Understanding the 1099-SA Distribution Code 1: An Overview

The 1099-SA is a tax form used to report distributions from a Health Savings Account (HSA) or a Medical Savings Account (MSA). One of the most critical pieces of information on this form is the distribution code, which indicates the reason for the distribution. Distribution Code 1 is used to report distributions that are not subject to the 20% additional tax, meaning the distribution is for a qualified medical expense or the account holder has reached age 65, is disabled, or has died. In this article, we will explore five ways to understand the 1099-SA Distribution Code 1.

What is a 1099-SA Form?

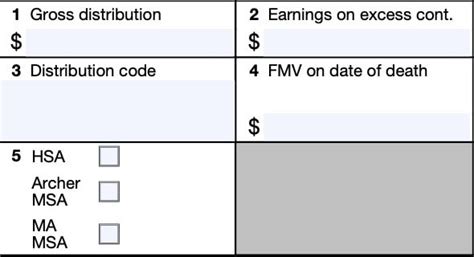

Before diving into the distribution code, it's essential to understand what a 1099-SA form is. The 1099-SA is a tax form used to report distributions from an HSA or MSA. This form is typically issued by the account custodian or trustee and provides information about the distribution, including the amount, distribution code, and account holder's name and address.

5 Ways to Understand 1099-SA Distribution Code 1

- Qualified Medical Expenses

The most common reason for a Distribution Code 1 is a qualified medical expense. According to the IRS, qualified medical expenses are expenses that are not reimbursed by insurance and are related to the diagnosis, cure, mitigation, treatment, or prevention of disease. This includes expenses such as doctor visits, hospital stays, prescriptions, and medical equipment.

- Age 65 or Older

Another reason for a Distribution Code 1 is if the account holder is 65 or older. At this age, the account holder is no longer subject to the 20% additional tax on distributions. This means that even if the distribution is not for a qualified medical expense, the account holder will not be penalized.

Disability and Death

In addition to qualified medical expenses and age 65 or older, a Distribution Code 1 may also be used if the account holder is disabled or has died. If the account holder is disabled, the distribution is not subject to the 20% additional tax. Similarly, if the account holder has died, the distribution is not subject to the 20% additional tax, and the beneficiary may use the funds for qualified medical expenses.

How to Report a Distribution Code 1

When reporting a Distribution Code 1, the account custodian or trustee will complete the 1099-SA form and provide the following information:

- The account holder's name and address

- The account number

- The distribution amount

- The distribution code (1)

- The date of the distribution

What to Do with a Distribution Code 1

If you receive a 1099-SA with a Distribution Code 1, you will need to report the distribution on your tax return. You will need to complete Form 8889, which is the Health Savings Account (HSA) form. You will report the distribution on Line 14a of the form and complete the rest of the form as instructed.

Common Mistakes to Avoid

When dealing with a 1099-SA and Distribution Code 1, there are several common mistakes to avoid:

- Failing to report the distribution on your tax return

- Reporting the distribution as taxable income

- Failing to complete Form 8889 correctly

- Not keeping records of qualified medical expenses

Conclusion

In conclusion, understanding the 1099-SA Distribution Code 1 is crucial for accurate tax reporting. By following the five ways to understand Distribution Code 1 outlined in this article, you can ensure that you are reporting your HSA or MSA distributions correctly. Remember to report the distribution on your tax return, complete Form 8889 correctly, and keep records of qualified medical expenses.

We encourage you to share your experiences with 1099-SA forms and Distribution Code 1 in the comments below. If you have any questions or need further clarification, please don't hesitate to ask.

FAQs:

What is a 1099-SA form?

+A 1099-SA is a tax form used to report distributions from a Health Savings Account (HSA) or a Medical Savings Account (MSA).

What is Distribution Code 1?

+Distribution Code 1 is used to report distributions that are not subject to the 20% additional tax, meaning the distribution is for a qualified medical expense or the account holder has reached age 65, is disabled, or has died.

How do I report a Distribution Code 1?

+You will need to complete Form 8889, which is the Health Savings Account (HSA) form. You will report the distribution on Line 14a of the form and complete the rest of the form as instructed.