As a partner in a foreign partnership, you're likely no stranger to the complexities of international taxation. The IRS requires foreign partnerships to comply with specific reporting requirements, and one of the key forms involved in this process is the IRS Form 8805. In this comprehensive guide, we'll delve into the details of Form 8805, its purpose, and the steps you need to take to ensure compliance.

Understanding IRS Form 8805

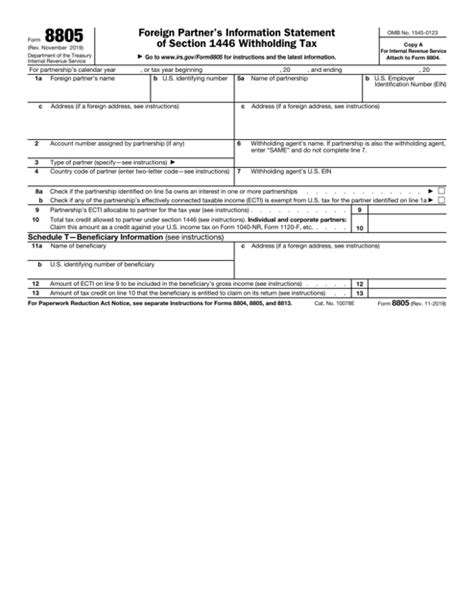

The IRS Form 8805, also known as the Foreign Partner's Information Statement of Section 1446 Withholding Tax, is a crucial document for foreign partnerships with U.S.-source income. This form is used to report the amount of withholding tax paid on behalf of foreign partners, as well as to provide information about the partnership's income and distributions.

Purpose of Form 8805

The primary purpose of Form 8805 is to report the withholding tax paid on behalf of foreign partners under Section 1446 of the Internal Revenue Code. This section requires partnerships to withhold tax on certain types of income, such as rents, royalties, and interest, that are allocable to foreign partners.

In addition to reporting withholding tax, Form 8805 also serves as a mechanism for partnerships to provide information about the identity of their foreign partners, as well as the amount of income and distributions allocable to these partners.

Who Needs to File Form 8805?

Form 8805 is required to be filed by partnerships that have:

- U.S.-source income that is subject to withholding under Section 1446.

- Foreign partners who have a U.S. tax obligation.

This includes partnerships that are:

- Foreign partnerships with U.S. partners.

- U.S. partnerships with foreign partners.

- Partnerships that have elected to be treated as a foreign partnership for U.S. tax purposes.

Consequences of Non-Compliance

Failure to file Form 8805 or failure to comply with the withholding requirements under Section 1446 can result in significant penalties and fines. These may include:

- A penalty of $100 for each partner for whom the required information is not provided.

- A penalty of 10% of the amount of tax that was required to be withheld.

- Interest on any unpaid tax.

How to Complete Form 8805

To complete Form 8805, you'll need to provide the following information:

- Partnership information, including the partnership's name, address, and employer identification number.

- Information about each foreign partner, including their name, address, and taxpayer identification number.

- The amount of U.S.-source income allocable to each foreign partner.

- The amount of withholding tax paid on behalf of each foreign partner.

- The amount of distributions made to each foreign partner.

The form is divided into several sections, including:

- Section 1: Partnership Information

- Section 2: Foreign Partner Information

- Section 3: Income and Withholding Tax

- Section 4: Distributions

Steps to File Form 8805

To file Form 8805, follow these steps:

- Gather all required information and documentation.

- Complete the form in its entirety.

- Attach any required supporting documentation, such as Forms W-8BEN or W-8ECI.

- File the form with the IRS by the required deadline.

Deadlines and Extensions

The deadline for filing Form 8805 is typically March 15th of each year, for the preceding tax year. However, an automatic 6-month extension of time to file can be obtained by filing Form 8804.

Common Questions and Answers

Here are some common questions and answers related to Form 8805:

Q: What is the purpose of Form 8805? A: The purpose of Form 8805 is to report the withholding tax paid on behalf of foreign partners, as well as to provide information about the partnership's income and distributions.

Q: Who needs to file Form 8805? A: Partnerships that have U.S.-source income that is subject to withholding under Section 1446 and have foreign partners who have a U.S. tax obligation.

Q: What are the consequences of non-compliance? A: Failure to file Form 8805 or failure to comply with the withholding requirements under Section 1446 can result in significant penalties and fines.

Conclusion

In conclusion, Form 8805 is a critical component of foreign partner tax compliance. By understanding the purpose and requirements of this form, partnerships can ensure that they are meeting their U.S. tax obligations and avoiding potential penalties and fines.

We hope this comprehensive guide has provided you with the information and resources you need to navigate the complexities of Form 8805. If you have any further questions or concerns, please don't hesitate to reach out.

What is the deadline for filing Form 8805?

+The deadline for filing Form 8805 is typically March 15th of each year, for the preceding tax year.

Can I obtain an extension of time to file Form 8805?

+Yes, an automatic 6-month extension of time to file can be obtained by filing Form 8804.

What are the consequences of non-compliance with Form 8805?

+Failure to file Form 8805 or failure to comply with the withholding requirements under Section 1446 can result in significant penalties and fines.