The Form 5500 is a crucial document for employee benefit plans, providing the U.S. Department of Labor with essential information about the plan's financial condition, investments, and operations. One of the most critical components of the Form 5500 is Schedule A, which requires detailed information about the plan's insurance contracts and other investment arrangements. In this article, we will explore five essential tips for completing Form 5500 Schedule A accurately and efficiently.

Understanding the Purpose of Form 5500 Schedule A

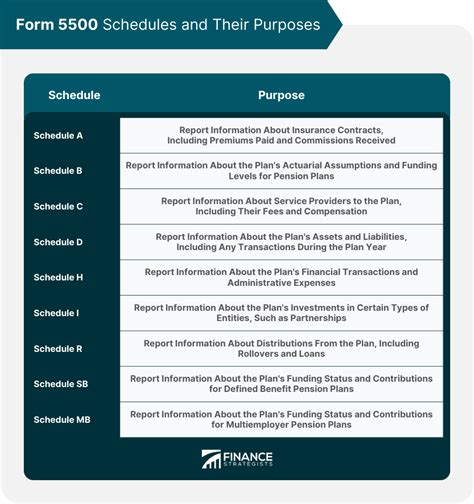

Before diving into the tips, it's essential to understand the purpose of Form 5500 Schedule A. This schedule is designed to collect information about the plan's insurance contracts and other investment arrangements, including the type of contract, the insurance company or investment provider, and the premiums or contributions paid. The information reported on Schedule A helps the Department of Labor to ensure that the plan is complying with the Employee Retirement Income Security Act (ERISA) and other relevant regulations.

Tip 1: Identify the Correct Insurance Contracts and Investment Arrangements

The first step in completing Form 5500 Schedule A is to identify the correct insurance contracts and investment arrangements that need to be reported. This includes annuity contracts, insurance contracts, and other investment arrangements, such as mutual funds or exchange-traded funds (ETFs). It's essential to review the plan's documents and records to ensure that all relevant contracts and arrangements are identified and reported.

Type of Insurance Contracts and Investment Arrangements

Some common types of insurance contracts and investment arrangements that need to be reported on Schedule A include:

- Annuity contracts

- Insurance contracts

- Mutual funds

- Exchange-traded funds (ETFs)

- Real estate investment trusts (REITs)

- Hedge funds

- Private equity funds

Tip 2: Gather Required Information

Once the correct insurance contracts and investment arrangements have been identified, the next step is to gather the required information. This includes the type of contract or arrangement, the name and address of the insurance company or investment provider, and the premiums or contributions paid. It's essential to review the plan's records and documents to ensure that all required information is accurate and complete.

Required Information for Schedule A

Some of the required information for Schedule A includes:

- Type of contract or arrangement

- Name and address of the insurance company or investment provider

- Premiums or contributions paid

- Aggregate value of the contracts or arrangements

- Date of the contract or arrangement

Tip 3: Complete Schedule A Accurately and Efficiently

Completing Schedule A accurately and efficiently requires careful attention to detail and a thorough understanding of the instructions and requirements. It's essential to review the plan's records and documents to ensure that all required information is accurate and complete. Additionally, using software or other tools to assist with the completion of Schedule A can help to reduce errors and improve efficiency.

Best Practices for Completing Schedule A

Some best practices for completing Schedule A include:

- Reviewing the plan's records and documents carefully

- Using software or other tools to assist with completion

- Double-checking information for accuracy and completeness

- Seeking assistance from a qualified professional if needed

Tip 4: Attach Required Supporting Documentation

In addition to completing Schedule A, it's also essential to attach required supporting documentation. This includes a copy of the insurance contract or investment arrangement, as well as any other relevant documents or records. It's essential to review the instructions and requirements carefully to ensure that all required supporting documentation is attached.

Required Supporting Documentation

Some of the required supporting documentation for Schedule A includes:

- Copy of the insurance contract or investment arrangement

- Statements or records from the insurance company or investment provider

- Other relevant documents or records

Tip 5: Review and Verify Information Carefully

Finally, it's essential to review and verify the information on Schedule A carefully. This includes reviewing the information for accuracy and completeness, as well as verifying the information with the insurance company or investment provider. It's also essential to ensure that all required supporting documentation is attached and that the schedule is signed and dated properly.

Importance of Reviewing and Verifying Information

Reviewing and verifying the information on Schedule A is essential to ensure that the plan is complying with ERISA and other relevant regulations. Failure to report accurate and complete information can result in penalties and fines, so it's essential to take the time to review and verify the information carefully.

Additional Tips and Resources

In addition to the five essential tips outlined above, there are several additional resources and tips that can help with completing Form 5500 Schedule A. These include:

- The U.S. Department of Labor's website, which provides detailed instructions and guidance on completing Form 5500 and Schedule A

- The IRS website, which provides information on the tax implications of Form 5500 and Schedule A

- Professional associations and organizations, such as the American Society of Pension Professionals and Actuaries (ASPPA) and the National Association of Plan Advisors (NAPA), which provide guidance and resources on completing Form 5500 and Schedule A

By following these tips and resources, plan administrators and sponsors can ensure that they are completing Form 5500 Schedule A accurately and efficiently, and that they are complying with ERISA and other relevant regulations.

Take Action

If you are a plan administrator or sponsor, take action today to ensure that you are completing Form 5500 Schedule A accurately and efficiently. Review the instructions and requirements carefully, gather the required information, complete the schedule accurately and efficiently, attach required supporting documentation, and review and verify the information carefully. By taking these steps, you can ensure that your plan is complying with ERISA and other relevant regulations, and that you are avoiding penalties and fines.

Share Your Thoughts

We hope this article has been helpful in providing you with essential tips for completing Form 5500 Schedule A. If you have any questions or comments, please share them below. We would love to hear from you!

What is Form 5500 Schedule A?

+Form 5500 Schedule A is a component of the Form 5500 that requires detailed information about the plan's insurance contracts and other investment arrangements.

What type of insurance contracts and investment arrangements need to be reported on Schedule A?

+Some common types of insurance contracts and investment arrangements that need to be reported on Schedule A include annuity contracts, insurance contracts, mutual funds, exchange-traded funds (ETFs), real estate investment trusts (REITs), hedge funds, and private equity funds.

What information is required for Schedule A?

+Some of the required information for Schedule A includes the type of contract or arrangement, the name and address of the insurance company or investment provider, premiums or contributions paid, aggregate value of the contracts or arrangements, and date of the contract or arrangement.