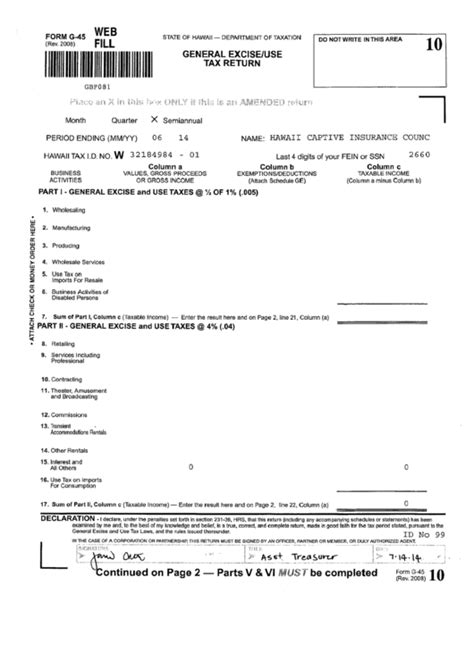

The Hawaii G-45 form, also known as the "Hawaii General Excise Tax Return," is a crucial document for businesses operating in the state of Hawaii. The form is used to report and pay general excise taxes, which are levied on businesses that provide services or sell products in Hawaii. Filling out the G-45 form correctly is essential to avoid penalties, fines, and other consequences. In this article, we will explore five ways to fill out the Hawaii G-45 form correctly.

Understanding the G-45 Form

Before we dive into the ways to fill out the G-45 form correctly, it's essential to understand the purpose and structure of the form. The G-45 form is a quarterly return that must be filed by businesses that have a Hawaii tax license. The form consists of several sections, including the business information, taxable sales, deductions, and tax liability.

1. Gather Required Information

To fill out the G-45 form correctly, you need to gather all the required information. This includes:

- Your business name and address

- Your Hawaii tax license number

- Your federal employer identification number (FEIN)

- Your business activity code

- Your taxable sales and use tax information

- Your deductions and exemptions

Make sure you have all the necessary documents and records to support the information you provide on the form.

Calculating Taxable Sales

Calculating taxable sales is a critical part of filling out the G-45 form. You need to report all sales that are subject to Hawaii general excise tax. This includes:

- Sales of tangible personal property

- Sales of services

- Sales of intangible personal property

You can use the following formula to calculate your taxable sales:

Taxable Sales = Total Sales - Exempt Sales - Deductions

2. Claiming Deductions and Exemptions

Deductions and exemptions can help reduce your tax liability. You can claim deductions for:

- Sales of tangible personal property that are exempt from tax

- Sales of services that are exempt from tax

- Intangible personal property that is exempt from tax

- Other deductions allowed by law

You can also claim exemptions for:

- Sales to exempt entities, such as non-profit organizations

- Sales of prescription drugs and medical devices

- Sales of certain agricultural products

Make sure you have documentation to support your deductions and exemptions.

Common Deductions and Exemptions

Here are some common deductions and exemptions that businesses in Hawaii can claim:

- Exemption for sales to non-profit organizations

- Exemption for sales of prescription drugs and medical devices

- Exemption for sales of certain agricultural products

- Deduction for sales of tangible personal property that are exempt from tax

3. Reporting Use Tax

Use tax is a critical component of the G-45 form. You need to report use tax on all tangible personal property that you purchased from out-of-state sellers and used in Hawaii. This includes:

- Purchases of tangible personal property from out-of-state sellers

- Purchases of intangible personal property that are subject to use tax

You can use the following formula to calculate your use tax liability:

Use Tax Liability = Total Purchases x Use Tax Rate

Understanding Use Tax Rates

Use tax rates in Hawaii vary depending on the type of property and the location of the purchaser. Here are the current use tax rates in Hawaii:

- 4.166% for most tangible personal property

- 0.15% for certain agricultural products

- 0.50% for certain prescription drugs and medical devices

Make sure you understand the use tax rates that apply to your business.

4. Filing the G-45 Form

Once you have gathered all the required information and calculated your taxable sales, deductions, and use tax liability, you can file the G-45 form. You can file the form online or by mail.

Make sure you file the form on time to avoid penalties and fines. The filing deadline for the G-45 form is the 20th day of the month following the end of the quarter.

Filing Options

Here are the filing options for the G-45 form:

- Online filing: You can file the G-45 form online through the Hawaii Department of Taxation's website.

- Mail filing: You can file the G-45 form by mail by sending it to the Hawaii Department of Taxation.

5. Reviewing and Revising the Form

Before you submit the G-45 form, make sure you review it carefully for accuracy and completeness. Check for any errors or omissions, and revise the form as necessary.

It's also a good idea to have a tax professional review the form to ensure that it is accurate and complete.

Common Errors to Avoid

Here are some common errors to avoid when filling out the G-45 form:

- Incorrect business information

- Incorrect taxable sales information

- Failure to claim deductions and exemptions

- Failure to report use tax liability

Make sure you avoid these common errors to ensure that your G-45 form is accurate and complete.

Conclusion

Filling out the Hawaii G-45 form correctly is essential for businesses operating in Hawaii. By following these five ways to fill out the G-45 form correctly, you can ensure that your business is in compliance with Hawaii tax laws and regulations. Remember to gather all required information, calculate taxable sales and use tax liability accurately, claim deductions and exemptions, file the form on time, and review and revise the form carefully.

We hope this article has provided you with valuable insights and information on how to fill out the Hawaii G-45 form correctly. If you have any questions or need further assistance, please don't hesitate to comment below.

What is the purpose of the Hawaii G-45 form?

+The Hawaii G-45 form is used to report and pay general excise taxes, which are levied on businesses that provide services or sell products in Hawaii.

What is the filing deadline for the G-45 form?

+The filing deadline for the G-45 form is the 20th day of the month following the end of the quarter.

Can I file the G-45 form online?

+Yes, you can file the G-45 form online through the Hawaii Department of Taxation's website.