As a U.S. citizen or resident, you're likely familiar with the complexities of international taxation. One crucial aspect of this is the Form 5471, also known as the Information Return of U.S. Persons with Respect to Certain Foreign Corporations. Within this form lies Schedule Q, a crucial component that requires meticulous attention to detail. In this comprehensive guide, we'll delve into the Form 5471 Schedule Q instructions, providing a step-by-step walkthrough to ensure you're accurately completing this vital tax document.

The Importance of Form 5471 and Schedule Q

Before we dive into the instructions, it's essential to understand the significance of Form 5471 and Schedule Q. The IRS requires U.S. citizens and residents who own or control foreign corporations to file Form 5471 annually. This form provides the IRS with crucial information about the foreign corporation's operations, income, and taxes paid. Schedule Q, specifically, focuses on the foreign corporation's accumulated earnings and profits (E&P).

Accurate completion of Schedule Q is vital to avoid potential penalties and ensure compliance with U.S. tax laws. Failure to file or incorrectly completing Form 5471 and Schedule Q can result in severe consequences, including fines and interest on unpaid taxes.

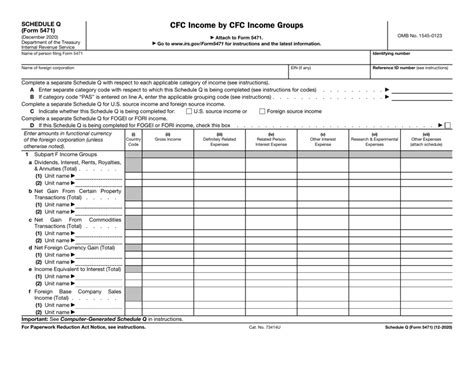

Form 5471 Schedule Q: A Breakdown of the Components

To complete Schedule Q, you'll need to gather various financial data and supporting documentation. The following components are crucial to understanding the schedule:

- Accumulated Earnings and Profits (E&P): This refers to the foreign corporation's undistributed earnings and profits, which are taxable to the U.S. shareholder.

- Current Earnings and Profits (E&P): This represents the foreign corporation's current-year earnings and profits, which may be subject to U.S. taxation.

- Dividends Distributed: This includes any dividends distributed to U.S. shareholders during the tax year.

- Stock Basis Adjustments: This involves adjusting the U.S. shareholder's stock basis in the foreign corporation to reflect changes in E&P.

Step 1: Determine the Reporting Requirements

Before completing Schedule Q, ensure you understand the reporting requirements for your specific situation. You'll need to determine:

- Whether you're a U.S. shareholder of a controlled foreign corporation (CFC)

- If the foreign corporation is a CFC for U.S. tax purposes

- The applicable tax year for reporting

Form 5471 Schedule Q Instructions: A Step-by-Step Guide

Now that you've gathered the necessary information, follow these step-by-step instructions to complete Schedule Q:

Step 1: Complete Part I - Accumulated Earnings and Profits

- Enter the foreign corporation's accumulated E&P as of the beginning of the tax year

- Calculate the current-year E&P and enter the amount

- Complete columns (a) through (e) to report the accumulated E&P, current-year E&P, and dividends distributed

Step 2: Complete Part II - Stock Basis Adjustments

- Calculate the U.S. shareholder's stock basis adjustment for the tax year

- Enter the stock basis adjustment in column (a)

- Complete columns (b) through (e) to report the stock basis adjustments

Step 3: Complete Part III - Dividends Distributed

- Report the dividends distributed to U.S. shareholders during the tax year

- Enter the dividends distributed in column (a)

- Complete columns (b) through (e) to report the dividends distributed

Step 4: Complete Part IV - Reconciliation of Accumulated Earnings and Profits

- Reconcile the accumulated E&P reported in Part I with the accumulated E&P reported on the foreign corporation's financial statements

- Enter the reconciliation in column (a)

Additional Tips and Considerations

- Ensure you accurately complete all parts of Schedule Q to avoid potential penalties

- Maintain detailed records and supporting documentation to substantiate the information reported on Schedule Q

- Consult with a tax professional if you're unsure about any aspect of the Form 5471 or Schedule Q

Common Challenges and FAQs

We've compiled a list of common challenges and frequently asked questions to help you navigate the complexities of Form 5471 and Schedule Q:

- Q: What is the deadline for filing Form 5471 and Schedule Q? A: The deadline for filing Form 5471 and Schedule Q is typically April 15th of each year, unless an automatic six-month extension is filed.

- Q: Can I file Form 5471 and Schedule Q electronically? A: Yes, you can file Form 5471 and Schedule Q electronically through the IRS's Modernized e-File (MeF) system.

- Q: What are the penalties for failing to file or incorrectly completing Form 5471 and Schedule Q? A: The penalties for failing to file or incorrectly completing Form 5471 and Schedule Q can range from $10,000 to $50,000 or more, depending on the specific circumstances.

What is the purpose of Form 5471 and Schedule Q?

+Form 5471 and Schedule Q are used to report information about a U.S. person's ownership in a foreign corporation, including accumulated earnings and profits, current-year earnings and profits, and dividends distributed.

Who is required to file Form 5471 and Schedule Q?

+U.S. citizens and residents who own or control foreign corporations are required to file Form 5471 and Schedule Q annually.

What are the consequences of failing to file or incorrectly completing Form 5471 and Schedule Q?

+Failing to file or incorrectly completing Form 5471 and Schedule Q can result in penalties, fines, and interest on unpaid taxes.

By following the Form 5471 Schedule Q instructions outlined in this guide, you'll be well on your way to accurately completing this critical tax document. Remember to maintain detailed records, consult with a tax professional if needed, and stay up-to-date on any changes to U.S. tax laws and regulations.