As a responsible individual, planning for the future and ensuring that your loved ones are taken care of after you're gone is crucial. One way to do this is by designating a payable on death (POD) beneficiary for your Huntington Bank accounts. In this article, we'll delve into the world of POD forms, explaining what they are, how they work, and providing a step-by-step guide on how to complete a Huntington Bank payable on death form.

Having a POD beneficiary in place can provide peace of mind, knowing that your assets will be transferred to your chosen beneficiary without the need for probate. But before we dive into the details, let's start with the basics.

What is a Payable on Death (POD) Form?

A payable on death form, also known as a POD beneficiary designation, is a document that allows you to designate a beneficiary to receive the funds in your bank account after your passing. This type of account is also known as a Totten trust or a revocable trust.

The POD form is typically used for bank accounts, certificates of deposit (CDs), and other deposit accounts. By designating a POD beneficiary, you can ensure that your assets are transferred to your loved ones quickly and efficiently, without the need for probate.

How Does a Payable on Death Form Work?

When you complete a payable on death form, you're essentially creating a contract between you and the bank. The form designates a beneficiary who will receive the funds in your account after your passing.

Here's how it works:

- You complete the POD form, designating a beneficiary and providing their contact information.

- The form is submitted to the bank, where it's kept on file.

- When you pass away, the bank will distribute the funds in your account to the designated beneficiary.

The POD form does not affect your ability to manage your account during your lifetime. You can still make withdrawals, deposits, and other transactions as you normally would.

Benefits of Using a Payable on Death Form

Using a payable on death form can provide several benefits, including:

- Avoiding probate: By designating a POD beneficiary, you can avoid the probate process, which can be time-consuming and costly.

- Ensuring quick distribution of assets: The POD form allows for the quick distribution of assets to your beneficiary, providing them with financial support during a difficult time.

- Maintaining control: You maintain control over your account during your lifetime, and the POD form only comes into effect after your passing.

How to Complete a Huntington Bank Payable on Death Form

Completing a Huntington Bank payable on death form is a straightforward process. Here's a step-by-step guide to help you get started:

Step 1: Obtain the POD Form

You can obtain a payable on death form from Huntington Bank's website or by visiting a local branch. The form may be available online, or you may need to request it from a bank representative.

Step 2: Complete the Form

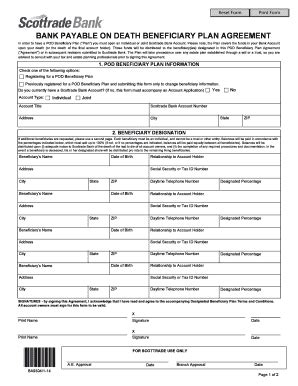

Once you have the form, you'll need to provide the following information:

- Your name and account number

- The name and contact information of your beneficiary

- The beneficiary's Social Security number or Individual Taxpayer Identification Number (ITIN)

Step 3: Sign the Form

Once you've completed the form, you'll need to sign it in the presence of a notary public. This is an important step, as it ensures that the form is legally binding.

Step 4: Submit the Form

After signing the form, you'll need to submit it to Huntington Bank. You can do this by mailing the form to the bank or by taking it to a local branch.

Frequently Asked Questions

What happens if I don't designate a POD beneficiary?

If you don't designate a POD beneficiary, your account will be subject to probate after your passing. This can be a time-consuming and costly process.

Can I change my POD beneficiary?

Yes, you can change your POD beneficiary at any time by completing a new payable on death form and submitting it to the bank.

Are POD accounts taxable?

POD accounts are generally not taxable during your lifetime. However, the beneficiary may be required to pay taxes on the funds they receive after your passing.

Conclusion and Final Thoughts

Completing a Huntington Bank payable on death form is a simple and effective way to ensure that your assets are transferred to your loved ones after your passing. By following the steps outlined in this article, you can provide peace of mind for yourself and your family.

If you have any questions or concerns about the payable on death form process, don't hesitate to reach out to Huntington Bank or a financial advisor.

What is a payable on death (POD) form?

+A payable on death form is a document that allows you to designate a beneficiary to receive the funds in your bank account after your passing.

How does a payable on death form work?

+When you complete a payable on death form, you're creating a contract between you and the bank. The form designates a beneficiary who will receive the funds in your account after your passing.

Can I change my POD beneficiary?

+Yes, you can change your POD beneficiary at any time by completing a new payable on death form and submitting it to the bank.

I hope this article has provided you with valuable insights into the world of payable on death forms. If you have any further questions or concerns, please don't hesitate to ask. Share your thoughts and experiences in the comments section below.