Citibank Direct Deposit Authorization Form: A Comprehensive Guide

Are you a Citibank account holder looking to simplify your finances by setting up direct deposit? Or perhaps you're an employer seeking to streamline payroll processes for your employees? Either way, understanding the Citibank Direct Deposit Authorization Form is essential. In this article, we'll delve into the world of direct deposit, exploring its benefits, how it works, and provide a step-by-step guide on completing the authorization form.

Benefits of Direct Deposit

Direct deposit is a payment method that allows funds to be transferred electronically from one bank account to another. It's a convenient, secure, and efficient way to receive payments, eliminating the need for physical checks. By setting up direct deposit with Citibank, you can enjoy several benefits, including:

• Faster access to funds: With direct deposit, you can access your money sooner, as it's deposited directly into your account. • Increased security: Electronic transfers reduce the risk of lost or stolen checks. • Reduced paperwork: No more paper checks to process or deposit. • Environmental benefits: Less paper waste contributes to a more sustainable environment.

How Direct Deposit Works

The direct deposit process involves three main parties: the payer, the bank, and the recipient. Here's a simplified overview:

- Payer initiation: The payer (e.g., an employer) initiates the direct deposit process by providing the recipient's bank account information and the amount to be deposited.

- Bank processing: The payer's bank sends the deposit information to the recipient's bank through the Automated Clearing House (ACH) network.

- Recipient receipt: The recipient's bank receives the deposit and credits the funds to the recipient's account.

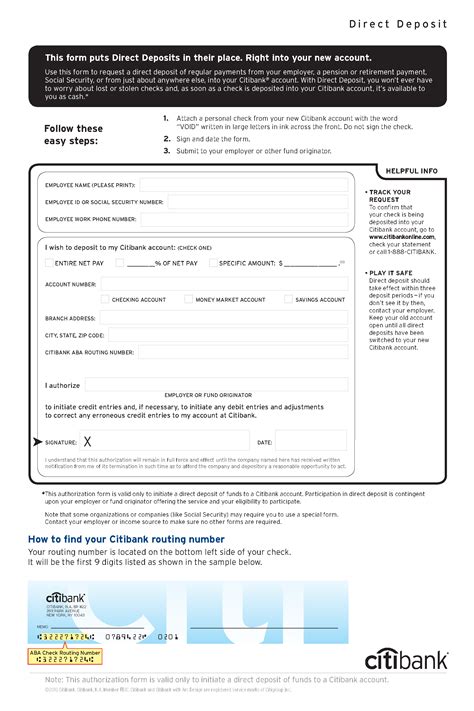

Completing the Citibank Direct Deposit Authorization Form

To set up direct deposit with Citibank, you'll need to complete the Direct Deposit Authorization Form. This form authorizes Citibank to deposit funds directly into your account. Here's a step-by-step guide to help you complete the form:

Step 1: Download and print the form

You can download the Citibank Direct Deposit Authorization Form from the Citibank website or obtain a copy from your local Citibank branch. Print the form and review it carefully.

Step 2: Fill in your account information

Complete the form by providing your:

- Citibank account number

- Account type (checking or savings)

- Routing number (also known as the ABA number)

Step 3: Specify the deposit amount and frequency

Indicate the amount you want to deposit and the frequency of the deposits (e.g., weekly, biweekly, monthly).

Step 4: Provide the payer's information

Enter the payer's name, address, and phone number.

Step 5: Sign and date the form

Sign and date the form to authorize Citibank to deposit funds into your account.

Step 6: Return the form

Return the completed form to Citibank via mail, fax, or in-person at your local branch.

Tips and Reminders

When completing the Citibank Direct Deposit Authorization Form, keep the following tips and reminders in mind:

- Ensure you have a valid Citibank account and provide accurate account information.

- Verify the payer's information to avoid any errors or delays.

- Keep a copy of the completed form for your records.

- Allow 1-2 weeks for the direct deposit setup to take effect.

Common Questions and Concerns

Here are some frequently asked questions and concerns about the Citibank Direct Deposit Authorization Form:

- Q: Can I use direct deposit for both personal and business accounts?

- A: Yes, you can use direct deposit for both personal and business accounts.

- Q: Is direct deposit secure?

- A: Yes, direct deposit is a secure payment method, as it uses the ACH network and is regulated by the National Automated Clearing House Association (NACHA).

- Q: Can I cancel or change my direct deposit setup?

- A: Yes, you can cancel or change your direct deposit setup by contacting Citibank and providing written notice.

Conclusion

Setting up direct deposit with Citibank is a straightforward process that can simplify your finances and reduce paperwork. By following the steps outlined in this article and completing the Direct Deposit Authorization Form, you can enjoy the benefits of direct deposit. Remember to keep a copy of the completed form for your records and allow time for the setup to take effect.

What's your experience with direct deposit? Share your thoughts and questions in the comments below!

What is the Citibank Direct Deposit Authorization Form?

+The Citibank Direct Deposit Authorization Form is a document that authorizes Citibank to deposit funds directly into your account.

How do I obtain the Citibank Direct Deposit Authorization Form?

+You can download the form from the Citibank website or obtain a copy from your local Citibank branch.

Can I use direct deposit for both personal and business accounts?

+Yes, you can use direct deposit for both personal and business accounts.