Navigating the world of tax forms can be a daunting task, especially when it comes to specific state forms like the Arizona Form 140PY. This form is a crucial part of the tax filing process for many Arizona residents, and understanding how to accurately fill it out is essential for ensuring compliance with state tax regulations and potentially maximizing your refund. Here are five key tips to help guide you through the process.

Understanding the Purpose of the AZ Form 140PY

Before diving into the tips for filling out the AZ Form 140PY, it's essential to understand its purpose. This form, also known as the Part-Year Resident and Nonresident Tax Form, is used by individuals who are part-year residents or nonresidents of Arizona to report their income earned within the state. It's a critical document for those who have moved to or from Arizona during the tax year or for those who are not residents but have income sourced from Arizona.

<h3-tip-1:-Gather-All-Relevant-Documentation

To accurately fill out the AZ Form 140PY, you'll need to gather all relevant documentation. This includes:

- Your W-2 forms from all employers

- Any 1099 forms for freelance or contract work, interest, dividends, or capital gains

- Records of any deductions you're eligible for, such as mortgage interest, charitable donations, or medical expenses

- Information about any dependents you're claiming

- Records of any estimated tax payments you've made throughout the year

Having all your documents in one place will make the process smoother and less prone to errors.

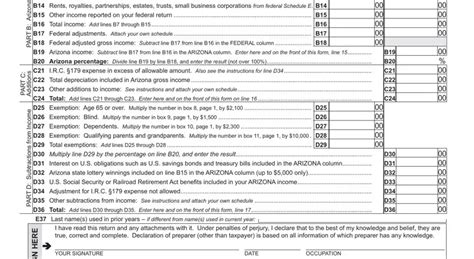

Accurately Calculate Your Income

The AZ Form 140PY requires you to accurately calculate your income, taking into account both your Arizona and non-Arizona sourced income. You'll need to determine which income is taxable and which deductions you're eligible for. This may involve complex calculations, especially if you have income from multiple sources or if you've moved to or from Arizona during the tax year.

<h3-tip-2:-Understand-Residency-Status

Determining your residency status for tax purposes is crucial when filling out the AZ Form 140PY. If you're a part-year resident, you'll need to calculate your Arizona income for the period you were a resident. If you're a nonresident, you'll only report income earned from Arizona sources. Understanding your residency status will help you accurately complete the form and avoid any potential discrepancies.

Making Adjustments and Claiming Credits

After calculating your income, you may be eligible for adjustments and credits that can reduce your tax liability. These can include deductions for contributions to retirement accounts, education expenses, or charitable donations. Credits might include those for working families, homeowners, or individuals with disabilities. Ensuring you claim all eligible adjustments and credits can significantly impact your refund.

<h3-tip-3:-Consult-Professional-Help-if-Needed

Given the complexity of tax laws and the specific requirements of the AZ Form 140PY, it's not uncommon for individuals to seek professional help. If you're unsure about any aspect of the form, from determining your residency status to calculating deductions and credits, consulting a tax professional can provide peace of mind and ensure accuracy.

Double-Check for Accuracy

Before submitting your AZ Form 140PY, it's crucial to double-check for accuracy. A single mistake can lead to delays or even an audit. Ensure all numbers are correctly calculated, all necessary documentation is attached, and you've signed the form. Accuracy is key to a smooth tax filing process.

<h3-tip-4:-Submit-on-Time-and-Track-Your-Refund

Finally, ensure you submit your AZ Form 140PY on time to avoid any penalties. The Arizona Department of Revenue typically follows the same filing deadlines as the IRS. After submission, you can track the status of your refund online or through the Arizona Department of Revenue's mobile app. Understanding the timeline can help you plan financially.

Staying Informed About Tax Law Changes

Tax laws and regulations can change annually, affecting how you fill out the AZ Form 140PY. Staying informed about these changes can help you navigate the tax filing process more effectively. The Arizona Department of Revenue's website is a valuable resource for updates on tax laws, filing deadlines, and any changes to the AZ Form 140PY.

<h3-tip-5:-Keep-Records-for-Audit-Purposes

After filing your AZ Form 140PY, it's essential to keep all related documents and records. In case of an audit, having these records readily available can make the process less stressful and help resolve any issues more quickly. This includes not only the form itself but also all supporting documentation used to complete it.

By following these five tips, you'll be well-equipped to accurately fill out the AZ Form 140PY, ensuring compliance with Arizona's tax laws and potentially maximizing your refund. Remember, understanding the form's purpose, gathering all necessary documentation, accurately calculating income, making adjustments and claiming credits, double-checking for accuracy, and staying informed about tax law changes are all crucial steps in the process.

What is the AZ Form 140PY used for?

+The AZ Form 140PY is used by part-year residents and nonresidents of Arizona to report their income earned within the state.

Do I need to file the AZ Form 140PY if I'm a full-year resident of Arizona?

+No, if you're a full-year resident of Arizona, you would file the AZ Form 140, not the AZ Form 140PY.

What if I'm unsure about how to fill out the AZ Form 140PY?

+If you're unsure about any aspect of filling out the AZ Form 140PY, it's recommended to consult a tax professional for assistance.

We hope this article has provided valuable insights into navigating the AZ Form 140PY. If you have any questions or would like to share your experiences with filling out this form, please feel free to comment below. Your input can help others facing similar challenges.