The world of tax relief can be complex and overwhelming, especially for individuals and businesses navigating the intricate landscape of deductions and credits. One often-overlooked aspect of tax relief is the discovery of hidden gems on platforms like Reddit, where users share valuable insights and expertise. In this article, we'll delve into the Ir-4506-C form and explore how Reddit discoveries can help unlock tax relief opportunities.

Understanding the Ir-4506-C Form

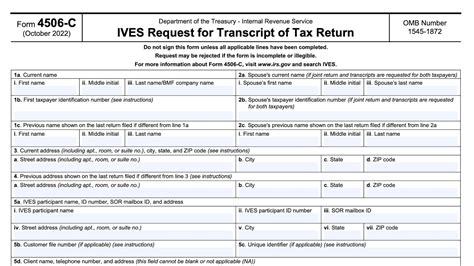

The Ir-4506-C form is a request for a copy of a tax return transcript, which is used to obtain a transcript of a previously filed tax return. This form is essential for taxpayers who need to verify their income, such as when applying for a mortgage or student loan. However, the Ir-4506-C form can also be a valuable tool for identifying tax relief opportunities.

Benefits of Using the Ir-4506-C Form

- Verification of Income: The Ir-4506-C form allows taxpayers to obtain a transcript of their previously filed tax return, which can be used to verify income.

- Amended Returns: The form can be used to request a transcript of an amended return, which can help identify potential tax relief opportunities.

- Tax Planning: By analyzing the transcript, taxpayers can identify areas for tax planning and optimization.

Reddit Discoveries for Tax Relief

Reddit is a treasure trove of information, with communities like r/taxprep and r/accounting sharing valuable insights and expertise. By leveraging these communities, taxpayers can unlock tax relief opportunities and gain a deeper understanding of the Ir-4506-C form.

Reddit Threads for Tax Relief

- "Tax Relief Opportunities You're Missing Out On": This thread discusses often-overlooked tax relief opportunities, including the use of the Ir-4506-C form.

- "Amended Returns: A Step-by-Step Guide": This thread provides a comprehensive guide to filing amended returns, including the use of the Ir-4506-C form.

- "Tax Planning Strategies for Small Business Owners": This thread shares tax planning strategies for small business owners, including the use of the Ir-4506-C form.

Steps to Unlock Tax Relief with the Ir-4506-C Form

By following these steps, taxpayers can unlock tax relief opportunities using the Ir-4506-C form:

- Request a Transcript: Use the Ir-4506-C form to request a transcript of your previously filed tax return.

- Analyze the Transcript: Review the transcript to identify potential tax relief opportunities.

- Consult a Tax Professional: Consult with a tax professional to ensure you're taking advantage of all available tax relief opportunities.

Common Mistakes to Avoid

When using the Ir-4506-C form, taxpayers should avoid the following common mistakes:

- Incomplete or Inaccurate Information: Ensure that all information on the form is complete and accurate.

- Failure to Sign the Form: Sign the form to ensure it's processed correctly.

- Not Keeping Records: Keep a copy of the form and transcript for future reference.

Conclusion

The Ir-4506-C form is a powerful tool for unlocking tax relief opportunities. By leveraging Reddit discoveries and following the steps outlined in this article, taxpayers can gain a deeper understanding of the form and identify potential tax relief opportunities. Remember to avoid common mistakes and consult with a tax professional to ensure you're taking advantage of all available tax relief opportunities.

Call to Action

Don't miss out on tax relief opportunities! Share your experiences with the Ir-4506-C form in the comments below. Have you used the form to unlock tax relief opportunities? What tips do you have for fellow taxpayers? Share your insights and help others navigate the complex world of tax relief.

What is the Ir-4506-C form used for?

+The Ir-4506-C form is used to request a copy of a tax return transcript, which can be used to verify income or identify potential tax relief opportunities.

How do I request a transcript using the Ir-4506-C form?

+Complete the Ir-4506-C form and sign it. Then, mail or fax the form to the IRS address listed on the form.

What are some common mistakes to avoid when using the Ir-4506-C form?

+Common mistakes to avoid include incomplete or inaccurate information, failure to sign the form, and not keeping records.