As tax season approaches, millions of Americans are preparing to file their annual tax returns. One of the most important forms for individuals to complete is Form 1040, which reports their income, deductions, and credits. However, many taxpayers are unaware of the additional schedules that may be required to complete their return. One of these schedules is Form 1040 Schedule 3, also known as the "Additional Income and Losses" schedule. In this article, we will provide 7 tips to help you master Form 1040 Schedule 3 and ensure that your tax return is accurate and complete.

Understanding Form 1040 Schedule 3

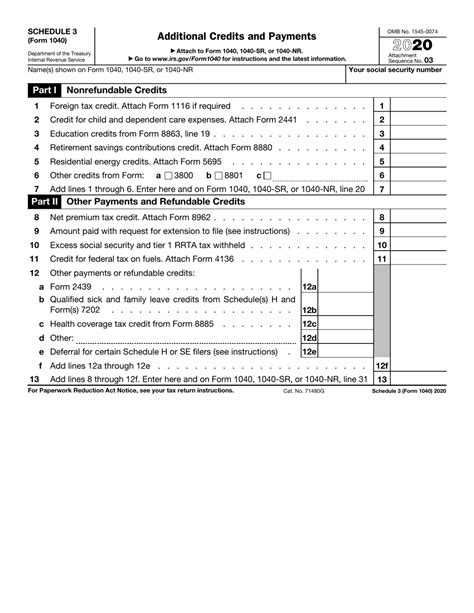

Form 1040 Schedule 3 is used to report various types of income and losses that are not reported on the main Form 1040. This includes income from sources such as alimony, prizes and awards, and tax refunds, as well as losses from activities such as hobby losses and losses from the sale of property. The schedule is divided into several sections, each corresponding to a specific type of income or loss.

Types of Income Reported on Schedule 3

Some of the types of income reported on Form 1040 Schedule 3 include:

- Alimony received

- Prizes and awards

- Tax refunds

- Unemployment compensation

- Social Security benefits

Tips for Completing Form 1040 Schedule 3

Now that we have a basic understanding of Form 1040 Schedule 3, let's move on to some tips for completing the form.

1. Review Your Tax Documents

Before starting to complete Schedule 3, make sure you have all the necessary tax documents, such as your W-2 forms, 1099 forms, and any other relevant documents. This will help ensure that you report all your income accurately.

2. Understand the Different Types of Income

As mentioned earlier, Schedule 3 reports various types of income. Make sure you understand the different types of income and which ones apply to your situation. For example, if you received alimony, you will need to report it on Schedule 3.

3. Report Alimony Received

If you received alimony during the tax year, you will need to report it on Schedule 3. You will need to provide the payer's name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

4. Report Prizes and Awards

If you won any prizes or awards during the tax year, you will need to report them on Schedule 3. This includes prizes won from contests, sweepstakes, and other competitions.

5. Report Tax Refunds

If you received a tax refund during the tax year, you will need to report it on Schedule 3. This includes refunds from federal, state, and local taxes.

6. Report Unemployment Compensation

If you received unemployment compensation during the tax year, you will need to report it on Schedule 3. You will need to provide the amount of unemployment compensation received and the state that issued the compensation.

7. Review and Sign the Schedule

Once you have completed Schedule 3, review it carefully to ensure that all the information is accurate and complete. Sign and date the schedule, and attach it to your Form 1040.

Common Errors to Avoid

When completing Form 1040 Schedule 3, there are several common errors to avoid. These include:

- Failing to report all income

- Reporting incorrect amounts

- Failing to sign and date the schedule

- Failing to attach the schedule to Form 1040

By avoiding these common errors, you can ensure that your tax return is accurate and complete.

Conclusion

Completing Form 1040 Schedule 3 can be a complex and time-consuming process. However, by following the tips outlined in this article, you can ensure that your tax return is accurate and complete. Remember to review your tax documents, understand the different types of income, and report all income accurately. By doing so, you can avoid common errors and ensure that your tax return is processed quickly and efficiently.If you have any questions or concerns about completing Form 1040 Schedule 3, don't hesitate to ask. Leave a comment below, and we will do our best to assist you.

What is Form 1040 Schedule 3 used for?

+Form 1040 Schedule 3 is used to report various types of income and losses that are not reported on the main Form 1040.

What types of income are reported on Schedule 3?

+Schedule 3 reports various types of income, including alimony, prizes and awards, tax refunds, unemployment compensation, and Social Security benefits.

What are some common errors to avoid when completing Schedule 3?

+Common errors to avoid include failing to report all income, reporting incorrect amounts, failing to sign and date the schedule, and failing to attach the schedule to Form 1040.