Filling out a T Rowe Price mutual fund form can seem like a daunting task, but with a clear understanding of the process, it can be accomplished with ease. As a leading financial institution, T Rowe Price offers a wide range of mutual funds that cater to various investment goals and risk appetites. In this article, we will guide you through the 5 essential steps to fill out a T Rowe Price mutual fund form.

Why Investing with T Rowe Price Matters

Before we dive into the steps, it's essential to understand the benefits of investing with T Rowe Price. With over 80 years of experience in the financial industry, T Rowe Price has established itself as a trusted name in mutual fund investing. Their funds are designed to provide long-term growth, income, and capital preservation, making them an attractive option for investors seeking to achieve their financial goals.

Step 1: Gather Required Information and Documents

Before you start filling out the form, ensure you have all the necessary information and documents. These typically include:

- Personal details: name, address, phone number, and Social Security number or Individual Taxpayer Identification Number (ITIN)

- Account information: existing account number (if applicable), investment amount, and fund selection

- Tax information: tax identification number, tax filing status, and tax withholding elections (if applicable)

- Beneficiary information (if applicable): name, address, and Social Security number or ITIN

Having all the required information and documents readily available will save you time and reduce the likelihood of errors.

Step 2: Choose Your Investment Option

Understanding T Rowe Price Mutual Fund Options

T Rowe Price offers a diverse range of mutual funds, each with its unique investment objective, strategy, and risk profile. It's essential to choose a fund that aligns with your investment goals, risk tolerance, and time horizon.

Some popular T Rowe Price mutual fund options include:

- Equity funds: invest in stocks to provide long-term growth

- Fixed income funds: invest in bonds to provide regular income

- Balanced funds: invest in a mix of stocks and bonds to provide a balance between growth and income

- Index funds: track a specific market index to provide broad diversification

When selecting a fund, consider factors such as investment minimums, expense ratios, and historical performance.

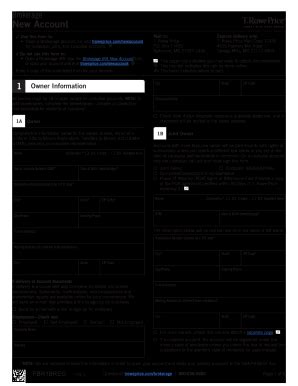

Step 3: Fill Out the Account Application

Once you've chosen your investment option, it's time to fill out the account application. The application will ask for personal and account information, as well as investment details.

When filling out the application:

- Ensure you provide accurate and complete information to avoid delays or errors

- Review the fund's prospectus and shareholder reports to understand the investment strategy and risks

- Consider consulting with a financial advisor or conducting your own research to make an informed investment decision

Step 4: Complete the Investment Section

Understanding Investment Minimums and Requirements

When completing the investment section, you'll need to specify the investment amount and select the fund(s) you wish to invest in. Be aware of the following:

- Investment minimums: the minimum amount required to invest in a particular fund

- Investment requirements: additional requirements, such as automatic investment plans or systematic withdrawal plans

It's essential to review the fund's prospectus and shareholder reports to understand the investment minimums and requirements.

Step 5: Review, Sign, and Submit the Form

Once you've completed the form, review it carefully to ensure accuracy and completeness. Sign the form and submit it to T Rowe Price, either online, by mail, or through a financial advisor.

After submitting the form, you can expect to receive a confirmation of your investment, as well as ongoing statements and reports to help you monitor your investment's performance.

Stay Informed and Engaged

Investing with T Rowe Price is just the first step in achieving your financial goals. To ensure long-term success, it's essential to stay informed and engaged with your investments.

- Regularly review your investment portfolio to ensure it remains aligned with your goals and risk tolerance

- Stay up-to-date with market news and trends to make informed investment decisions

- Consider consulting with a financial advisor or conducting your own research to optimize your investment strategy

By following these 5 essential steps and staying informed and engaged, you can confidently fill out a T Rowe Price mutual fund form and take the first step towards achieving your financial goals.

We encourage you to share your experiences and insights in the comments section below. If you have any questions or concerns, please don't hesitate to reach out.

What is the minimum investment required to invest in a T Rowe Price mutual fund?

+The minimum investment required to invest in a T Rowe Price mutual fund varies depending on the fund. Some funds have a minimum investment requirement of $2,500, while others may have a higher or lower minimum.

How do I choose the right T Rowe Price mutual fund for my investment goals?

+To choose the right T Rowe Price mutual fund for your investment goals, consider factors such as your risk tolerance, time horizon, and investment objectives. You can also consult with a financial advisor or conduct your own research to make an informed investment decision.

Can I invest in a T Rowe Price mutual fund online?

+Yes, you can invest in a T Rowe Price mutual fund online through their website or through a financial advisor.