Tax season can be a daunting time for many individuals, especially for those who are not familiar with the tax laws and regulations of the District of Columbia (DC). As a nonresident of DC, you may be wondering if you need to file a tax return with the DC Office of Tax and Revenue. The answer is yes, if you have earned income from sources within DC. In this article, we will provide you with 5 essential filing tips for the DC nonresident tax form.

Understanding DC Nonresident Tax Obligations

As a nonresident of DC, you are required to file a tax return if you have earned income from sources within the District. This includes income from employment, self-employment, and other sources such as rent, dividends, and interest. The DC nonresident tax form is used to report this income and calculate the tax owed to the District.

What is Considered DC Source Income?

DC source income includes:

- Wages, salaries, and tips earned from working in DC

- Self-employment income earned from a business or profession conducted in DC

- Rent and royalty income from properties located in DC

- Dividend and interest income from DC sources

- Capital gains from the sale of DC real property or securities

Filing Tips for DC Nonresident Tax Form

Here are 5 essential filing tips for the DC nonresident tax form:

1. Determine Your Filing Status

Your filing status will determine the tax rates and credits you are eligible for. As a nonresident, you will file as a single individual or as married filing separately. You will not be eligible to file jointly with your spouse unless you are a resident of DC.

2. Gather All Necessary Documents

Make sure you have all the necessary documents to complete your tax return. This includes:

- W-2 forms from employers

- 1099 forms for self-employment income

- Rent and royalty statements

- Dividend and interest statements

- Capital gains statements

3. Use the Correct Tax Forms

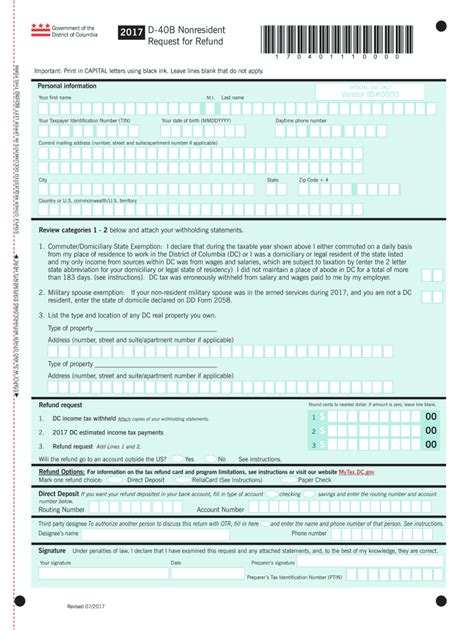

The DC nonresident tax form is Form D-40B. You will also need to complete Schedule H to report your DC source income. Make sure you use the correct forms to avoid delays in processing your return.

4. Take Advantage of Credits and Deductions

As a nonresident, you may be eligible for credits and deductions on your DC tax return. This includes the standard deduction, personal exemption, and credits for taxes paid to other jurisdictions. Make sure you take advantage of these credits and deductions to reduce your tax liability.

5. File Electronically or by Mail

You can file your DC nonresident tax form electronically or by mail. Electronic filing is faster and more secure, and you will receive your refund faster. If you file by mail, make sure you use the correct mailing address and follow the instructions carefully.

Penalties for Not Filing or Late Filing

If you fail to file your DC nonresident tax form or file late, you may be subject to penalties and interest. The penalty for not filing is 5% of the tax due per month, up to a maximum of 25%. The penalty for late filing is 1% of the tax due per month, up to a maximum of 12%.

Additional Resources

If you need additional help or resources, you can contact the DC Office of Tax and Revenue or visit their website. They offer a variety of resources, including tax forms, instructions, and FAQs.

Conclusion

Filing a DC nonresident tax form can be a complex and time-consuming process. However, by following these 5 essential filing tips, you can ensure that you file correctly and avoid penalties and interest. Remember to determine your filing status, gather all necessary documents, use the correct tax forms, take advantage of credits and deductions, and file electronically or by mail.

We hope this article has been informative and helpful. If you have any questions or comments, please feel free to share them below.

What is the deadline for filing the DC nonresident tax form?

+The deadline for filing the DC nonresident tax form is April 15th of each year.

Do I need to file a DC nonresident tax form if I have no tax liability?

+No, you do not need to file a DC nonresident tax form if you have no tax liability.