Understanding the 941-X Worksheet 2 Fillable Form: A Comprehensive Guide

For employers, filing taxes can be a daunting task, especially when it comes to correcting previously filed returns. The 941-X Worksheet 2 Fillable Form is a crucial tool in this process, allowing employers to adjust employment tax returns and make necessary corrections. In this article, we will delve into the world of the 941-X Worksheet 2, providing a comprehensive guide on how to fill it out accurately and efficiently.

Why is the 941-X Worksheet 2 Important?

The 941-X Worksheet 2 is a critical component of the Form 941-X, which is used to correct errors or make adjustments to previously filed employment tax returns. The worksheet helps employers calculate the corrected employment tax liability, taking into account any adjustments made. It's essential to understand the importance of this worksheet, as it directly affects the accuracy of the Form 941-X and, ultimately, the employer's tax liability.

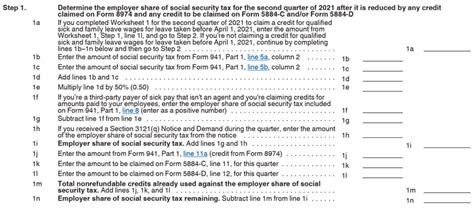

How to Fill Out the 941-X Worksheet 2

To accurately fill out the 941-X Worksheet 2, employers must follow these steps:

- Determine the quarter being corrected: Identify the specific quarter for which the correction is being made.

- Calculate the corrected employment tax liability: Use the worksheet to calculate the corrected employment tax liability, taking into account any adjustments made.

- Complete the necessary columns: Fill out the required columns, including the corrected employment tax liability, the adjustment amount, and the resulting corrected employment tax liability.

- Sign and date the worksheet: Ensure that the worksheet is signed and dated by the employer or authorized representative.

Understanding the Columns

The 941-X Worksheet 2 consists of several columns that require accurate completion. Here's a breakdown of each column:- Column 1: Corrected employment tax liability: Enter the corrected employment tax liability for the quarter being corrected.

- Column 2: Adjustment amount: Enter the adjustment amount, which represents the change to the original employment tax liability.

- Column 3: Resulting corrected employment tax liability: Calculate the resulting corrected employment tax liability by adding the adjustment amount to the corrected employment tax liability.

Common Mistakes to Avoid

When filling out the 941-X Worksheet 2, it's essential to avoid common mistakes that can lead to errors and delays. Some of these mistakes include:

- Inaccurate calculations: Ensure that all calculations are accurate and correct.

- Incomplete information: Make sure to complete all required columns and sections.

- Incorrect quarter: Verify that the correct quarter is being corrected.

Benefits of Using the 941-X Worksheet 2

Using the 941-X Worksheet 2 offers several benefits, including:

- Accurate calculations: The worksheet helps ensure accurate calculations, reducing the risk of errors.

- Streamlined corrections: The worksheet streamlines the correction process, making it easier to adjust previously filed returns.

- Compliance: The worksheet helps employers comply with employment tax regulations and requirements.

Best Practices for Filing the 941-X Worksheet 2

To ensure a smooth filing process, follow these best practices:

- Verify accuracy: Double-check all calculations and information for accuracy.

- Use the correct forms: Ensure that the correct forms and worksheets are used.

- File on time: File the corrected return on time to avoid penalties and interest.

By following these guidelines and best practices, employers can accurately fill out the 941-X Worksheet 2 and ensure compliance with employment tax regulations.

Call to Action: Share your experiences or ask questions about the 941-X Worksheet 2 in the comments section below. Don't forget to share this article with others who may benefit from this comprehensive guide.

What is the purpose of the 941-X Worksheet 2?

+The 941-X Worksheet 2 is used to calculate the corrected employment tax liability and make adjustments to previously filed employment tax returns.

What are the common mistakes to avoid when filling out the 941-X Worksheet 2?

+Common mistakes to avoid include inaccurate calculations, incomplete information, and incorrect quarter.

What are the benefits of using the 941-X Worksheet 2?

+The benefits of using the 941-X Worksheet 2 include accurate calculations, streamlined corrections, and compliance with employment tax regulations.