The UCLA 1098-T form is a crucial document for students and families who want to claim tax benefits for their education expenses. As a student or family member, understanding the 1098-T form and its implications can help you navigate the complex world of tax benefits and maximize your savings.

The 1098-T form is an annual statement that colleges and universities, including the University of California, Los Angeles (UCLA), provide to students who paid qualified tuition and related expenses during the tax year. This form reports the amount of tuition and fees paid, as well as any scholarships, grants, or other forms of financial aid received. The purpose of the 1098-T form is to help students and their families claim tax credits and deductions for education expenses.

Why is the 1098-T form important?

The 1098-T form is essential for students and families who want to claim tax benefits for education expenses. The form provides critical information that helps you determine whether you are eligible for tax credits or deductions. By reviewing the 1098-T form carefully, you can ensure that you are taking advantage of all the tax benefits available to you.

Types of tax benefits for education expenses

There are two main types of tax benefits for education expenses: the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). Both credits can help reduce your tax liability, but they have different eligibility requirements and benefits.

The AOTC is a refundable tax credit that provides up to $2,500 per eligible student. To qualify, you must have paid qualified tuition and fees for an eligible student during the tax year. The credit is subject to income limits, and you must claim the credit on your tax return.

The LLC is a non-refundable tax credit that provides up to $2,000 per tax return. To qualify, you must have paid qualified tuition and fees for an eligible student during the tax year. The credit is also subject to income limits, and you must claim the credit on your tax return.

In addition to tax credits, you may also be eligible for tax deductions for education expenses. The Tuition and Fees Deduction allows you to deduct up to $4,000 of qualified tuition and fees from your taxable income.

How to read and understand the 1098-T form

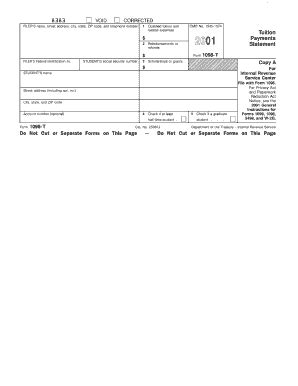

The 1098-T form is a complex document, but understanding its components can help you navigate the tax benefits process. Here's a breakdown of the form's key sections:

- Box 1: Payments received for qualified tuition and related expenses: This box reports the total amount of qualified tuition and fees paid during the tax year.

- Box 2: Amounts billed for qualified tuition and related expenses: This box reports the total amount of qualified tuition and fees billed during the tax year.

- Box 3: Scholarships or grants: This box reports the total amount of scholarships or grants received during the tax year.

- Box 4: Adjustments to scholarships or grants for a prior year: This box reports any adjustments to scholarships or grants for a prior year.

- Box 5: Adjustments to prior year's qualified tuition and related expenses: This box reports any adjustments to prior year's qualified tuition and fees.

Tips for claiming tax benefits

To maximize your tax benefits, follow these tips:

- Keep accurate records: Keep accurate records of your education expenses, including receipts, invoices, and bank statements.

- Review the 1098-T form carefully: Review the 1098-T form carefully to ensure that all information is accurate and complete.

- Claim the correct credit or deduction: Claim the correct credit or deduction based on your eligibility and the type of education expenses you incurred.

- Consult a tax professional: Consult a tax professional if you are unsure about how to claim tax benefits or need help with the tax preparation process.

UCLA's 1098-T form process

UCLA provides 1098-T forms to students who paid qualified tuition and fees during the tax year. Here's an overview of the process:

- Form availability: 1098-T forms are available by January 31st of each year.

- Form delivery: 1098-T forms are delivered electronically to students through the UCLA BruinBill portal.

- Form corrections: If you need to correct your 1098-T form, contact the UCLA Registrar's Office.

Common mistakes to avoid

To avoid common mistakes when claiming tax benefits, follow these tips:

- Avoid overreporting income: Avoid overreporting income by claiming credits or deductions for which you are not eligible.

- Avoid underreporting income: Avoid underreporting income by failing to claim credits or deductions for which you are eligible.

- Avoid filing incorrect forms: Avoid filing incorrect forms or schedules by reviewing the 1098-T form carefully and seeking help from a tax professional if needed.

Conclusion

The 1098-T form is a critical document for students and families who want to claim tax benefits for education expenses. By understanding the form and its implications, you can navigate the complex world of tax benefits and maximize your savings. Remember to keep accurate records, review the 1098-T form carefully, and claim the correct credit or deduction based on your eligibility.

What's next?

If you have questions or concerns about the 1098-T form or tax benefits, contact the UCLA Registrar's Office or a tax professional for assistance. Remember to stay informed about tax laws and regulations, and take advantage of all the tax benefits available to you.

FAQ Section:

What is the 1098-T form?

+The 1098-T form is an annual statement that colleges and universities provide to students who paid qualified tuition and related expenses during the tax year.

What are the types of tax benefits for education expenses?

+There are two main types of tax benefits for education expenses: the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC).

How do I claim tax benefits for education expenses?

+To claim tax benefits for education expenses, you must file a tax return and claim the correct credit or deduction based on your eligibility and the type of education expenses you incurred.