Filing Form 410 can be a daunting task, especially for those who are unfamiliar with the process. However, with the right guidance, it can be made easy. In this article, we will provide a comprehensive guide on how to file Form 410, including 5 proof of claim examples to help you understand the process better.

The Importance of Filing Form 410

Form 410, also known as the "Proof of Claim" form, is a critical document that must be filed with the court in order to assert a claim against a debtor's estate. This form is typically used in bankruptcy cases, where creditors are required to file a proof of claim in order to receive payment from the debtor's estate.

Filing Form 410 can be a complex process, and failure to do so correctly can result in the loss of valuable rights. Therefore, it is essential to understand the process of filing Form 410 and to seek professional help if necessary.

Who Needs to File Form 410?

Not everyone needs to file Form 410. Typically, only creditors who have a claim against the debtor's estate are required to file this form. Creditors may include:

- Individuals who have loaned money to the debtor

- Businesses that have provided goods or services to the debtor

- Government agencies that have a tax claim against the debtor

- Other entities that have a legitimate claim against the debtor's estate

If you are a creditor and want to assert a claim against the debtor's estate, you will need to file Form 410.

What is a Proof of Claim?

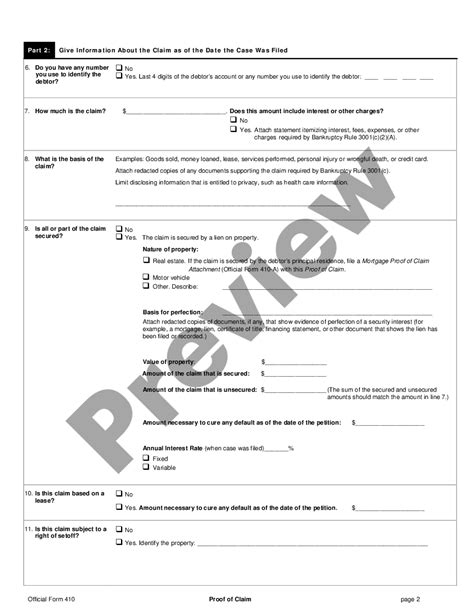

A proof of claim is a document that outlines the creditor's claim against the debtor's estate. The proof of claim must include certain information, such as:

- The creditor's name and address

- The debtor's name and address

- A description of the claim

- The amount of the claim

- A statement of the basis for the claim

The proof of claim must be filed with the court in order to assert a claim against the debtor's estate.

5 Proof of Claim Examples

To help you understand the process of filing Form 410, we have included 5 proof of claim examples below.

Example 1: Simple Proof of Claim

- Creditor's name and address: John Doe, 123 Main Street, Anytown, USA

- Debtor's name and address: Jane Smith, 456 Elm Street, Anytown, USA

- Description of claim: John Doe loaned Jane Smith $10,000 on January 1, 2020.

- Amount of claim: $10,000

- Basis for claim: John Doe has a promissory note signed by Jane Smith.

Example 2: Proof of Claim with Multiple Creditors

- Creditor's name and address: ABC Corporation, 789 Oak Street, Anytown, USA

- Debtor's name and address: John Smith, 901 Maple Street, Anytown, USA

- Description of claim: ABC Corporation provided goods to John Smith in the amount of $50,000 on February 1, 2020.

- Amount of claim: $50,000

- Basis for claim: ABC Corporation has an invoice signed by John Smith.

Example 3: Proof of Claim with a Government Agency

- Creditor's name and address: Internal Revenue Service, 1234 Government Street, Anytown, USA

- Debtor's name and address: Jane Doe, 456 Pine Street, Anytown, USA

- Description of claim: The Internal Revenue Service has a tax claim against Jane Doe in the amount of $20,000.

- Amount of claim: $20,000

- Basis for claim: The Internal Revenue Service has a tax lien against Jane Doe.

Example 4: Proof of Claim with a Secured Creditor

- Creditor's name and address: Bank of America, 567 Bank Street, Anytown, USA

- Debtor's name and address: John Doe, 890 Bank Street, Anytown, USA

- Description of claim: Bank of America has a mortgage against John Doe's property in the amount of $200,000.

- Amount of claim: $200,000

- Basis for claim: Bank of America has a mortgage deed signed by John Doe.

Example 5: Proof of Claim with a Contingent Claim

- Creditor's name and address: XYZ Corporation, 901 Contingent Street, Anytown, USA

- Debtor's name and address: Jane Smith, 234 Contingent Street, Anytown, USA

- Description of claim: XYZ Corporation has a contingent claim against Jane Smith in the amount of $30,000.

- Amount of claim: $30,000

- Basis for claim: XYZ Corporation has a contract with Jane Smith that may result in a claim in the future.

How to File Form 410

Filing Form 410 can be a complex process, but it can be broken down into several steps.

- Obtain a copy of Form 410 from the court or download it from the court's website.

- Complete the form by filling in the required information, including the creditor's name and address, the debtor's name and address, a description of the claim, the amount of the claim, and a statement of the basis for the claim.

- Attach supporting documentation to the form, such as invoices, contracts, or promissory notes.

- File the form with the court by mail or in person.

- Pay the required filing fee.

It is essential to follow the court's rules and procedures for filing Form 410. Failure to do so can result in the loss of valuable rights.

Tips for Filing Form 410

Here are some tips for filing Form 410:

- Make sure to complete the form accurately and thoroughly.

- Attach all required supporting documentation.

- File the form on time to avoid missing the deadline.

- Pay the required filing fee.

- Seek professional help if necessary.

Conclusion

Filing Form 410 can be a complex process, but it can be made easy with the right guidance. By understanding the process and following the tips outlined above, you can ensure that your proof of claim is filed correctly and on time. Remember to seek professional help if necessary, and don't hesitate to reach out to the court for assistance.

What is Form 410?

+Form 410, also known as the "Proof of Claim" form, is a document that outlines a creditor's claim against a debtor's estate.

Who needs to file Form 410?

+Creditors who have a claim against the debtor's estate need to file Form 410.

What is a proof of claim?

+A proof of claim is a document that outlines the creditor's claim against the debtor's estate, including the creditor's name and address, the debtor's name and address, a description of the claim, the amount of the claim, and a statement of the basis for the claim.