Understanding Form 8879-S: An Overview

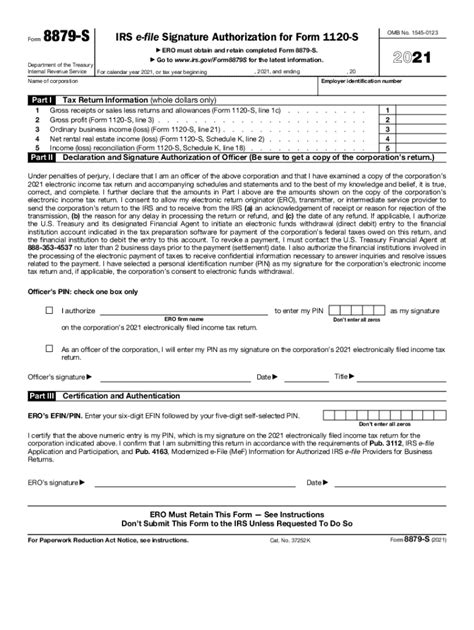

As a tax professional or electronic return originator (ERO), completing Form 8879-S is a critical step in the e-filing process for the IRS. The IRS Form 8879-S, also known as the IRS e-file Signature Authorization for Form 1120S, is used by S corporations to authorize the e-filing of their tax returns. In this article, we will delve into the intricacies of Form 8879-S, discussing its importance, benefits, and the steps to complete it correctly.

The IRS introduced Form 8879-S to simplify the e-filing process for S corporations, enabling them to electronically sign and authorize their tax returns. This form is a crucial component of the e-filing process, as it ensures that the S corporation's tax return is accurate, complete, and authorized by the required parties.

Benefits of Using Form 8879-S

The use of Form 8879-S offers several benefits, including:- Simplified e-filing process: Form 8879-S streamlines the e-filing process, reducing the need for manual signatures and paperwork.

- Increased accuracy: By using Form 8879-S, S corporations can ensure that their tax returns are accurate and complete, reducing the risk of errors and rejected returns.

- Improved security: Form 8879-S provides an additional layer of security, as it requires the authorization of the S corporation's principal and/or responsible official.

5 Ways to Complete Form 8879-S Correctly

To ensure that Form 8879-S is completed correctly, follow these five steps:

Step 1: Identify the Principal and/or Responsible Official

The first step in completing Form 8879-S is to identify the principal and/or responsible official of the S corporation. This individual is typically the president, CEO, or other high-ranking officer who is authorized to sign on behalf of the corporation.Step 2: Gather Required Information

Before completing Form 8879-S, gather the required information, including:- The S corporation's Employer Identification Number (EIN)

- The tax year for which the return is being filed

- The principal and/or responsible official's name, title, and signature

Step 3: Complete Part I of Form 8879-S

Part I of Form 8879-S requires the S corporation's information, including the EIN, tax year, and business name. This section also requires the signature of the principal and/or responsible official.Step 4: Complete Part II of Form 8879-S

Part II of Form 8879-S requires the signature of the ERO, who is responsible for preparing and submitting the S corporation's tax return.Step 5: Review and Submit Form 8879-S

The final step is to review Form 8879-S for accuracy and completeness, ensuring that all required signatures and information are included. Once complete, submit Form 8879-S along with the S corporation's tax return.Common Errors to Avoid When Completing Form 8879-S

When completing Form 8879-S, avoid the following common errors:

- Incomplete or missing information

- Incorrect or missing signatures

- Failure to identify the principal and/or responsible official

- Incorrect tax year or EIN

By avoiding these common errors, you can ensure that Form 8879-S is completed correctly and that the S corporation's tax return is processed efficiently.

Best Practices for Completing Form 8879-S

To ensure that Form 8879-S is completed correctly, follow these best practices:

- Use the most recent version of Form 8879-S

- Carefully review the form for accuracy and completeness

- Ensure that all required signatures are obtained

- Submit Form 8879-S along with the S corporation's tax return

By following these best practices, you can ensure that Form 8879-S is completed correctly and that the S corporation's tax return is processed efficiently.

Conclusion: Final Thoughts on Completing Form 8879-S

Completing Form 8879-S correctly is crucial for S corporations that e-file their tax returns. By following the steps outlined in this article, you can ensure that Form 8879-S is completed accurately and efficiently. Remember to avoid common errors and follow best practices to ensure a smooth e-filing process.

If you have any questions or concerns about completing Form 8879-S, please don't hesitate to comment below. Share this article with your colleagues and friends who may find it useful.

What is Form 8879-S used for?

+Form 8879-S is used by S corporations to authorize the e-filing of their tax returns.

Who is required to sign Form 8879-S?

+The principal and/or responsible official of the S corporation, as well as the ERO, are required to sign Form 8879-S.

What are the consequences of not completing Form 8879-S correctly?

+If Form 8879-S is not completed correctly, the S corporation's tax return may be rejected, and penalties may be assessed.