As the tax season approaches, individuals and businesses alike are scrambling to gather all necessary documents and forms to ensure a smooth filing process. Among these forms is the IRS Form 8915-F, a crucial document for those seeking to claim qualified retirement plan distributions due to the COVID-19 pandemic. In this article, we will delve into the intricacies of the IRS Form 8915-F, providing a comprehensive guide on how to unlock its benefits.

Understanding the IRS Form 8915-F

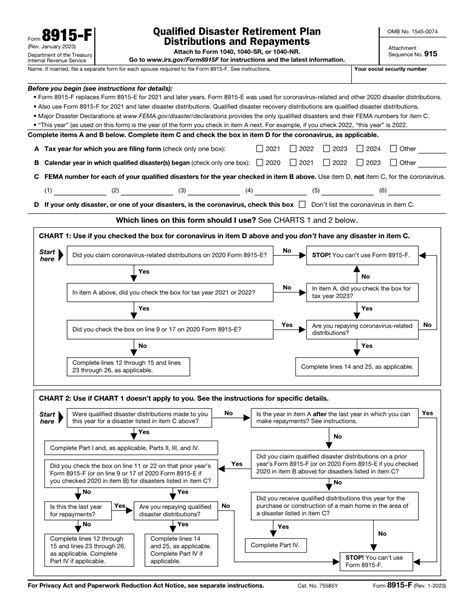

The IRS Form 8915-F, also known as the Qualified Disaster Retirement Plan Distributions and Repayments, is a form designed to help individuals affected by qualified disasters, including the COVID-19 pandemic, to claim distributions from their retirement plans without incurring the usual penalties. This form allows eligible individuals to report these distributions and repayments, ensuring compliance with the Internal Revenue Code.

Who is Eligible to File the IRS Form 8915-F?

To be eligible to file the IRS Form 8915-F, individuals must meet specific requirements, including:

- Being diagnosed with COVID-19 or experiencing adverse financial consequences due to the pandemic

- Having a spouse or dependent diagnosed with COVID-19

- Experiencing a reduction in work hours or pay due to the pandemic

- Being quarantined or furloughed due to the pandemic

- Having a business or industry affected by the pandemic

Key Benefits of the IRS Form 8915-F

The IRS Form 8915-F offers several benefits to eligible individuals, including:

- Waiver of the 10% penalty: The form allows individuals to claim distributions from their retirement plans without incurring the usual 10% penalty for early withdrawals.

- Taxation of distributions: The form enables individuals to report distributions from their retirement plans, ensuring compliance with tax laws.

- Repayment of distributions: The form allows individuals to repay distributions from their retirement plans, potentially reducing their tax liability.

How to Complete the IRS Form 8915-F

Completing the IRS Form 8915-F requires careful attention to detail and accurate information. Here's a step-by-step guide to help you complete the form:

- Gather necessary documents: Ensure you have all necessary documents, including your retirement plan statements, tax returns, and proof of COVID-19 diagnosis or pandemic-related financial hardship.

- Determine your eligibility: Verify that you meet the eligibility requirements for filing the IRS Form 8915-F.

- Complete Part I: Provide your personal and plan information, including your name, address, and plan details.

- Complete Part II: Report your qualified disaster distributions, including the amount and date of distribution.

- Complete Part III: Report any repayments made to your retirement plan.

- Sign and date the form: Ensure you sign and date the form, as required by the IRS.

Common Mistakes to Avoid When Filing the IRS Form 8915-F

When filing the IRS Form 8915-F, it's essential to avoid common mistakes that can lead to delays or even penalties. Here are some mistakes to avoid:

- Inaccurate information: Ensure you provide accurate and complete information on the form.

- Missing documentation: Verify that you have all necessary documentation, including proof of COVID-19 diagnosis or pandemic-related financial hardship.

- Failure to sign and date the form: Ensure you sign and date the form, as required by the IRS.

Seeking Professional Help

If you're unsure about completing the IRS Form 8915-F or have complex tax situations, it's recommended to seek professional help from a qualified tax professional or financial advisor. They can provide guidance on the form's requirements and ensure you're taking advantage of the available benefits.

Conclusion

The IRS Form 8915-F is a valuable resource for individuals affected by the COVID-19 pandemic, offering a chance to claim distributions from their retirement plans without incurring penalties. By understanding the form's requirements and avoiding common mistakes, you can unlock its benefits and ensure a smooth tax filing process. Don't hesitate to seek professional help if you're unsure about completing the form.

Final Thoughts

The IRS Form 8915-F is a crucial document for those seeking to claim qualified retirement plan distributions due to the COVID-19 pandemic. By following this simplified guide, you can ensure you're taking advantage of the available benefits and avoiding common mistakes. Remember to seek professional help if you're unsure about completing the form, and don't hesitate to reach out to us with any questions or concerns.

What is the IRS Form 8915-F?

+The IRS Form 8915-F, also known as the Qualified Disaster Retirement Plan Distributions and Repayments, is a form designed to help individuals affected by qualified disasters, including the COVID-19 pandemic, to claim distributions from their retirement plans without incurring the usual penalties.

Who is eligible to file the IRS Form 8915-F?

+To be eligible to file the IRS Form 8915-F, individuals must meet specific requirements, including being diagnosed with COVID-19 or experiencing adverse financial consequences due to the pandemic.

What are the benefits of the IRS Form 8915-F?

+The IRS Form 8915-F offers several benefits to eligible individuals, including the waiver of the 10% penalty for early withdrawals, taxation of distributions, and repayment of distributions.