The California Probate Code 4401 Form is a crucial document in the state's probate process. For those dealing with the estate of a deceased loved one, navigating the complexities of probate can be overwhelming. In this article, we will provide a step-by-step guide on how to complete the California Probate Code 4401 Form, making the process less daunting for those involved.

The Importance of Probate

Probate is a court-supervised process that ensures the distribution of a deceased person's assets according to their will or the state's intestacy laws. The process involves gathering the deceased person's assets, paying off debts and taxes, and distributing the remaining assets to beneficiaries. In California, the probate process is governed by the Probate Code, which provides a framework for the administration of estates.

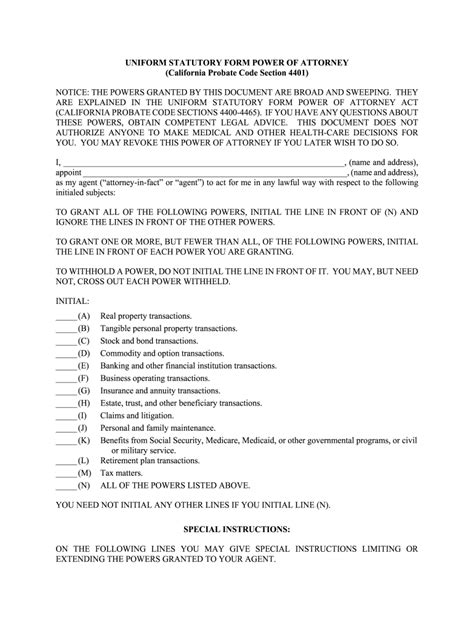

Understanding the California Probate Code 4401 Form

The California Probate Code 4401 Form, also known as the "Petition for Probate," is a document filed with the court to initiate the probate process. The form provides essential information about the deceased person, their estate, and the proposed personal representative. The court uses this information to determine whether to grant probate and appoint a personal representative to manage the estate.

Step-by-Step Guide to Completing the California Probate Code 4401 Form

Section 1: Decedent's Information

The first section of the form requires information about the deceased person, including their name, date of birth, and date of death.

- Decedent's Name: Enter the full name of the deceased person as it appears on their identification documents.

- Date of Birth: Enter the deceased person's date of birth in the format MM/DD/YYYY.

- Date of Death: Enter the deceased person's date of death in the format MM/DD/YYYY.

Section 2: Estate Information

The second section of the form requires information about the deceased person's estate, including the value of their assets and liabilities.

- Value of Assets: Estimate the total value of the deceased person's assets, including real estate, bank accounts, investments, and personal property.

- Value of Liabilities: Estimate the total value of the deceased person's liabilities, including debts, taxes, and other obligations.

Section 3: Personal Representative Information

The third section of the form requires information about the proposed personal representative, including their name, address, and contact information.

- Personal Representative's Name: Enter the full name of the proposed personal representative.

- Personal Representative's Address: Enter the proposed personal representative's address, including their street address, city, state, and zip code.

Filing the California Probate Code 4401 Form

Once the form is completed, it must be filed with the court in the county where the deceased person lived or owned property. The filing fee for the petition is currently $435, but this fee is subject to change.

Conclusion

The California Probate Code 4401 Form is a critical document in the state's probate process. By following this step-by-step guide, individuals can ensure that the form is completed accurately and efficiently. If you are dealing with the estate of a deceased loved one, it is essential to consult with an attorney to ensure that the probate process is handled correctly.

We hope this article has provided valuable insights into the California Probate Code 4401 Form. If you have any further questions or concerns, please do not hesitate to reach out to us.

What is the California Probate Code 4401 Form?

+The California Probate Code 4401 Form, also known as the "Petition for Probate," is a document filed with the court to initiate the probate process.

What information is required on the California Probate Code 4401 Form?

+The form requires information about the deceased person, their estate, and the proposed personal representative.

Where do I file the California Probate Code 4401 Form?

+The form must be filed with the court in the county where the deceased person lived or owned property.