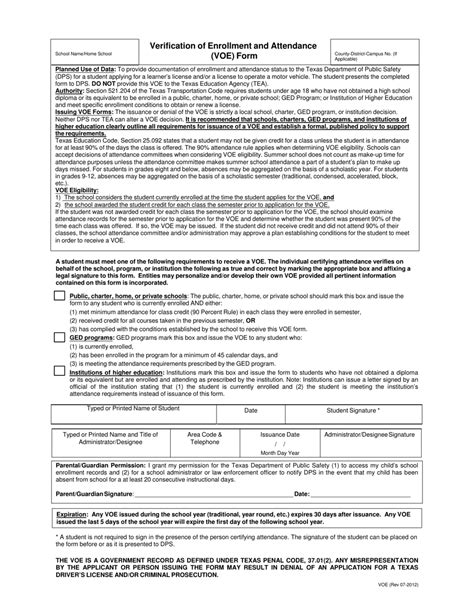

If you're a Texas employer, understanding the process of filing a wage claim, also known as a Voe (Verification of Employment), is crucial for resolving disputes and ensuring compliance with labor laws. A Voe in Texas is a formal document that verifies an employee's employment status, wages, and work history. It's often requested by government agencies, lenders, and other third parties to verify an individual's income and employment information. In this article, we'll provide you with 5 tips for filing a Voe in Texas, helping you navigate the process with ease.

Understanding the Importance of Voe in Texas

Filing a Voe in Texas is a critical step in verifying an employee's employment information. It's essential for employers to understand the process, as it can impact an employee's ability to access credit, benefits, or other services. By filing a Voe, employers can provide accurate and timely information, helping to resolve disputes and prevent potential issues.

Tip 1: Gather Required Information

Before filing a Voe in Texas, gather all required information about the employee, including:

- Employee name and identification number

- Dates of employment

- Job title and department

- Wage information (hourly rate, salary, or other compensation)

- Number of hours worked per week

- Reason for leaving (if applicable)

Having this information readily available will help streamline the process and ensure accuracy.

Tip 2: Choose the Correct Voe Form

The Texas Workforce Commission (TWC) provides two types of Voe forms: the Voe-1 and the Voe-2. The Voe-1 is used for verifying employment and wages, while the Voe-2 is used for verifying employment only. Choose the correct form based on the requestor's needs and the information you're able to provide.

Tip 3: Complete the Voe Form Accurately

Complete the Voe form accurately and thoroughly, using the information gathered in Tip 1. Ensure all sections are filled out, and signatures are obtained from authorized personnel. Inaccurate or incomplete information can lead to delays or disputes.

Tip 4: Submit the Voe Form on Time

The TWC requires Voe forms to be submitted within 10 business days of receipt. Ensure you submit the completed form within this timeframe to avoid delays or penalties. You can submit the form by mail, fax, or email, depending on the requestor's preferences.

Tip 5: Maintain Accurate Records

Maintain accurate and up-to-date records of all Voe forms submitted, including the request date, form type, and submission date. This will help you track and respond to future requests efficiently.

By following these 5 tips for filing a Voe in Texas, employers can ensure compliance with labor laws and provide accurate information to requestors. Remember to gather required information, choose the correct form, complete the form accurately, submit on time, and maintain accurate records.

Take Action

Now that you've learned the tips for filing a Voe in Texas, take action by:

- Reviewing your current record-keeping practices

- Ensuring you have the necessary information for Voe forms

- Verifying your understanding of the Voe process

Share your experiences or questions about filing a Voe in Texas in the comments below. Help others by sharing this article with colleagues and friends.

FAQ Section

What is a Voe in Texas?

+A Voe in Texas is a formal document that verifies an employee's employment status, wages, and work history.

How long do I have to submit a Voe form in Texas?

+The Texas Workforce Commission requires Voe forms to be submitted within 10 business days of receipt.

What information is required for a Voe form in Texas?

+Required information includes employee name and identification number, dates of employment, job title and department, wage information, and number of hours worked per week.