ogden, UT 84404

- Internal Revenue Service

- 1190 W 700 S

- Ogden, UT 84404

Note: Businesses should check the IRS website for the most up-to-date mailing addresses and instructions.

Important Reminders

- File on time: Businesses need to file Form 7004 by the original deadline of their tax return to avoid penalties and interest.

- Pay estimated tax: Businesses need to pay estimated tax by the original deadline to avoid penalties and interest.

- Keep records: Businesses need to keep records of their Form 7004 filing, including the mailing address and proof of mailing.

Conclusion

Filing Form 7004 by mail can provide businesses and organizations with more time to file their tax returns and avoid penalties and interest. By following the steps outlined in this article, businesses can ensure that they file Form 7004 correctly and on time.