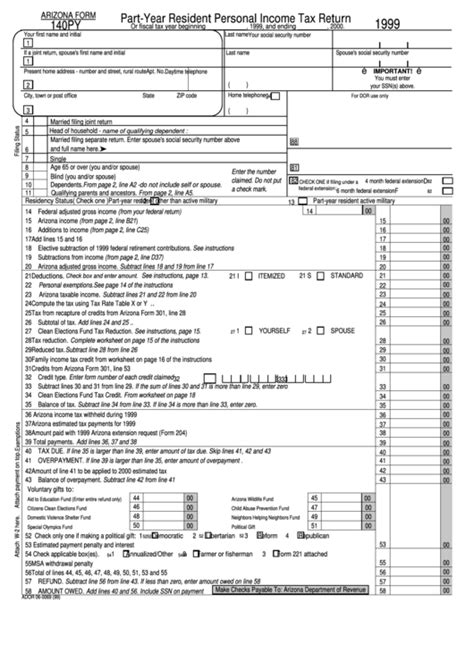

Arizona Form 140py, also known as the Arizona Part-Year Resident Income Tax Return, is a tax form used by individuals who have lived in Arizona for only part of the year. Filing this form can be a bit complex, but with the right guidance, you can navigate the process with ease. In this article, we will provide a step-by-step guide on how to file Arizona Form 140py, ensuring you comply with the Arizona Department of Revenue's requirements.

Why File Arizona Form 140py?

Before we dive into the filing instructions, it's essential to understand why you need to file Arizona Form 140py. If you have lived in Arizona for only part of the year, you are considered a part-year resident. As a part-year resident, you are required to file this form to report your Arizona income and claim any applicable credits or deductions.

Gathering Required Documents

Before starting the filing process, make sure you have all the necessary documents. These include:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your Arizona driver's license or state ID

- Your federal income tax return (Form 1040)

- All W-2 forms showing Arizona income

- All 1099 forms showing Arizona income

- Any other relevant tax documents

Step 1: Determine Your Filing Status

Your filing status will determine which form you need to file and what tax rates apply to you. Arizona recognizes the same filing statuses as the federal government:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Step 2: Complete Form 140py

Once you have determined your filing status, you can start completing Form 140py. The form is divided into several sections, including:

- Personal information

- Income

- Deductions

- Credits

- Tax calculation

Section 1: Personal Information

In this section, you will need to provide your personal information, including your name, address, Social Security number or ITIN, and Arizona driver's license or state ID.

Section 2: Income

In this section, you will need to report all your Arizona income, including:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Business income

- Other income

Section 3: Deductions

In this section, you can claim deductions to reduce your taxable income. These may include:

- Standard deduction

- Itemized deductions

- Business deductions

Section 4: Credits

In this section, you can claim credits to reduce your tax liability. These may include:

- Arizona earned income tax credit

- Child care credit

- Education credit

- Other credits

Section 5: Tax Calculation

In this section, you will calculate your tax liability based on your income, deductions, and credits.

Step 3: Complete Supporting Schedules

Depending on your specific situation, you may need to complete supporting schedules, such as:

- Schedule A: Itemized deductions

- Schedule B: Interest and dividends

- Schedule C: Business income

- Schedule D: Capital gains and losses

Step 4: Sign and Date the Form

Once you have completed Form 140py and any supporting schedules, sign and date the form.

Step 5: Submit the Form

You can submit Form 140py electronically or by mail. If you owe taxes, you will need to include a payment with your return.

Electronic Filing

You can file Form 140py electronically through the Arizona Department of Revenue's website or through a tax software provider. Electronic filing is faster and more secure than paper filing.

Paper Filing

If you prefer to file by paper, you can mail your return to:

Arizona Department of Revenue P.O. Box 29217 Phoenix, AZ 85038-9217

Important Deadlines

Make sure to file Form 140py by the due date to avoid penalties and interest. The due date is typically April 15th for calendar-year taxpayers.

Conclusion

Filing Arizona Form 140py can seem complex, but by following these step-by-step instructions, you can ensure you comply with the Arizona Department of Revenue's requirements. Remember to gather all necessary documents, determine your filing status, complete the form, complete supporting schedules, sign and date the form, and submit it electronically or by mail.

What's Next?

We hope this article has been helpful in guiding you through the process of filing Arizona Form 140py. If you have any questions or need further assistance, please don't hesitate to ask. You can also share this article with others who may find it helpful.

FAQs

What is Arizona Form 140py?

+Arizona Form 140py is the Arizona Part-Year Resident Income Tax Return form used by individuals who have lived in Arizona for only part of the year.

Who needs to file Arizona Form 140py?

+Individuals who have lived in Arizona for only part of the year need to file Arizona Form 140py.

What is the deadline for filing Arizona Form 140py?

+The deadline for filing Arizona Form 140py is typically April 15th for calendar-year taxpayers.