Mastering Fannie Mae Form 1007, also known as the Single Family Comparable Sales Report, is a crucial skill for real estate professionals, particularly appraisers and lenders. This form is used to provide a detailed analysis of comparable sales data, which is essential in determining the value of a property. In this article, we will break down the process of mastering Fannie Mae Form 1007 into 5 easy steps.

Understanding the Importance of Fannie Mae Form 1007

Fannie Mae Form 1007 is a critical document in the mortgage lending process. It provides a standardized format for appraisers to present their analysis of comparable sales data, which is used by lenders to determine the value of a property. The form helps to ensure that appraisals are accurate, reliable, and consistent, which is essential for maintaining the integrity of the mortgage lending process.

Step 1: Familiarizing Yourself with the Form

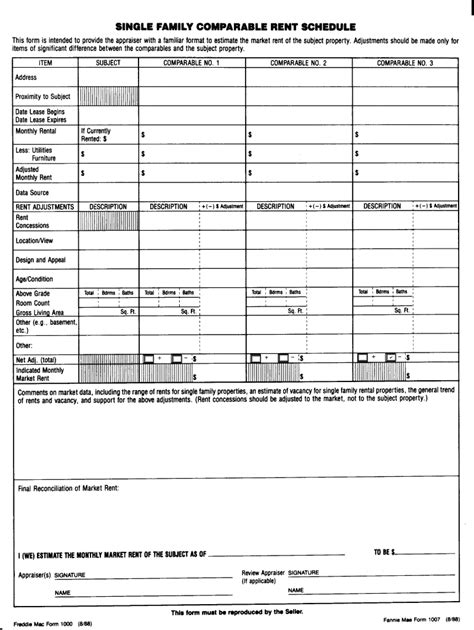

The first step in mastering Fannie Mae Form 1007 is to familiarize yourself with the form's layout and content. The form is divided into several sections, including:

- Property identification information

- Sales comparison analysis

- Adjustments to sales prices

- Reconciliation of the sales comparison analysis

Step 2: Gathering and Analyzing Comparable Sales Data

The next step is to gather and analyze comparable sales data. This involves identifying recent sales of similar properties in the same geographic area as the subject property. The data should include information such as the sales price, date of sale, and property characteristics.

When analyzing the data, appraisers should consider factors such as:

- Location

- Property type and size

- Age and condition of the property

- Amenities and features

Comparable Sales Data Analysis

- Identify recent sales of similar properties in the same geographic area as the subject property

- Analyze the data to identify trends and patterns

- Consider factors such as location, property type and size, age and condition of the property, and amenities and features

Step 3: Completing the Sales Comparison Analysis

Once the comparable sales data has been gathered and analyzed, the next step is to complete the sales comparison analysis section of the form. This involves presenting the data in a clear and concise manner, including:

- A summary of the comparable sales data

- An analysis of the data, including any trends or patterns identified

- Adjustments to the sales prices, if necessary

Sales Comparison Analysis

- Present the comparable sales data in a clear and concise manner

- Analyze the data, including any trends or patterns identified

- Make adjustments to the sales prices, if necessary

Step 4: Reconciling the Sales Comparison Analysis

The next step is to reconcile the sales comparison analysis. This involves reconciling the sales prices of the comparable properties to the subject property, taking into account any adjustments made. The reconciliation should be presented in a clear and concise manner, including:

- A summary of the reconciliation

- An explanation of any adjustments made

Reconciliation of the Sales Comparison Analysis

- Reconcile the sales prices of the comparable properties to the subject property

- Take into account any adjustments made

- Present the reconciliation in a clear and concise manner

Step 5: Reviewing and Finalizing the Form

The final step is to review and finalize the form. This involves reviewing the form for accuracy and completeness, and making any necessary revisions. The form should be signed and dated by the appraiser, and any supporting documentation should be attached.

Reviewing and Finalizing the Form

- Review the form for accuracy and completeness

- Make any necessary revisions

- Sign and date the form

- Attach any supporting documentation

By following these 5 easy steps, real estate professionals can master Fannie Mae Form 1007 and ensure that their appraisals are accurate, reliable, and consistent.

Conclusion

Mastering Fannie Mae Form 1007 is a critical skill for real estate professionals. By following the 5 easy steps outlined in this article, appraisers and lenders can ensure that their appraisals are accurate, reliable, and consistent. We hope that this article has been informative and helpful. Please share your thoughts and comments below.

FAQs

What is Fannie Mae Form 1007?

+Fannie Mae Form 1007 is a standardized form used to provide a detailed analysis of comparable sales data, which is essential in determining the value of a property.

What is the purpose of Fannie Mae Form 1007?

+The purpose of Fannie Mae Form 1007 is to provide a standardized format for appraisers to present their analysis of comparable sales data, which is used by lenders to determine the value of a property.

How do I complete Fannie Mae Form 1007?

+To complete Fannie Mae Form 1007, follow the 5 easy steps outlined in this article, including familiarizing yourself with the form, gathering and analyzing comparable sales data, completing the sales comparison analysis, reconciling the sales comparison analysis, and reviewing and finalizing the form.