The Maryland state government has implemented various measures to support its residents, including the Supplemental Unemployment Tax, also known as Form 502SU. This tax is crucial for individuals who have received unemployment benefits and need to report them on their tax returns. In this article, we will delve into the details of Maryland Form 502SU, explaining its purpose, who needs to file it, and how to complete it accurately.

What is Maryland Form 502SU?

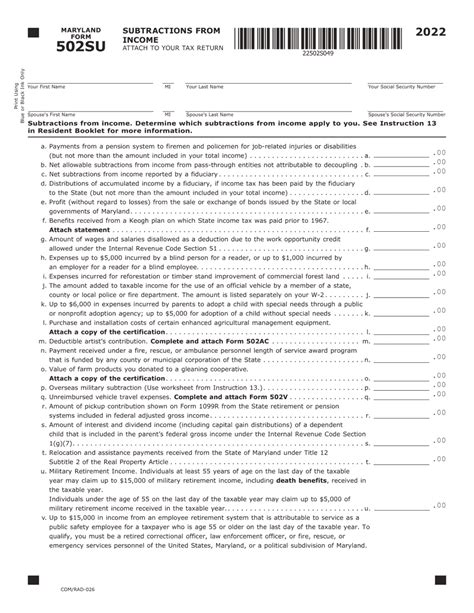

Maryland Form 502SU is a supplemental tax form used to report unemployment benefits received by individuals during the tax year. The form is used to calculate the tax owed on these benefits and to claim any eligible credits or deductions. The state of Maryland requires individuals who have received unemployment benefits to file this form along with their annual tax return, Form 502.

Who Needs to File Maryland Form 502SU?

Not everyone who receives unemployment benefits needs to file Maryland Form 502SU. The following individuals are required to file this form:

- Those who received unemployment benefits from the Maryland Department of Labor, Licensing and Regulation (DLLR) during the tax year.

- Individuals who received unemployment benefits from another state or the federal government, but are Maryland residents.

- Those who need to report unemployment benefits on their Maryland tax return, Form 502.

How to Complete Maryland Form 502SU

Completing Maryland Form 502SU requires some basic information and calculations. Here's a step-by-step guide to help you fill out the form accurately:

- Gather Required Documents: Collect your unemployment benefits statements, Form 1099-G, and any other relevant documents.

- Enter Unemployment Benefits: Report the total amount of unemployment benefits received during the tax year on Line 1 of Form 502SU.

- Calculate Tax Owed: Use the Maryland tax tables or the Maryland income tax calculator to determine the tax owed on your unemployment benefits. Enter this amount on Line 2 of Form 502SU.

- Claim Credits and Deductions: If eligible, claim any credits or deductions on Lines 3-5 of Form 502SU. Common credits and deductions include the Earned Income Tax Credit (EITC) and the Maryland subtraction modification for unemployment benefits.

- Calculate Total Tax: Add the tax owed on unemployment benefits to any other tax owed on your Maryland tax return. Enter this total on Line 6 of Form 502SU.

Tips and Reminders

- File Maryland Form 502SU along with your annual tax return, Form 502, by the designated deadline to avoid penalties and interest.

- Use the correct tax year and form number when filing Maryland Form 502SU.

- Keep accurate records of your unemployment benefits and tax documents to ensure accurate completion of the form.

- If you have questions or concerns, consult the Maryland Comptroller's office or a tax professional for assistance.

Frequently Asked Questions

What is the deadline to file Maryland Form 502SU?

+The deadline to file Maryland Form 502SU is the same as the deadline for filing your annual tax return, Form 502. Typically, this deadline is April 15th of each year.

Can I e-file Maryland Form 502SU?

+Yes, you can e-file Maryland Form 502SU through the Maryland Comptroller's website or through a tax software provider.

What happens if I don't file Maryland Form 502SU?

+If you don't file Maryland Form 502SU, you may be subject to penalties and interest on the tax owed. Additionally, you may not be able to claim eligible credits or deductions.

By understanding the purpose and requirements of Maryland Form 502SU, you can ensure accurate completion and avoid any potential penalties or interest. If you have any further questions or concerns, don't hesitate to reach out to the Maryland Comptroller's office or a tax professional for assistance.

Share Your Thoughts

We hope this article has provided you with a comprehensive understanding of Maryland Form 502SU. If you have any comments, questions, or suggestions, please share them with us in the comments section below. Don't forget to share this article with friends and family who may benefit from this information.