As an investor, ensuring the security and authenticity of your transactions is crucial. One way to achieve this is by using a TreasuryDirect authorization form. In this article, we will delve into the world of TreasuryDirect, exploring its benefits, working mechanisms, and the steps involved in using an authorization form.

What is TreasuryDirect?

TreasuryDirect is an online platform provided by the U.S. Department of the Treasury that allows individuals to purchase, manage, and redeem securities directly. The platform offers a range of investment options, including Treasury bills, notes, bonds, and Treasury Inflation-Protected Securities (TIPS). With TreasuryDirect, investors can easily manage their accounts, view transaction history, and make changes to their investments online.

Benefits of Using TreasuryDirect

There are several benefits to using TreasuryDirect for your investment needs. Some of the most significant advantages include:

- Convenience: TreasuryDirect allows investors to manage their accounts online, 24/7, from the comfort of their own homes.

- Security: The platform uses advanced security measures, including encryption and secure authentication, to protect investor accounts and transactions.

- Low Costs: TreasuryDirect does not charge fees for purchasing or managing securities, making it a cost-effective option for investors.

- Flexibility: The platform offers a range of investment options, allowing investors to diversify their portfolios and achieve their financial goals.

What is a TreasuryDirect Authorization Form?

A TreasuryDirect authorization form is a document that grants permission to another individual or entity to access and manage a TreasuryDirect account. This form is typically used when an investor wants to allow a third party, such as a financial advisor or attorney, to manage their account on their behalf.

When to Use a TreasuryDirect Authorization Form

There are several situations in which a TreasuryDirect authorization form may be necessary:

- When an investor wants to grant access to their account to a third party, such as a financial advisor or attorney.

- When an investor is unable to manage their account themselves, due to illness or disability.

- When an investor wants to allow a third party to make transactions on their behalf.

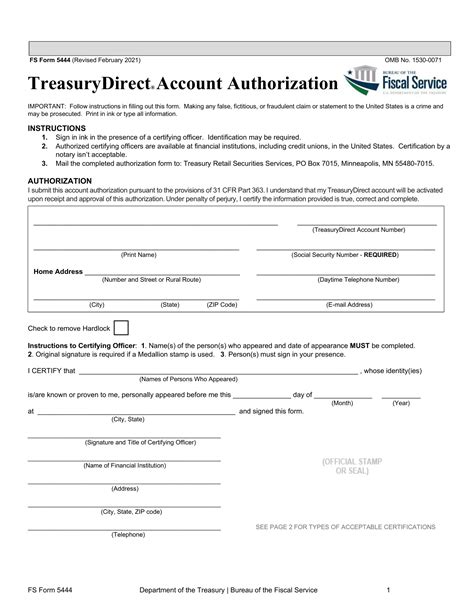

How to Complete a TreasuryDirect Authorization Form

Completing a TreasuryDirect authorization form is a straightforward process. Here are the steps involved:

- Download the authorization form from the TreasuryDirect website or obtain a copy from a TreasuryDirect customer service representative.

- Fill out the form completely and accurately, providing all required information.

- Sign the form in the presence of a notary public.

- Return the completed form to TreasuryDirect via mail or fax.

What Information is Required on the Authorization Form?

The TreasuryDirect authorization form requires the following information:

- The investor's name and account number

- The name and address of the authorized individual or entity

- A description of the authority being granted

- The investor's signature, witnessed by a notary public

Security Measures for TreasuryDirect Authorization Forms

TreasuryDirect takes the security of authorization forms seriously. Here are some of the security measures in place:

- Encryption: TreasuryDirect uses advanced encryption technology to protect authorization forms and other sensitive information.

- Secure Authentication: TreasuryDirect requires secure authentication, including passwords and PINs, to access and manage accounts.

- Physical Security: TreasuryDirect stores authorization forms and other sensitive documents in secure facilities, protected by alarms, cameras, and other security measures.

Best Practices for Using TreasuryDirect Authorization Forms

Here are some best practices for using TreasuryDirect authorization forms:

- Use strong passwords and PINs to protect your account and authorization forms.

- Keep your authorization form and other sensitive documents in a secure location.

- Monitor your account activity regularly to detect any unauthorized transactions.

- Review and update your authorization form periodically to ensure it remains accurate and up-to-date.

Conclusion

In conclusion, a TreasuryDirect authorization form is a secure and convenient way to grant access to your TreasuryDirect account to a third party. By following the steps outlined in this article and using best practices for security and authorization, you can ensure that your account and transactions are protected.

We invite you to share your experiences and questions about using TreasuryDirect authorization forms in the comments section below. Your feedback and insights will help others who are looking to use this secure and convenient investment option.

What is the purpose of a TreasuryDirect authorization form?

+A TreasuryDirect authorization form grants permission to another individual or entity to access and manage a TreasuryDirect account.

How do I complete a TreasuryDirect authorization form?

+To complete a TreasuryDirect authorization form, download the form from the TreasuryDirect website, fill it out completely and accurately, sign it in the presence of a notary public, and return it to TreasuryDirect via mail or fax.

What security measures are in place for TreasuryDirect authorization forms?

+TreasuryDirect uses advanced encryption technology, secure authentication, and physical security measures to protect authorization forms and other sensitive information.