Are you struggling to fill out TurboTax Form 5329, also known as the Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts? You're not alone. Many taxpayers find themselves overwhelmed by the complexities of tax laws and regulations, especially when it comes to navigating the intricacies of retirement accounts and tax penalties.

Fortunately, we're here to help. In this article, we'll break down the ins and outs of Form 5329 and provide you with a step-by-step guide on how to fill it out accurately and efficiently. We'll also explore some common mistakes to avoid and provide some valuable tips to help you minimize your tax liability.

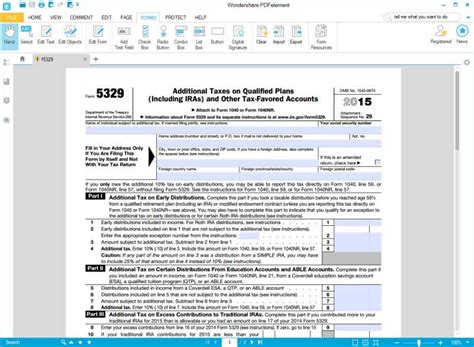

Understanding Form 5329

Before we dive into the nitty-gritty of filling out Form 5329, let's take a moment to understand what it's used for. Form 5329 is a tax form used to report additional taxes on qualified plans, including Individual Retirement Accounts (IRAs), 401(k) plans, and other tax-favored accounts. The form is used to calculate and report excise taxes, penalties, and interest on these types of accounts.

5 Ways to Fill Out TurboTax Form 5329

Now that we've got a basic understanding of Form 5329, let's move on to the good stuff. Here are five ways to fill out the form:

1. Gather Your Documents

Before you start filling out Form 5329, make sure you have all the necessary documents and information at your fingertips. This includes:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your IRA or retirement account statements

- Your tax return from the previous year

- Any correspondence from the IRS related to your retirement account

Part I: Additional Taxes on Qualified Plans

This section of the form is used to report additional taxes on qualified plans, including IRAs and 401(k) plans. You'll need to report the following information:

- The type of qualified plan you have (e.g. IRA, 401(k), etc.)

- The account balance as of December 31st of the previous year

- The amount of any excess contributions or distributions

2. Calculate Your Additional Taxes

Once you've gathered all the necessary information, you'll need to calculate your additional taxes. This involves multiplying the account balance by the applicable tax rate. The tax rate will depend on the type of qualified plan you have and the amount of any excess contributions or distributions.

Excess Contributions

If you made excess contributions to your IRA or retirement account, you'll need to report this on Form 5329. Excess contributions are contributions that exceed the annual contribution limit. For example, if you contributed $6,000 to your IRA in 2022, but the annual contribution limit was $5,500, you would have made an excess contribution of $500.

3. Report Your Excess Contributions

To report your excess contributions, you'll need to complete Part II of Form 5329. This involves reporting the following information:

- The amount of any excess contributions

- The date you made the excess contributions

- The amount of any penalties or interest

4. Calculate Your Penalty

If you made excess contributions or distributions from your qualified plan, you may be subject to a penalty. The penalty is calculated as a percentage of the excess contribution or distribution. For example, if you made an excess contribution of $1,000, and the penalty is 6%, you would owe a penalty of $60.

Part III: Penalty on Excess Accumulation

This section of the form is used to report the penalty on excess accumulation. You'll need to report the following information:

- The amount of any excess accumulation

- The date you made the excess accumulation

- The amount of any penalties or interest

5. Complete the Form and Submit It

Once you've completed all the necessary sections of Form 5329, you'll need to sign and date the form. You can submit the form electronically or by mail. If you're submitting the form electronically, you'll need to use the IRS's electronic filing system. If you're submitting the form by mail, you'll need to send it to the address listed on the form.

Common Mistakes to Avoid

When filling out Form 5329, there are several common mistakes to avoid. These include:

- Failing to report excess contributions or distributions

- Underreporting or overreporting the amount of excess contributions or distributions

- Failing to calculate the penalty correctly

- Failing to sign and date the form

Tips for Minimizing Your Tax Liability

Here are some tips for minimizing your tax liability:

- Contribute the maximum amount to your IRA or retirement account

- Avoid making excess contributions or distributions

- Keep accurate records of your contributions and distributions

- Consider consulting a tax professional if you're unsure about how to fill out Form 5329

Conclusion

Filling out Form 5329 can be a complex and time-consuming process, but with the right guidance, you can avoid common mistakes and minimize your tax liability. By following the steps outlined in this article, you'll be well on your way to accurately and efficiently completing Form 5329. Remember to gather all the necessary documents, calculate your additional taxes, report your excess contributions, calculate your penalty, and complete the form and submit it. With a little practice and patience, you'll be a pro at filling out Form 5329 in no time!

FAQ Section

What is Form 5329 used for?

+Form 5329 is used to report additional taxes on qualified plans, including IRAs and 401(k) plans.

How do I calculate my additional taxes?

+To calculate your additional taxes, you'll need to multiply the account balance by the applicable tax rate.

What is the penalty for excess contributions?

+The penalty for excess contributions is calculated as a percentage of the excess contribution.