The NY Form IT-201 is a crucial document for New York State residents, and understanding its instructions can seem daunting. However, with a step-by-step guide, you'll be able to navigate the process with ease.

Understanding the Importance of NY Form IT-201

The NY Form IT-201, also known as the New York State Income Tax Return, is a vital document for residents who need to file their state income tax. The form is used to report income, claim deductions and credits, and calculate tax liability. As a resident of New York State, it's essential to understand the instructions for completing this form accurately to avoid any delays or penalties.

Who Needs to File NY Form IT-201?

Not everyone needs to file the NY Form IT-201. However, if you meet any of the following conditions, you're required to file:

- You're a resident of New York State and have a federal gross income of $5,000 or more.

- You're a non-resident with income sourced from New York State.

- You're a part-year resident with income earned during the time you lived in New York State.

Gathering Necessary Documents

Before starting the filing process, gather the necessary documents, including:

- W-2 forms from your employer(s)

- 1099 forms for freelance or self-employment income

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense receipts

Step-by-Step Instructions for NY Form IT-201

Now that you have the necessary documents, follow these step-by-step instructions to complete the NY Form IT-201:

Section 1: Personal Information

- Enter your name, address, and Social Security number.

- Check the box indicating your filing status (single, married filing jointly, etc.).

- Enter your spouse's name and Social Security number (if applicable).

Section 2: Income

- Report your income from W-2 forms, 1099 forms, and other sources.

- Calculate your total income and enter it on line 1.

Types of Income

- Wages, salaries, and tips

- Self-employment income

- Interest and dividend income

- Capital gains and losses

Section 3: Deductions and Exemptions

- Claim the standard deduction or itemize deductions.

- Enter your exemptions, including personal and dependent exemptions.

Types of Deductions

- Standard deduction

- Itemized deductions (medical expenses, charitable donations, etc.)

- Personal exemptions

- Dependent exemptions

Section 4: Credits

- Claim credits for child care, education expenses, and other qualified expenses.

Types of Credits

- Child care credit

- Education credit

- Earned Income Tax Credit (EITC)

Section 5: Tax Liability and Payment

- Calculate your tax liability based on your income, deductions, and credits.

- Enter the amount you owe or the amount you're due for a refund.

Filing and Payment Options

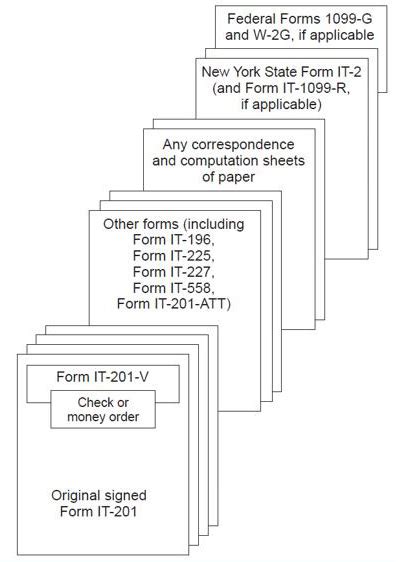

You can file your NY Form IT-201 electronically or by mail. If you owe taxes, you can pay online, by phone, or by mail.

Common Errors to Avoid

- Inaccurate or incomplete information

- Failure to report income or claim deductions and credits

- Incorrect calculations or math errors

By following these step-by-step instructions and avoiding common errors, you'll be able to complete the NY Form IT-201 with confidence. Remember to review your return carefully before submitting it to ensure accuracy and avoid any delays or penalties.

What is the deadline for filing NY Form IT-201?

+The deadline for filing NY Form IT-201 is typically April 15th, but it may vary depending on your individual circumstances. Check the New York State Department of Taxation and Finance website for specific deadlines and extensions.

Can I file NY Form IT-201 electronically?

+Yes, you can file NY Form IT-201 electronically through the New York State Department of Taxation and Finance website or through a tax preparation software. Electronic filing is faster and more convenient than paper filing.

What if I need help with my NY Form IT-201?

+If you need help with your NY Form IT-201, you can contact the New York State Department of Taxation and Finance or seek assistance from a tax professional. They can provide guidance and support to ensure you complete your return accurately and efficiently.

We hope this comprehensive guide has helped you understand the instructions for NY Form IT-201. Remember to take your time, and don't hesitate to seek help if you need it. Share your thoughts and questions in the comments below, and don't forget to share this article with others who may find it helpful!