The IRS Form 15111 is a document that taxpayers use to request a refund or credit for overpaid taxes, penalties, or interest. If you have submitted this form and are eagerly waiting for a response, you're probably wondering how to check the status of your request. In this article, we will explore five ways to check the status of your IRS Form 15111.

Taxpayers who submit Form 15111 want to ensure their request is processed quickly and efficiently. After all, who doesn't want to receive a refund or credit as soon as possible? The IRS offers several methods to track the status of your form, and we will outline each one below.

Understanding IRS Form 15111

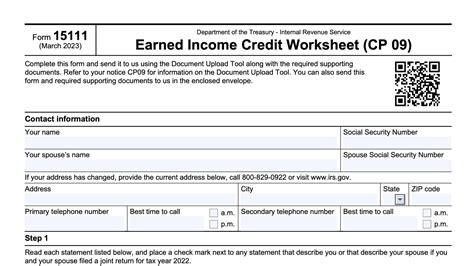

Before we dive into the methods to check the status of your form, let's take a brief look at what Form 15111 is and why you might need to submit it. The IRS uses Form 15111 to process requests for refunds or credits related to overpaid taxes, penalties, or interest. You may need to submit this form if you have overpaid your taxes, made an error on your tax return, or if the IRS has made an error in processing your return.

Method 1: Check Online Using the IRS Website

The IRS website offers a convenient way to check the status of your Form 15111. You can visit the IRS website and use the "Where's My Refund?" tool to track the status of your refund or credit. To use this tool, you will need to provide your Social Security number or Individual Taxpayer Identification Number (ITIN), your filing status, and the exact amount of your refund.

Steps to Check Online:**

- Visit the IRS website at irs.gov.

- Click on the "Refunds" tab.

- Select "Where's My Refund?".

- Enter your Social Security number or ITIN.

- Select your filing status.

- Enter the exact amount of your refund.

Method 2: Call the IRS Phone Number

If you prefer to speak with a live representative, you can call the IRS phone number to check the status of your Form 15111. The IRS offers a dedicated phone line for refund inquiries. You can call the IRS at 1-800-829-1040 (individuals) or 1-800-829-4933 (businesses). Be prepared to provide your Social Security number or ITIN and the exact amount of your refund.

Steps to Call the IRS:**

- Dial the IRS phone number (1-800-829-1040 for individuals or 1-800-829-4933 for businesses).

- Follow the automated prompts to reach a live representative.

- Provide your Social Security number or ITIN.

- Provide the exact amount of your refund.

Method 3: Check Your Email

If you submitted your Form 15111 electronically, you may receive an email from the IRS with updates on the status of your request. The IRS may send you an email to confirm receipt of your form or to request additional information. Be sure to check your email regularly for any updates from the IRS.

Method 4: Check Your Mail

The IRS may send you a letter or notice with updates on the status of your Form 15111. Be sure to check your mail regularly for any correspondence from the IRS. If you receive a letter or notice, be sure to follow the instructions carefully and respond promptly if required.

Method 5: Visit Your Local IRS Office

If you prefer to speak with a representative in person, you can visit your local IRS office to check the status of your Form 15111. Be sure to bring your Social Security number or ITIN and the exact amount of your refund. You can find your local IRS office by visiting the IRS website and using the "Help & Resources" tool.

Steps to Visit Your Local IRS Office:**

- Visit the IRS website at irs.gov.

- Click on the "Help & Resources" tab.

- Select "Contact Your Local IRS Office".

- Enter your city and state or zip code.

- Find your local IRS office and visit in person.

Now that you know the five ways to check the status of your IRS Form 15111, you can stay informed and up-to-date on the progress of your refund or credit. Remember to be patient and allow the IRS sufficient time to process your request.

We hope this article has been helpful in guiding you through the process of checking the status of your Form 15111. If you have any questions or concerns, please feel free to ask in the comments below.

How long does it take to process Form 15111?

+The processing time for Form 15111 varies depending on the complexity of the request and the workload of the IRS. Generally, it can take several weeks to several months to process a refund or credit.

Can I track the status of my Form 15111 online?

+What if I made an error on my Form 15111?

+If you made an error on your Form 15111, you will need to correct the error and resubmit the form. You can also contact the IRS for assistance.