Understanding Form 2441 and Its Purpose

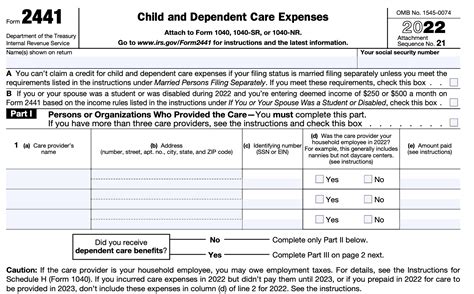

As a taxpayer, you may have encountered Form 2441 while preparing your taxes using TurboTax. Form 2441 is used to claim the Child and Dependent Care Credit, which can provide significant tax savings for eligible individuals. However, in some cases, you may need to remove Form 2441 from TurboTax due to changes in your tax situation or errors in your tax return.

Why You May Need to Remove Form 2441

There are several reasons why you may need to remove Form 2441 from TurboTax:

- You may have made an error in claiming the Child and Dependent Care Credit.

- Your tax situation has changed, and you are no longer eligible for the credit.

- You have already claimed the credit on a different tax return.

In this article, we will explore five ways to remove Form 2441 from TurboTax.

Method 1: Delete the Form 2441 from the TurboTax Dashboard

One way to remove Form 2441 from TurboTax is to delete it directly from the TurboTax dashboard. Here's how:

- Log in to your TurboTax account and navigate to the dashboard.

- Click on the "Taxes" tab and select the tax return that contains Form 2441.

- Click on the "Forms" tab and locate Form 2441.

- Click on the "Delete" button next to Form 2441.

- Confirm that you want to delete the form.

Method 2: Use the TurboTax "Remove Form" Feature

TurboTax provides a feature that allows you to remove forms from your tax return. Here's how to use this feature:

- Log in to your TurboTax account and navigate to the dashboard.

- Click on the "Taxes" tab and select the tax return that contains Form 2441.

- Click on the "Forms" tab and locate Form 2441.

- Click on the "Remove Form" button.

- Select the reason why you want to remove the form.

- Confirm that you want to remove the form.

Method 3: Re-Enter Your Tax Information

If you need to remove Form 2441 due to errors in your tax return, you may need to re-enter your tax information. Here's how:

- Log in to your TurboTax account and navigate to the dashboard.

- Click on the "Taxes" tab and select the tax return that contains Form 2441.

- Click on the "Start Over" button.

- Re-enter your tax information, making sure to correct any errors.

- Proceed with the tax preparation process, and Form 2441 will be automatically removed.

Method 4: Use the TurboTax "Amend" Feature

If you have already filed your tax return and need to remove Form 2441, you may need to amend your return. Here's how:

- Log in to your TurboTax account and navigate to the dashboard.

- Click on the "Taxes" tab and select the tax return that contains Form 2441.

- Click on the "Amend" button.

- Follow the prompts to amend your tax return, removing Form 2441 as needed.

Method 5: Contact TurboTax Support

If you are unable to remove Form 2441 using the above methods, you may need to contact TurboTax support for assistance. Here's how:

- Log in to your TurboTax account and navigate to the dashboard.

- Click on the "Help" tab and select "Contact Us."

- Explain your issue to the support representative, and they will assist you in removing Form 2441.

Conclusion and Next Steps

Removing Form 2441 from TurboTax can be a straightforward process, but it requires attention to detail and an understanding of the tax preparation process. By following the methods outlined above, you should be able to remove Form 2441 from your tax return. If you have any further questions or concerns, be sure to contact TurboTax support for assistance.

What is Form 2441 used for?

+Form 2441 is used to claim the Child and Dependent Care Credit, which provides tax savings for eligible individuals.

Can I remove Form 2441 from TurboTax if I have already filed my tax return?

+Yes, you can remove Form 2441 from TurboTax if you have already filed your tax return by using the "Amend" feature or contacting TurboTax support.

What happens if I remove Form 2441 from TurboTax?

+Removing Form 2441 from TurboTax will update your tax return to reflect the changes. You may need to re-enter your tax information or amend your return, depending on the circumstances.