As the tax season approaches, many individuals and families are preparing to file their tax returns. For those who received advance payments of the Premium Tax Credit (APTC) or want to claim the Premium Tax Credit (PTC) on their tax return, filling out Form 8962 is a crucial step. However, completing this form can be overwhelming, especially for those who are new to the process. In this article, we will guide you through five ways to complete fillable Form 8962 accurately and efficiently.

Understanding Form 8962

Before we dive into the five ways to complete fillable Form 8962, it's essential to understand what this form is and why it's necessary. Form 8962, also known as the Premium Tax Credit (PTC), is a tax form used to reconcile the advance payments of the Premium Tax Credit (APTC) with the actual credit amount you're eligible for based on your income and family size.

Who Needs to File Form 8962?

You need to file Form 8962 if:

- You received advance payments of the Premium Tax Credit (APTC) in 2022

- You want to claim the Premium Tax Credit (PTC) on your 2022 tax return

- You're eligible for the Premium Tax Credit (PTC) but didn't receive advance payments

5 Ways to Complete Fillable Form 8962

Now that you understand the purpose of Form 8962, let's move on to the five ways to complete it accurately and efficiently.

1. Use Tax Preparation Software

One of the easiest ways to complete fillable Form 8962 is to use tax preparation software like TurboTax, H&R Block, or TaxAct. These programs will guide you through the process, ensuring you fill out the form correctly and accurately. Simply answer the questions, and the software will populate the form for you.

2. Hire a Tax Professional

If you're not comfortable using tax preparation software or need personalized assistance, consider hiring a tax professional. They will help you gather the necessary documents, fill out Form 8962, and ensure you're taking advantage of all the credits and deductions you're eligible for.

3. Use the IRS Free File Program

The IRS Free File program is a free service that allows you to prepare and file your tax return, including Form 8962, for free. This program is available to individuals and families with incomes below $69,000. You can access the program through the IRS website.

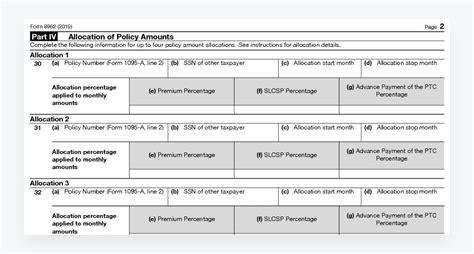

4. Fill Out Form 8962 Manually

If you prefer to fill out Form 8962 manually, you can download the form from the IRS website or pick one up at your local IRS office. Make sure to read the instructions carefully and fill out the form accurately. You can also use the IRS Form 8962 instructions to help guide you through the process.

5. Use the IRS Form 8962 Worksheet

The IRS Form 8962 worksheet is a helpful tool that can assist you in filling out Form 8962. The worksheet will guide you through the calculations and ensure you're reporting the correct information.

Tips for Completing Form 8962

To ensure you complete Form 8962 accurately, follow these tips:

- Gather all necessary documents, including your 1095-A form and proof of income

- Read the instructions carefully before filling out the form

- Use tax preparation software or consult a tax professional if you're unsure about any part of the process

- Double-check your calculations to ensure accuracy

Conclusion

Completing fillable Form 8962 can be a daunting task, but with the right tools and resources, you can ensure accuracy and efficiency. By following the five ways outlined in this article, you'll be well on your way to completing Form 8962 with confidence.

Take Action

Don't wait until the last minute to complete Form 8962. Start gathering your documents and choose the method that works best for you. If you have any questions or concerns, leave a comment below or consult a tax professional.

What is Form 8962 used for?

+Form 8962 is used to reconcile the advance payments of the Premium Tax Credit (APTC) with the actual credit amount you're eligible for based on your income and family size.

Who needs to file Form 8962?

+You need to file Form 8962 if you received advance payments of the Premium Tax Credit (APTC), want to claim the Premium Tax Credit (PTC) on your tax return, or are eligible for the Premium Tax Credit (PTC) but didn't receive advance payments.

What documents do I need to complete Form 8962?

+You'll need your 1095-A form, proof of income, and other supporting documents to complete Form 8962.