As a retiree or an individual receiving government payments, you may be required to submit Form W-4V to the Internal Revenue Service (IRS) to certify your voluntary withholding of federal income tax. In this article, we will discuss the top 5 places to mail Form W-4V, ensuring you meet the necessary requirements and deadlines.

Why is Form W-4V Important?

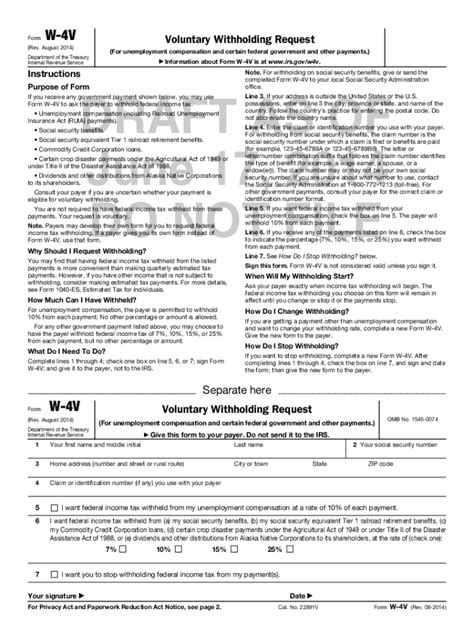

Form W-4V is a crucial document that allows you to elect voluntary withholding of federal income tax on certain government payments, such as Social Security benefits, Supplemental Security Income (SSI), and Railroad Retirement benefits. By submitting this form, you can avoid potential tax liabilities and penalties. The IRS requires that you mail the completed form to a specific address, which we will discuss below.

Top 5 Places to Mail Form W-4V

To ensure timely processing, it is essential to mail your completed Form W-4V to the correct address. Here are the top 5 places to mail your form:1. Internal Revenue Service Center, Cincinnati, OH

The IRS Center in Cincinnati, Ohio, is the primary address for mailing Form W-4V. You can send your completed form to:Internal Revenue Service Center 1111 Constitution Ave NW Washington, DC 20224

2. Social Security Administration, Office of International Operations

If you are a Social Security beneficiary living outside the United States, you can mail your Form W-4V to the Social Security Administration's Office of International Operations:Social Security Administration Office of International Operations P.O. Box 17741 Baltimore, MD 21235-7741

3. Railroad Retirement Board, Office of General Counsel

Railroad Retirement beneficiaries can mail their Form W-4V to the Railroad Retirement Board's Office of General Counsel:Railroad Retirement Board Office of General Counsel 844 N. Rush St. Chicago, IL 60611-2092

4. Office of Personnel Management, Retirement Operations

Federal retirees can mail their Form W-4V to the Office of Personnel Management's Retirement Operations:Office of Personnel Management Retirement Operations P.O. Box 45 Boyers, PA 16017-0045

5. Department of Veterans Affairs, Debt Management Center

Veterans receiving VA benefits can mail their Form W-4V to the Department of Veterans Affairs' Debt Management Center:Department of Veterans Affairs Debt Management Center P.O. Box 11930 St. Paul, MN 55111-0930

Additional Tips and Reminders

Before mailing your Form W-4V, ensure you have completed it accurately and signed it. You can use the following tips to avoid common mistakes:- Use black ink to sign your form.

- Make a copy of your completed form for your records.

- Verify the mailing address to ensure timely processing.

- Use a trackable mail service, such as certified mail or a courier, to ensure delivery confirmation.

By following these guidelines and mailing your Form W-4V to the correct address, you can ensure that your voluntary withholding request is processed efficiently and effectively.

What is the purpose of Form W-4V?

+Form W-4V is used to certify voluntary withholding of federal income tax on certain government payments, such as Social Security benefits, Supplemental Security Income (SSI), and Railroad Retirement benefits.

Can I submit Form W-4V electronically?

+No, Form W-4V must be mailed to the specified address. Electronic submissions are not accepted.

How long does it take to process Form W-4V?

+The processing time for Form W-4V typically takes 4-6 weeks. However, this timeframe may vary depending on the workload of the processing center.