Pennsylvania is one of the few states in the US that imposes an inheritance tax on beneficiaries. When a person passes away, their heirs are required to pay taxes on the inheritance they receive. However, there are certain circumstances under which an inheritance tax waiver can be obtained. In this article, we will provide a step-by-step guide on how to obtain a Pennsylvania inheritance tax waiver form and explain the process of filling it out.

Understanding Pennsylvania Inheritance Tax

Before we dive into the process of obtaining an inheritance tax waiver, it's essential to understand how Pennsylvania inheritance tax works. The tax is imposed on the transfer of property from a deceased person to their beneficiaries. The tax rate varies depending on the relationship between the deceased and the beneficiary.

Who Is Exempt from Pennsylvania Inheritance Tax?

Not everyone is required to pay Pennsylvania inheritance tax. The following individuals are exempt:

- Spouses

- Parents

- Children

- Grandchildren

- Siblings

However, if the beneficiary is not a direct relative, they may be subject to the tax.

Inheritance Tax Rates in Pennsylvania

The inheritance tax rate in Pennsylvania varies depending on the relationship between the deceased and the beneficiary. The rates are as follows:

- 0% for spouses, parents, children, and grandchildren

- 4.5% for siblings

- 12% for other relatives

- 15% for non-relatives

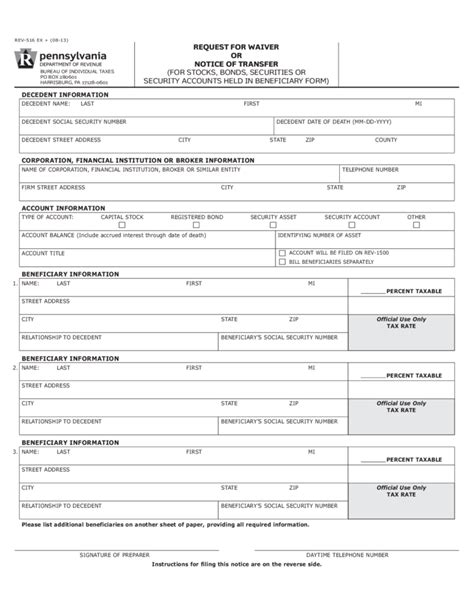

Pennsylvania Inheritance Tax Waiver Form

Now that we have a basic understanding of Pennsylvania inheritance tax, let's move on to the inheritance tax waiver form. The waiver form is used to request a waiver of the inheritance tax. There are several types of waiver forms, including:

- Waiver of Inheritance Tax for Real Property (Form REV-584)

- Waiver of Inheritance Tax for Personal Property (Form REV-585)

Obtaining the Waiver Form

The Pennsylvania inheritance tax waiver form can be obtained from the Pennsylvania Department of Revenue website or by contacting the department directly.

Filling Out the Waiver Form

Once you have obtained the waiver form, you can start filling it out. The form requires the following information:

- The name and address of the deceased

- The name and address of the beneficiary

- A description of the property being transferred

- The value of the property

Section 1: Beneficiary Information

In this section, you will need to provide information about the beneficiary, including their name, address, and relationship to the deceased.

Section 2: Property Information

In this section, you will need to provide a description of the property being transferred, including its value.

Section 3: Waiver Request

In this section, you will need to explain why you are requesting a waiver of the inheritance tax.

Submitting the Waiver Form

Once you have completed the waiver form, you will need to submit it to the Pennsylvania Department of Revenue. You can submit the form by mail or in person.

Processing Time

The processing time for the waiver form varies depending on the complexity of the case. On average, it takes 2-3 weeks for the department to review and process the waiver form.

Additional Requirements

In addition to the waiver form, you may need to provide additional documentation, such as:

- A copy of the deceased's will

- A copy of the property deed

- A copy of the beneficiary's identification

Conclusion

Obtaining a Pennsylvania inheritance tax waiver form can be a complex process, but with the right guidance, it can be done. By following the steps outlined in this article, you can ensure that you are taking the right steps to obtain a waiver of the inheritance tax. Remember to seek the advice of a qualified tax professional if you have any questions or concerns.

We hope this article has been informative and helpful. If you have any questions or comments, please feel free to share them below.

What is the Pennsylvania inheritance tax rate?

+The Pennsylvania inheritance tax rate varies depending on the relationship between the deceased and the beneficiary. The rates are as follows: 0% for spouses, parents, children, and grandchildren; 4.5% for siblings; 12% for other relatives; and 15% for non-relatives.

How do I obtain a Pennsylvania inheritance tax waiver form?

+The Pennsylvania inheritance tax waiver form can be obtained from the Pennsylvania Department of Revenue website or by contacting the department directly.

What information do I need to provide on the waiver form?

+The waiver form requires information about the deceased, the beneficiary, and the property being transferred, including its value.