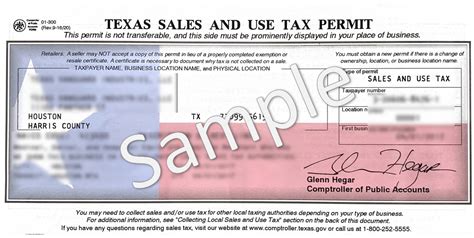

Obtaining a Texas Sales Tax Permit is a crucial step for businesses operating in the Lone Star State. The SS 5 Form, also known as the Sales Tax Permit Application, is the primary document required to register for a sales tax permit. In this article, we will guide you through the process of filing for a Texas Sales Tax Permit using the SS 5 Form.

Why Do You Need a Texas Sales Tax Permit?

As a business owner in Texas, you are required to collect sales tax on taxable sales and remit it to the state. The Texas Comptroller's office requires businesses to obtain a sales tax permit to ensure compliance with state tax laws. Without a valid sales tax permit, you may face penalties, fines, and even business closure.

Who Needs a Texas Sales Tax Permit?

Any business that sells taxable goods or services in Texas is required to obtain a sales tax permit. This includes:

- Retailers

- Wholesalers

- Restaurants

- Hotels

- Online sellers

- Service providers (e.g., contractors, consulting services)

What is the SS 5 Form?

The SS 5 Form is the official application for a Texas Sales Tax Permit. The form requires businesses to provide detailed information about their operations, including business name, address, and type of business. The form also asks for information about the business owner(s) or officers, including their names, addresses, and Social Security numbers.

What Information is Required on the SS 5 Form?

To complete the SS 5 Form, you will need to provide the following information:

- Business name and address

- Type of business (e.g., sole proprietorship, partnership, corporation)

- Federal Employer Identification Number (FEIN)

- Social Security numbers for business owners or officers

- Business start date

- Description of taxable goods or services sold

- Sales tax account information (if applicable)

How to File for a Texas Sales Tax Permit

Filing for a Texas Sales Tax Permit is a relatively straightforward process. Here are the steps to follow:

- Gather required information: Before starting the application process, make sure you have all the required information, including your FEIN, Social Security numbers, and business start date.

- Complete the SS 5 Form: Fill out the SS 5 Form online or by mail. You can download the form from the Texas Comptroller's website or request one by mail.

- Submit the application: Submit the completed SS 5 Form along with any required supporting documents, such as a copy of your FEIN letter.

- Pay the filing fee: There is no filing fee for a Texas Sales Tax Permit.

- Wait for processing: The Texas Comptroller's office will review your application and issue a sales tax permit if your application is approved.

Supporting Documents

You may need to provide additional supporting documents with your SS 5 Form, including:

- Copy of your FEIN letter

- Business registration documents (e.g., articles of incorporation, partnership agreement)

- Proof of identity (e.g., driver's license, passport)

Common Mistakes to Avoid

When filing for a Texas Sales Tax Permit, avoid the following common mistakes:

- Inaccurate or incomplete information: Make sure to provide accurate and complete information on the SS 5 Form.

- Late filing: File your application in a timely manner to avoid penalties and fines.

- Insufficient supporting documents: Provide all required supporting documents to avoid delays in processing.

Penalties for Non-Compliance

Failure to obtain a Texas Sales Tax Permit or comply with sales tax laws can result in penalties and fines, including:

- Fines: Up to $500 per offense

- Penalties: Up to 10% of the tax due

- Interest: On unpaid taxes and penalties

- Business closure: In severe cases, the Texas Comptroller's office may close your business for non-compliance.

Conclusion: Getting Started with Your Texas Sales Tax Permit

Obtaining a Texas Sales Tax Permit is a crucial step for businesses operating in Texas. By following the steps outlined in this article and avoiding common mistakes, you can ensure a smooth application process. Remember to file your application in a timely manner and provide all required information and supporting documents.

We hope this article has provided you with a comprehensive guide to filing for a Texas Sales Tax Permit using the SS 5 Form. If you have any further questions or concerns, please don't hesitate to comment below.

What is the purpose of the SS 5 Form?

+The SS 5 Form is the official application for a Texas Sales Tax Permit. It requires businesses to provide detailed information about their operations, including business name, address, and type of business.

Who needs a Texas Sales Tax Permit?

+Any business that sells taxable goods or services in Texas is required to obtain a sales tax permit. This includes retailers, wholesalers, restaurants, hotels, online sellers, and service providers.

What are the penalties for non-compliance with Texas sales tax laws?

+Failure to obtain a Texas Sales Tax Permit or comply with sales tax laws can result in penalties and fines, including fines up to $500 per offense, penalties up to 10% of the tax due, interest on unpaid taxes and penalties, and business closure in severe cases.