The American Express 4506-C form, also known as the "Request for Copy of Tax Return" form, is a crucial document required by lenders, including American Express, to verify an individual's or business's income and tax compliance. This form is typically requested during the application process for a business loan or credit card, such as the American Express Business Platinum Card. In this article, we will provide a comprehensive guide on how to fill out the American Express 4506-C form, highlighting the necessary steps, required information, and common pitfalls to avoid.

Understanding the American Express 4506-C Form

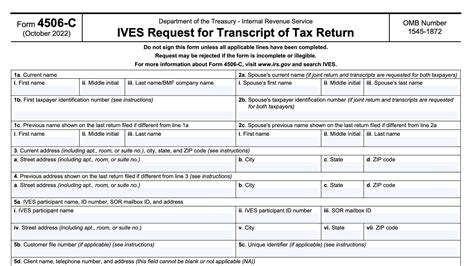

Before we dive into the filling-out process, it's essential to understand the purpose and content of the form. The American Express 4506-C form is a standardized document used by the Internal Revenue Service (IRS) to request a copy of a taxpayer's return. The form includes sections for taxpayer identification, return information, and a signature section.

What is the Purpose of the American Express 4506-C Form?

The primary purpose of the American Express 4506-C form is to verify a taxpayer's income and tax compliance. By signing the form, you are authorizing the IRS to disclose your tax return information to American Express. This information is used to evaluate your creditworthiness and make informed lending decisions.

Step 1: Section 1 - Taxpayer Identification

In this section, you will need to provide your taxpayer identification information, including:

- Your name and address

- Your social security number or employer identification number (EIN)

- Your spouse's name and social security number (if applicable)

Make sure to double-check your information for accuracy, as any errors may cause delays in processing your request.

What if I'm a Business Owner?

If you're a business owner, you will need to provide your business name and EIN. Additionally, you may need to provide the name and social security number of the business owner or authorized representative.

Step 2: Section 2 - Return Information

In this section, you will need to specify the type of return you are requesting, including:

- The tax year(s) you are requesting

- The type of return (e.g., Form 1040, Form 1120, etc.)

- The number of returns you are requesting

Make sure to carefully review the return information section, as requesting the wrong type of return or tax year may delay processing.

What if I Need to Request Multiple Returns?

If you need to request multiple returns, you can specify the additional returns in the "Number of returns" section. However, keep in mind that you may need to submit separate forms for each return.

Step 3: Section 3 - Signature Section

In this section, you will need to sign and date the form, authorizing the IRS to disclose your tax return information to American Express. Make sure to sign the form in the presence of a notary public, if required.

What if I'm Signing on Behalf of a Business?

If you're signing on behalf of a business, you will need to provide your title and authority to sign on behalf of the business.

Common Pitfalls to Avoid

When filling out the American Express 4506-C form, there are several common pitfalls to avoid, including:

- Inaccurate or incomplete information

- Incorrect return type or tax year

- Failure to sign the form in the presence of a notary public (if required)

- Submitting multiple forms for the same return

By avoiding these common pitfalls, you can ensure a smooth and efficient processing of your request.

Conclusion

Filling out the American Express 4506-C form may seem like a daunting task, but by following these steps and avoiding common pitfalls, you can ensure a successful submission. Remember to carefully review the form, provide accurate information, and sign the form in the presence of a notary public (if required). By doing so, you can help American Express verify your income and tax compliance, ultimately facilitating the lending process.What is the purpose of the American Express 4506-C form?

+The primary purpose of the American Express 4506-C form is to verify a taxpayer's income and tax compliance.

How do I fill out the taxpayer identification section?

+In the taxpayer identification section, you will need to provide your name and address, social security number or EIN, and spouse's name and social security number (if applicable).

What if I need to request multiple returns?

+If you need to request multiple returns, you can specify the additional returns in the "Number of returns" section. However, keep in mind that you may need to submit separate forms for each return.