As a resident of Virginia, understanding your tax obligations is crucial to avoid any penalties or fines. One of the most important tax forms in Virginia is the Form 502A, also known as the "Schedule of Adjustments". This form is used to report adjustments to income, deductions, and credits that are not reported on the federal tax return. In this article, we will delve into the world of Virginia Form 502A, explaining its tax requirements, guidelines, and providing practical examples to help you navigate the process.

What is Virginia Form 502A?

Virginia Form 502A is a supplemental form that must be filed with the Virginia Department of Taxation (TAX) along with the federal tax return (Form 1040). The purpose of this form is to report any adjustments to income, deductions, and credits that are not reported on the federal tax return. These adjustments may include items such as:

- State-specific deductions and exemptions

- Local taxes and fees

- Adjustments to federal adjusted gross income (AGI)

- State-specific credits and incentives

Who Needs to File Form 502A?

Not everyone needs to file Form 502A. You are required to file this form if you have any of the following:

- State-specific deductions and exemptions that exceed the federal standard deduction

- Local taxes and fees that are not reported on the federal tax return

- Adjustments to federal AGI that affect your Virginia taxable income

- State-specific credits and incentives that are not reported on the federal tax return

However, if you have no adjustments to report, you can simply file the federal tax return (Form 1040) and attach a copy of the Virginia Schedule 1 (Form 760) to your return.

Tax Requirements for Form 502A

To file Form 502A, you will need to gather the following information:

- Your federal tax return (Form 1040)

- Your Virginia Schedule 1 (Form 760)

- Any supporting documentation for state-specific deductions and exemptions

- Any supporting documentation for local taxes and fees

- Any supporting documentation for adjustments to federal AGI

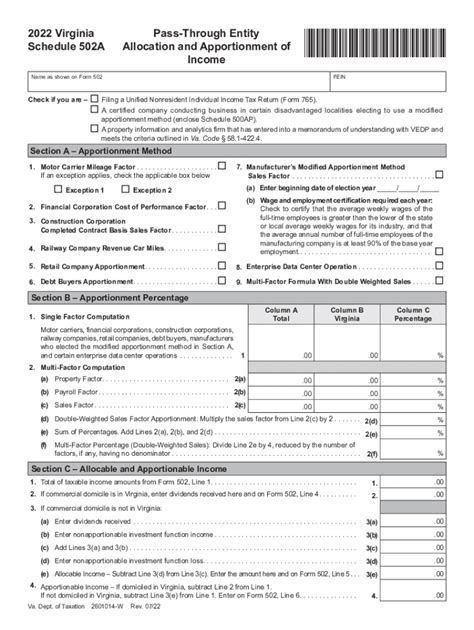

Once you have gathered all the necessary information, you can begin filling out Form 502A. The form is divided into several sections, including:

- Section 1: Adjustments to Federal Adjusted Gross Income (AGI)

- Section 2: State-Specific Deductions and Exemptions

- Section 3: Local Taxes and Fees

- Section 4: State-Specific Credits and Incentives

Each section requires you to report specific information and calculate the adjustments accordingly.

Section 1: Adjustments to Federal AGI

In this section, you will report any adjustments to federal AGI that affect your Virginia taxable income. This may include items such as:

- State-specific deductions and exemptions

- Local taxes and fees

- Adjustments to federal AGI for state-specific purposes

You will need to report the federal AGI from your Form 1040 and then calculate the adjustments accordingly.

Guidelines for Filing Form 502A

To ensure accurate and timely filing of Form 502A, follow these guidelines:

- File Form 502A along with your federal tax return (Form 1040) and Virginia Schedule 1 (Form 760)

- Use the correct form and instructions for the tax year you are filing

- Report all required information accurately and completely

- Attach all supporting documentation, including receipts and invoices

- File electronically or by mail, depending on your preference

Penalties for Late or Inaccurate Filing

Failure to file Form 502A or filing an inaccurate return can result in penalties and fines. The Virginia Department of Taxation may impose the following penalties:

- Late filing penalty: 6% of the tax due for each month or part of a month, up to a maximum of 30%

- Inaccurate filing penalty: 20% of the tax due

To avoid these penalties, it is essential to file Form 502A accurately and on time.

Conclusion

Understanding Virginia Form 502A is crucial for accurate and timely filing of your state tax return. By following the guidelines and requirements outlined in this article, you can ensure compliance with the Virginia Department of Taxation and avoid any penalties or fines. Remember to file Form 502A along with your federal tax return and Virginia Schedule 1, and attach all supporting documentation to avoid any delays or issues.

We encourage you to share your thoughts and experiences with filing Form 502A in the comments below. Have you encountered any challenges or difficulties with filing this form? Do you have any questions or concerns about the tax requirements and guidelines? Let us know, and we will do our best to assist you.

FAQ Section:

What is the purpose of Virginia Form 502A?

+The purpose of Virginia Form 502A is to report adjustments to income, deductions, and credits that are not reported on the federal tax return.

Who needs to file Form 502A?

+You are required to file Form 502A if you have state-specific deductions and exemptions, local taxes and fees, adjustments to federal AGI, or state-specific credits and incentives.

What are the penalties for late or inaccurate filing of Form 502A?

+The Virginia Department of Taxation may impose a late filing penalty of 6% of the tax due for each month or part of a month, up to a maximum of 30%, and an inaccurate filing penalty of 20% of the tax due.