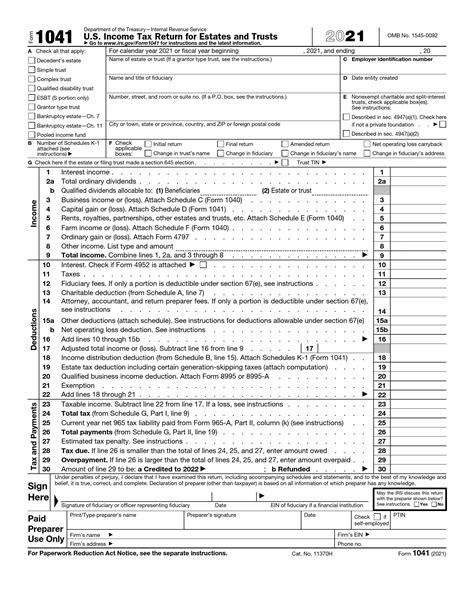

Filing taxes can be a daunting task, especially when dealing with complex forms and schedules. One such schedule that often raises questions is the 1041 Schedule B form, which is used by estates and trusts to report income and deductions. To help you better understand this form, we've put together six essential facts about the 1041 Schedule B form.

What is the 1041 Schedule B Form?

Who Needs to File the 1041 Schedule B Form?

The 1041 Schedule B form is required to be filed by estates and trusts that have income from interest, dividends, and capital gains distributions. This includes:- Estates of deceased individuals

- Trusts, including grantor trusts and non-grantor trusts

- Bankruptcy estates

What Information is Reported on the 1041 Schedule B Form?

- Interest income from bonds, notes, and other debt obligations

- Dividend income from stocks and other equity investments

- Capital gains distributions from mutual funds and other investment vehicles

- Foreign tax credits and deductions

- Other income and deductions related to interest, dividends, and capital gains distributions

How to Complete the 1041 Schedule B Form

To complete the 1041 Schedule B form, estates and trusts will need to gather the following information:- Statements from financial institutions and investment companies showing interest, dividend, and capital gains income

- Records of foreign tax credits and deductions

- Documentation of other income and deductions related to interest, dividends, and capital gains distributions

Once you have gathered the necessary information, you can complete the 1041 Schedule B form by following these steps:

- Report interest income on Line 1 of the form

- Report dividend income on Line 2 of the form

- Report capital gains distributions on Line 3 of the form

- Calculate foreign tax credits and deductions on Line 4 of the form

- Report other income and deductions on Line 5 of the form

Common Errors to Avoid When Filing the 1041 Schedule B Form

- Failing to report all interest, dividend, and capital gains income

- Incorrectly calculating foreign tax credits and deductions

- Failing to document other income and deductions related to interest, dividends, and capital gains distributions

- Failing to sign and date the form

Penalties for Failure to File or Inaccurate Filing of the 1041 Schedule B Form

Failure to file or inaccurate filing of the 1041 Schedule B form can result in penalties and interest. The IRS may impose a penalty of up to 47.6% of the underreported tax liability, plus interest on the underreported tax.Conclusion and Next Steps

If you have any questions or concerns about the 1041 Schedule B form, we encourage you to comment below or share this article with others who may benefit from this information. Additionally, if you need help with preparing and filing the 1041 Schedule B form, consider consulting with a tax professional or seeking guidance from the IRS.

What is the due date for filing the 1041 Schedule B form?

+The due date for filing the 1041 Schedule B form is typically April 15th of each year, but may be extended to October 15th if an automatic six-month extension is filed.

Can I file the 1041 Schedule B form electronically?

+Yes, the IRS offers electronic filing options for the 1041 Schedule B form through its Modernized e-File (MeF) program.

What happens if I fail to file the 1041 Schedule B form?

+Failing to file the 1041 Schedule B form can result in penalties, interest, and even loss of tax benefits. The IRS may also impose additional penalties for failure to pay tax due.