Filing taxes can be a daunting task, especially for those who are new to the process. In North Carolina, residents are required to file their state tax returns using the NC DOR Form D-400. This form is used to report an individual's income, claim deductions and credits, and calculate their tax liability. In this article, we will provide a comprehensive guide on how to file the NC DOR Form D-400, including who needs to file, what forms and documents are required, and how to calculate tax liability.

Who Needs to File the NC DOR Form D-400?

All North Carolina residents who have earned income during the tax year are required to file the NC DOR Form D-400. This includes individuals who have worked as employees, self-employed individuals, and those who have received income from other sources such as investments or retirement accounts. Even if an individual does not owe taxes, they may still need to file a return to report their income and claim any refunds they may be eligible for.

What Forms and Documents are Required?

To file the NC DOR Form D-400, individuals will need to gather several forms and documents, including:

- W-2 forms from employers

- 1099 forms for self-employment income or other income

- Interest statements from banks and investments

- Dividend statements from investments

- Charitable donation receipts

- Medical expense receipts

- Mortgage interest statements

Understanding the NC DOR Form D-400

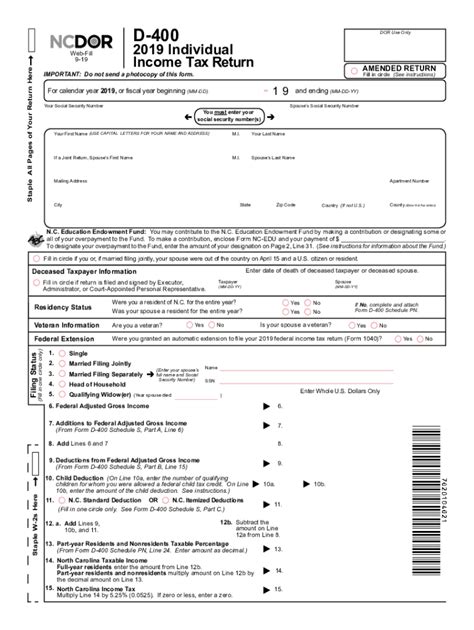

The NC DOR Form D-400 is a multi-page form that requires individuals to report their income, claim deductions and credits, and calculate their tax liability. The form is divided into several sections, including:

- Income: This section requires individuals to report their income from all sources, including wages, self-employment income, and other income.

- Deductions: This section allows individuals to claim deductions for expenses such as mortgage interest, charitable donations, and medical expenses.

- Credits: This section allows individuals to claim credits for expenses such as child care and education expenses.

- Tax Liability: This section requires individuals to calculate their tax liability based on their income and deductions.

Calculating Tax Liability

Calculating tax liability on the NC DOR Form D-400 can be complex, but it can be broken down into several steps:

- Determine taxable income: This is the individual's total income minus any deductions they are eligible for.

- Calculate tax liability: Using the tax tables or tax rate schedules, individuals can calculate their tax liability based on their taxable income.

- Apply credits: Individuals can apply credits to reduce their tax liability.

- Calculate total tax liability: This is the individual's tax liability after applying credits.

Filing the NC DOR Form D-400

The NC DOR Form D-400 can be filed electronically or by mail. Individuals who file electronically can use the NC Department of Revenue's online filing system, while those who file by mail can send their return to the address listed on the form.

Tips and Reminders

- File on time: The deadline for filing the NC DOR Form D-400 is typically April 15th, but this can vary depending on the tax year.

- Use the correct form: Make sure to use the correct form for the tax year you are filing for.

- Report all income: Report all income from all sources, including wages, self-employment income, and other income.

- Claim deductions and credits: Claim deductions and credits for expenses such as mortgage interest, charitable donations, and medical expenses.

Common Mistakes to Avoid

- Math errors: Double-check math calculations to avoid errors.

- Incomplete information: Make sure to include all required information, including income, deductions, and credits.

- Incorrect filing status: Make sure to use the correct filing status, such as single, married, or head of household.

Amending a Return

If an individual needs to make changes to their return after it has been filed, they can file an amended return using Form D-400X. This form allows individuals to correct errors, report additional income, or claim additional deductions and credits.

Conclusion

Filing the NC DOR Form D-400 can be a complex process, but by following the steps outlined in this guide, individuals can ensure they are in compliance with North Carolina state tax laws. Remember to report all income, claim deductions and credits, and calculate tax liability accurately. If you have any questions or concerns, consider consulting with a tax professional or contacting the NC Department of Revenue for assistance.

Call to Action

We hope this guide has been helpful in explaining the process of filing the NC DOR Form D-400. If you have any questions or need further assistance, please don't hesitate to reach out. Share this article with others who may be struggling with the tax filing process, and don't forget to follow us for more informative articles and guides.

FAQ Section

What is the deadline for filing the NC DOR Form D-400?

+The deadline for filing the NC DOR Form D-400 is typically April 15th, but this can vary depending on the tax year.

What forms and documents do I need to file the NC DOR Form D-400?

+You will need to gather several forms and documents, including W-2 forms, 1099 forms, interest statements, dividend statements, charitable donation receipts, medical expense receipts, and mortgage interest statements.

How do I calculate my tax liability on the NC DOR Form D-400?

+To calculate your tax liability, you will need to determine your taxable income, calculate your tax liability using the tax tables or tax rate schedules, apply credits, and calculate your total tax liability.