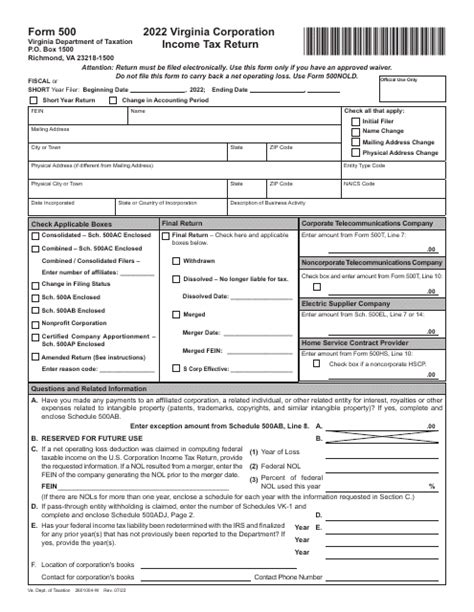

The Virginia Form 500 is a crucial document for businesses operating in the state of Virginia. It serves as the annual report for corporations, limited liability companies (LLCs), and other business entities, providing essential information to the State Corporation Commission (SCC). Filing this form accurately and on time is essential to maintain compliance and avoid penalties. In this article, we will delve into the instructions and requirements for filing the Virginia Form 500.

Importance of Filing Virginia Form 500

Filing the Virginia Form 500 is a mandatory requirement for all business entities registered in the state of Virginia. The form provides critical information about the company's structure, ownership, and operations, which helps the SCC maintain accurate records and ensure compliance with state laws. Failure to file the form on time or with inaccurate information can result in penalties, fines, and even loss of business license.

Who Needs to File Virginia Form 500?

The following business entities are required to file the Virginia Form 500:

- Corporations (including non-profit corporations)

- Limited Liability Companies (LLCs)

- Limited Partnerships (LPs)

- Limited Liability Partnerships (LLPs)

- Professional Corporations

- Real Estate Investment Trusts (REITs)

Filing Requirements for Virginia Form 500

To file the Virginia Form 500, businesses must provide the following information:

- Business entity name and type

- Business address and mailing address

- Registered agent name and address

- Officer and director information (for corporations)

- Member and manager information (for LLCs)

- Financial information (including revenue and expenses)

- Description of business activities

How to File Virginia Form 500

Businesses can file the Virginia Form 500 online or by mail. The online filing option is available through the SCC's website, and the form can be completed and submitted electronically. For mail filing, the form must be printed, completed, and mailed to the SCC with the required filing fee.

- Online Filing:

- Mail Filing: State Corporation Commission, P.O. Box 1197, Richmond, VA 23218

Deadlines and Fees for Virginia Form 500

The deadline for filing the Virginia Form 500 is the last day of the anniversary month of the business entity's formation. For example, if a corporation was formed on June 15, 2020, the annual report must be filed by June 30, 2021.

The filing fee for the Virginia Form 500 varies depending on the type of business entity:

- Corporations: $100

- LLCs: $50

- LPs and LLPs: $50

- Professional Corporations: $100

- REITs: $100

Consequences of Late or Inaccurate Filing

Failure to file the Virginia Form 500 on time or with inaccurate information can result in penalties and fines. The SCC may impose the following penalties:

- Late filing fee: $25

- Inaccurate information fee: $50

- Revocation of business license (in extreme cases)

Tips for Accurate and Timely Filing

To ensure accurate and timely filing of the Virginia Form 500, businesses should:

- Review the form carefully before submitting

- Verify the accuracy of information provided

- File the form online to reduce the risk of errors

- Pay the filing fee on time to avoid late fees

- Keep records of filing and payment for future reference

By following these instructions and requirements, businesses can ensure compliance with the Virginia Form 500 filing requirements and avoid penalties. It is essential to review the form carefully and verify the accuracy of information provided to maintain good standing with the State Corporation Commission.

We hope this article has provided valuable information and insights into the Virginia Form 500 filing instructions and requirements. If you have any further questions or concerns, please do not hesitate to reach out to us.

What is the deadline for filing the Virginia Form 500?

+The deadline for filing the Virginia Form 500 is the last day of the anniversary month of the business entity's formation.

How much is the filing fee for the Virginia Form 500?

+The filing fee for the Virginia Form 500 varies depending on the type of business entity, ranging from $50 to $100.

What happens if I file the Virginia Form 500 late or with inaccurate information?

+Failure to file the Virginia Form 500 on time or with inaccurate information can result in penalties and fines, including a late filing fee of $25 and an inaccurate information fee of $50.