As a business owner in Florida, it's essential to stay on top of your sales tax obligations to avoid any penalties or fines. One crucial aspect of sales tax compliance is obtaining and maintaining valid resale certificates from your customers. In this article, we'll delve into the importance of Florida annual resale certificate upload for sales tax DR-13 and provide a comprehensive guide on how to navigate this process.

Understanding the Importance of Resale Certificates

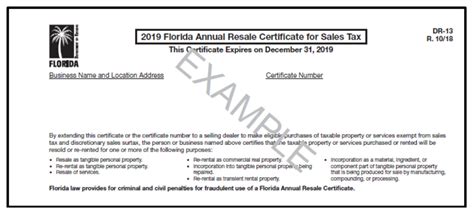

Resale certificates, also known as DR-13 certificates, are documents provided by customers to vendors that certify the purchase is for resale purposes. As a vendor, it's your responsibility to collect and maintain these certificates to support your sales tax exemption claims. Without valid resale certificates, you may be liable for sales tax on exempt sales, which can lead to costly penalties and fines.

What is a DR-13 Certificate?

A DR-13 certificate is a specific type of resale certificate used in Florida to document exempt sales. The certificate must be completed and signed by the purchaser, stating that the purchase is for resale purposes. The DR-13 certificate is usually valid for a period of three years, after which it must be renewed or updated.

Why is Annual Resale Certificate Upload Necessary?

The Florida Department of Revenue requires businesses to maintain accurate records of resale certificates, including uploading them annually. This ensures that vendors can support their sales tax exemption claims and demonstrates compliance with state regulations.

Failing to upload resale certificates annually can lead to:

- Penalties and fines for non-compliance

- Loss of sales tax exemption benefits

- Increased audit risk

- Reputational damage

Benefits of Annual Resale Certificate Upload

Uploading resale certificates annually provides several benefits, including:

- Demonstrated compliance with Florida sales tax regulations

- Reduced risk of penalties and fines

- Improved audit preparedness

- Enhanced reputation and credibility

How to Upload Resale Certificates for Sales Tax DR-13

To upload resale certificates for sales tax DR-13, follow these steps:

- Collect and review resale certificates: Ensure that all resale certificates are complete, signed, and up-to-date.

- Scan and digitize certificates: Scan and digitize the resale certificates to create electronic copies.

- Log in to the Florida Department of Revenue's website: Access the Florida Department of Revenue's website and log in to your account.

- Navigate to the resale certificate upload section: Locate the resale certificate upload section and select the option to upload certificates.

- Upload the digitized certificates: Upload the digitized resale certificates, ensuring that all required information is accurate and complete.

- Verify and confirm upload: Verify that the upload was successful and confirm that the certificates are now accessible.

Best Practices for Maintaining Resale Certificates

To ensure compliance and reduce the risk of penalties, follow these best practices for maintaining resale certificates:

- Regularly review and update resale certificates

- Verify the accuracy and completeness of certificates

- Store certificates securely and maintain accurate records

- Train staff on the importance of resale certificates and the upload process

Common Challenges and Solutions

Common challenges associated with resale certificate upload include:

- Missing or incomplete certificates: Ensure that all certificates are complete and signed.

- Difficulty navigating the upload process: Seek guidance from the Florida Department of Revenue or a qualified tax professional.

- Inadequate record-keeping: Implement a secure and organized record-keeping system.

By understanding the importance of Florida annual resale certificate upload for sales tax DR-13 and following the steps outlined in this article, you can ensure compliance and reduce the risk of penalties.

Conclusion

In conclusion, uploading resale certificates annually is a critical aspect of sales tax compliance in Florida. By understanding the importance of resale certificates and following the steps outlined in this article, you can ensure compliance and reduce the risk of penalties. Remember to regularly review and update resale certificates, verify the accuracy and completeness of certificates, and store certificates securely.

Take Action Now

Upload your resale certificates today and ensure compliance with Florida sales tax regulations. If you have any questions or concerns, don't hesitate to reach out to a qualified tax professional or the Florida Department of Revenue.

Share Your Thoughts

Have you experienced any challenges with resale certificate upload? Share your thoughts and experiences in the comments section below.

What is a resale certificate, and why is it necessary?

+A resale certificate is a document provided by customers to vendors that certifies the purchase is for resale purposes. It's necessary to support sales tax exemption claims and demonstrate compliance with state regulations.

How often do I need to upload resale certificates?

+Resale certificates must be uploaded annually to ensure compliance with Florida sales tax regulations.

What are the consequences of failing to upload resale certificates?

+Failing to upload resale certificates can lead to penalties and fines, loss of sales tax exemption benefits, increased audit risk, and reputational damage.