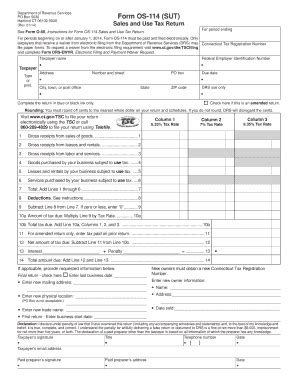

Completing the CT Form OS-114 is a crucial step for businesses and individuals operating in Connecticut, as it is used to file and pay various taxes, fees, and assessments owed to the state. The form is used to report and pay tax liabilities for a range of taxes, including sales and use tax, withholding tax, and business entity tax. Given its importance, it's essential to ensure that the form is completed accurately and successfully to avoid any penalties or delays.

Understanding the CT Form OS-114

The CT Form OS-114 is a comprehensive form that requires filers to provide detailed information about their tax liabilities, including the type of tax, the period for which the tax is being reported, and the amount of tax due. The form also requires filers to provide their business or personal identification information, including their name, address, and tax registration number.

Tax Types and Filing Requirements

The CT Form OS-114 is used to file and pay various taxes, including:

- Sales and use tax

- Withholding tax

- Business entity tax

- Other taxes and fees

It's essential to understand the specific tax types and filing requirements that apply to your business or individual situation. Failing to file and pay the correct taxes can result in penalties and interest charges.

5 Ways to Complete the CT Form OS-114 Successfully

To complete the CT Form OS-114 successfully, follow these five steps:

Step 1: Gather Required Information and Documents

Before starting to complete the form, gather all the required information and documents, including:

- Business or personal identification information

- Tax registration number

- Tax liability information

- Payment information (e.g., check or electronic payment details)

Step 2: Choose the Correct Filing Status

Choose the correct filing status that applies to your business or individual situation. This will determine which sections of the form need to be completed and which tax rates apply.

Step 3: Complete the Form Accurately and Thoroughly

Complete the form accurately and thoroughly, making sure to:

- Fill in all required fields

- Report all tax liabilities accurately

- Calculate the correct amount of tax due

- Sign and date the form

Step 4: Review and Verify the Form

Review and verify the form to ensure that:

- All information is accurate and complete

- All tax liabilities are reported correctly

- The correct amount of tax is due

Step 5: File and Pay the Form on Time

File and pay the form on time to avoid penalties and interest charges. The form can be filed electronically or by mail, and payment can be made by check or electronic payment.

Common Errors to Avoid When Completing the CT Form OS-114

When completing the CT Form OS-114, avoid the following common errors:

- Inaccurate or incomplete information

- Incorrect tax liability reporting

- Failure to sign and date the form

- Late filing or payment

Conclusion

Completing the CT Form OS-114 successfully requires careful attention to detail and a thorough understanding of the tax types and filing requirements that apply to your business or individual situation. By following the five steps outlined above and avoiding common errors, you can ensure that your form is completed accurately and on time.

We encourage you to share your experiences and tips for completing the CT Form OS-114 in the comments section below.

What is the CT Form OS-114 used for?

+The CT Form OS-114 is used to file and pay various taxes, fees, and assessments owed to the state of Connecticut.

What types of taxes can be filed using the CT Form OS-114?

+The CT Form OS-114 can be used to file sales and use tax, withholding tax, business entity tax, and other taxes and fees.

How can I avoid common errors when completing the CT Form OS-114?

+To avoid common errors, make sure to gather all required information and documents, choose the correct filing status, complete the form accurately and thoroughly, review and verify the form, and file and pay the form on time.