Filling Out Social Security Form 1724 Made Easy

Are you a representative payee managing the finances of a Social Security beneficiary? If so, you're likely familiar with the importance of accurately completing Social Security Form 1724, also known as the "Report of Income and Resources" form. This form is crucial for reporting the beneficiary's income and resources to the Social Security Administration (SSA). However, filling out this form can be a daunting task, especially for those who are new to managing someone's finances.

In this article, we'll break down the process of filling out Social Security Form 1724, step by step, to help you navigate the complexities of this form. We'll cover the importance of accuracy, common mistakes to avoid, and provide practical tips to make the process easier.

Why is Social Security Form 1724 Important?

Social Security Form 1724 is essential for the SSA to determine the beneficiary's eligibility for benefits and to ensure that the correct amount of benefits is paid. As a representative payee, it's your responsibility to accurately report the beneficiary's income and resources. Failure to do so can result in incorrect benefit payments, which can lead to financial difficulties and potential penalties.

Understanding the Form

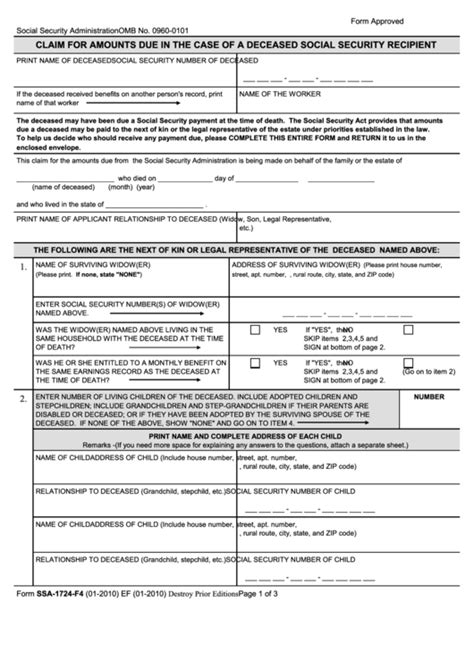

Before we dive into the step-by-step guide, let's take a closer look at the form itself. Social Security Form 1724 consists of several sections, each designed to collect specific information about the beneficiary's income and resources.

The form is divided into the following sections:

- Section 1: Beneficiary Information

- Section 2: Income

- Section 3: Resources

- Section 4: Deductions

- Section 5: Certification

Each section is crucial for accurately reporting the beneficiary's financial situation.

Step-by-Step Guide to Filling Out Social Security Form 1724

Now that we've covered the importance and layout of the form, let's move on to the step-by-step guide.

Section 1: Beneficiary Information

- Provide the beneficiary's name, Social Security number, and date of birth.

- List the beneficiary's address and phone number.

Section 2: Income

- Report the beneficiary's income from all sources, including:

- Wages

- Self-employment income

- Interest income

- Dividend income

- Rental income

- Provide documentation to support the reported income, such as pay stubs, tax returns, and bank statements.

Section 3: Resources

- List the beneficiary's resources, including:

- Cash

- Savings accounts

- Checking accounts

- Stocks

- Bonds

- Real estate

- Provide documentation to support the reported resources, such as bank statements and property deeds.

Section 4: Deductions

- List the beneficiary's deductions, including:

- Medical expenses

- Housing expenses

- Food expenses

- Provide documentation to support the reported deductions, such as receipts and invoices.

Section 5: Certification

- Certify that the information provided is accurate and complete.

- Sign and date the form.

Tips for Accurate Completion

To ensure accurate completion of Social Security Form 1724, follow these tips:

- Use black ink and print clearly.

- Use the correct Social Security number and beneficiary name.

- Report all income and resources, even if you're not sure if they're relevant.

- Provide documentation to support the reported information.

- Double-check the form for errors before submitting.

Common Mistakes to Avoid

When filling out Social Security Form 1724, it's essential to avoid common mistakes that can lead to delays or incorrect benefit payments. Here are some mistakes to watch out for:

- Incorrect Social Security number or beneficiary name.

- Failure to report all income and resources.

- Incomplete or inaccurate documentation.

- Failure to sign and date the form.

Conclusion

Filling out Social Security Form 1724 can seem daunting, but by following this step-by-step guide and tips, you can ensure accurate completion. Remember to report all income and resources, provide documentation to support the reported information, and avoid common mistakes.

By taking the time to complete the form accurately, you'll help ensure that the beneficiary receives the correct amount of benefits and avoid potential financial difficulties.

We hope this article has been helpful in guiding you through the process of filling out Social Security Form 1724. If you have any questions or concerns, please don't hesitate to reach out to the Social Security Administration for assistance.

Take Action

- Download Social Security Form 1724 from the SSA website or pick one up at your local SSA office.

- Gather all necessary documentation, including pay stubs, tax returns, and bank statements.

- Follow the step-by-step guide to complete the form accurately.

- Submit the completed form to the SSA by the deadline.

Share Your Thoughts

Have you filled out Social Security Form 1724 before? Share your experiences and tips in the comments below.

FAQ Section

What is Social Security Form 1724?

+Social Security Form 1724 is a report of income and resources form used by the Social Security Administration to determine a beneficiary's eligibility for benefits.

Who needs to fill out Social Security Form 1724?

+Representative payees managing the finances of a Social Security beneficiary need to fill out Social Security Form 1724.

What happens if I make a mistake on the form?

+If you make a mistake on the form, it may lead to delays or incorrect benefit payments. It's essential to double-check the form for errors before submitting.