As a fiduciary, filing taxes on behalf of an estate or trust can be a complex and daunting task. One of the most important forms to complete is Schedule J, also known as the "Accumulation Distribution for Certain Complex Trusts." In this article, we will provide you with 7 tips for filing Schedule J Form 1041 to ensure you comply with the IRS requirements and avoid any potential errors or penalties.

Understanding Schedule J

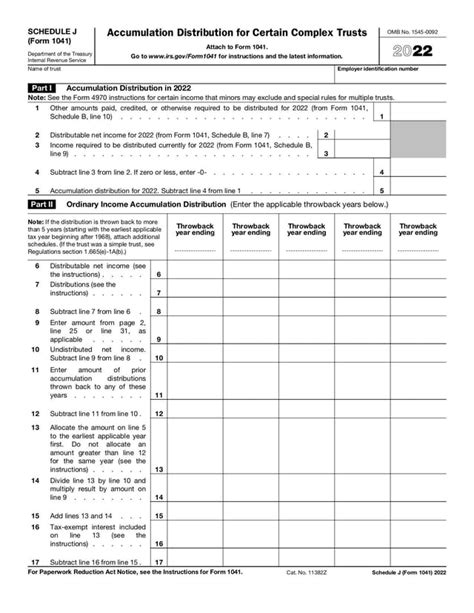

Before we dive into the tips, it's essential to understand what Schedule J is and why it's necessary. Schedule J is used to report the accumulation distribution for certain complex trusts, which includes the income, deductions, and credits accumulated by the trust. The form is used to calculate the trust's tax liability and to report any distributions made to beneficiaries.

Tip 1: Determine if You Need to File Schedule J

Not all estates and trusts are required to file Schedule J. To determine if you need to file this form, you'll need to review the trust's documentation and ensure that it meets the IRS requirements. Generally, if the trust has accumulated income and has not distributed all of its income to beneficiaries, you will need to file Schedule J.

Characteristics of Trusts that Require Schedule J

Trusts that require Schedule J typically have the following characteristics:

- Accumulated income

- Undistributed income

- Distributions made to beneficiaries

- Complex trust structures, such as tiered trusts or trusts with multiple beneficiaries

Tip 2: Gather Required Documents and Information

To complete Schedule J, you'll need to gather various documents and information, including:

- The trust's tax identification number

- The trust's financial statements, including income and expense statements

- The trust's tax returns for previous years

- Documentation of distributions made to beneficiaries

Required Documents for Schedule J

It's essential to ensure that you have all the required documents and information before starting to complete Schedule J. This will help you avoid errors and ensure that you can complete the form accurately.

Tip 3: Complete Schedule J Accurately

Completing Schedule J requires attention to detail and accuracy. Ensure that you carefully review the form and complete all the necessary sections, including:

- Part I: Accumulation Distribution

- Part II: Distributions to Beneficiaries

- Part III: Computation of Tax Liability

Common Errors to Avoid on Schedule J

Some common errors to avoid on Schedule J include:

- Incorrectly reporting accumulated income

- Failing to report distributions to beneficiaries

- Miscalculating the trust's tax liability

Tip 4: Report Distributions to Beneficiaries

If the trust made distributions to beneficiaries, you'll need to report these distributions on Schedule J. This includes:

- The amount of the distribution

- The beneficiary's tax identification number

- The type of distribution (e.g., income, principal, or capital gains)

Reporting Distributions to Beneficiaries on Schedule J

It's essential to ensure that you accurately report distributions to beneficiaries, as this will affect the trust's tax liability and the beneficiary's tax obligations.

Tip 5: Calculate the Trust's Tax Liability

To calculate the trust's tax liability, you'll need to complete Part III of Schedule J. This involves:

- Calculating the trust's taxable income

- Applying the trust's deductions and credits

- Determining the trust's tax liability

Calculating the Trust's Tax Liability on Schedule J

It's essential to ensure that you accurately calculate the trust's tax liability, as this will affect the trust's tax obligations and any potential penalties.

Tip 6: File Schedule J on Time

Schedule J must be filed with the trust's tax return (Form 1041) by the required filing deadline. If you're filing electronically, you'll need to ensure that you meet the IRS's electronic filing requirements.

Filing Deadlines for Schedule J

It's essential to ensure that you file Schedule J on time to avoid any potential penalties or fines.

Tip 7: Seek Professional Help if Needed

Completing Schedule J can be complex and time-consuming. If you're unsure about any aspect of the form or need help with calculations or documentation, consider seeking professional help from a tax professional or attorney.

Benefits of Seeking Professional Help

Seeking professional help can ensure that you complete Schedule J accurately and avoid any potential errors or penalties.

FAQs:

What is Schedule J?

+Schedule J is a form used to report the accumulation distribution for certain complex trusts, which includes the income, deductions, and credits accumulated by the trust.

Who needs to file Schedule J?

+Trusts that have accumulated income and have not distributed all of its income to beneficiaries need to file Schedule J.

What documents do I need to complete Schedule J?

+You'll need to gather various documents and information, including the trust's tax identification number, financial statements, and documentation of distributions made to beneficiaries.

We hope these 7 tips for filing Schedule J Form 1041 have been helpful in ensuring that you comply with the IRS requirements and avoid any potential errors or penalties. Remember to seek professional help if needed, and don't hesitate to reach out to us if you have any further questions or concerns.