As a business owner or tax professional, understanding Form 4562 is crucial for accurately reporting depreciation and amortization on your tax return. Form 4562, also known as the Depreciation and Amortization form, is a critical component of the tax filing process. In this comprehensive guide, we will walk you through the instructions for completing Form 4562, ensuring you are well-equipped to navigate this complex tax form.

Understanding Depreciation and Amortization

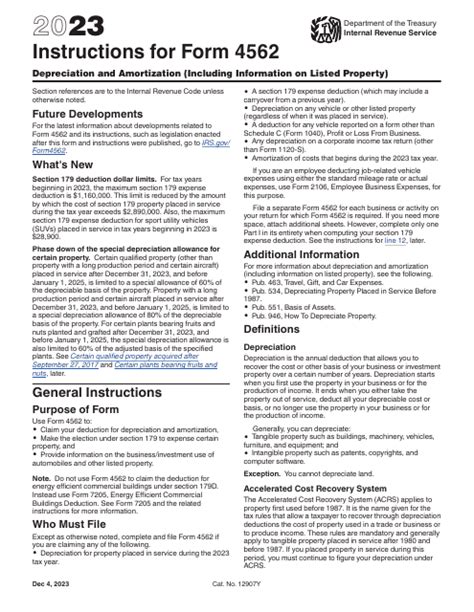

Before diving into the instructions for Form 4562, it's essential to understand the concepts of depreciation and amortization. Depreciation refers to the decrease in value of tangible assets, such as buildings, vehicles, and equipment, over time due to wear and tear. Amortization, on the other hand, refers to the decrease in value of intangible assets, such as patents, copyrights, and trademarks, over time.

Both depreciation and amortization are tax-deductible expenses, allowing businesses to recover the costs of these assets over their useful lives. Accurate reporting of these expenses on Form 4562 is critical to ensure businesses are taking advantage of the tax benefits available to them.

Completing Form 4562: Part I - General Information

When completing Form 4562, begin by providing general information about the taxpayer and the tax year. This includes:

- The taxpayer's name and address

- The tax year

- The type of tax return being filed (e.g., Form 1040, Form 1120)

Completing Form 4562: Part II - Depreciation

Depreciation Elections and Conventions

In Part II of Form 4562, taxpayers report their depreciation expenses. This section is divided into several parts, including:

- Section 179 Expense Deduction: Report the total amount of Section 179 expense deduction claimed for the tax year.

- Special Depreciation Allowance: Report the total amount of special depreciation allowance claimed for the tax year.

- Modified Accelerated Cost Recovery System (MACRS): Report the depreciation expenses for assets placed in service during the tax year using the MACRS method.

Completing Form 4562: Part III - Amortization

Amortization of Intangible Assets

In Part III of Form 4562, taxpayers report their amortization expenses. This section includes:

- Amortization of Intangible Assets: Report the total amount of amortization expense claimed for the tax year.

- Section 197 Intangibles: Report the amortization expenses for Section 197 intangibles, such as patents, copyrights, and trademarks.

Completing Form 4562: Part IV - Summary

Summary of Depreciation and Amortization

In Part IV of Form 4562, taxpayers summarize their depreciation and amortization expenses. This section includes:

- Total Depreciation: Report the total depreciation expense claimed for the tax year.

- Total Amortization: Report the total amortization expense claimed for the tax year.

Completing Form 4562: Part V - Additional Information

Additional Information and Elections

In Part V of Form 4562, taxpayers provide additional information and make elections related to depreciation and amortization. This section includes:

- Election to Expense Certain Qualified Real Property: Report the election to expense certain qualified real property.

- Election to Use Alternative Depreciation System: Report the election to use the alternative depreciation system.

Common Mistakes to Avoid

When completing Form 4562, it's essential to avoid common mistakes that can lead to errors and delays in processing your tax return. Some common mistakes to avoid include:

- Incorrect Classification of Assets: Ensure that assets are properly classified as either tangible or intangible.

- Incorrect Calculation of Depreciation and Amortization: Ensure that depreciation and amortization expenses are accurately calculated using the correct methods and conventions.

- Failure to Report Section 179 Expense Deduction: Ensure that the Section 179 expense deduction is properly reported.

Frequently Asked Questions

What is the purpose of Form 4562?

+Form 4562 is used to report depreciation and amortization expenses on a tax return.

What is the difference between depreciation and amortization?

+Depreciation refers to the decrease in value of tangible assets, while amortization refers to the decrease in value of intangible assets.

How do I calculate depreciation and amortization expenses?

+Depreciation and amortization expenses can be calculated using various methods and conventions, including the Modified Accelerated Cost Recovery System (MACRS) and the Alternative Depreciation System (ADS).

Conclusion

Completing Form 4562 can be a complex and time-consuming process, but by following the instructions outlined in this guide, taxpayers can ensure accurate reporting of depreciation and amortization expenses. Remember to avoid common mistakes, and don't hesitate to seek professional advice if needed. By taking the time to properly complete Form 4562, businesses can take advantage of the tax benefits available to them and minimize the risk of errors and delays in processing their tax return.