The Missouri Gas Tax Refund Form 4923-H is a valuable opportunity for individuals and businesses to claim a refund on the gas tax they paid on non-highway fuel usage. In this article, we will guide you through the 5 steps to claim your Mo Gas Tax Refund Form 4923-H.

Step 1: Determine Eligibility

Before starting the refund process, it is essential to determine if you are eligible to claim the Mo Gas Tax Refund. To qualify, you must have used gasoline or diesel fuel for non-highway purposes, such as:

- Agricultural purposes

- Aviation purposes

- Industrial purposes

- Railroad purposes

- Other off-highway purposes

You must also have paid the Missouri gas tax on the fuel you used. If you are unsure about your eligibility, you can consult the Missouri Department of Revenue's website or contact their customer service.

What is Non-Highway Fuel Usage?

Non-highway fuel usage refers to the use of gasoline or diesel fuel for purposes other than operating a vehicle on public highways. This includes fuel used for:

- Agricultural equipment, such as tractors and combines

- Aircraft and aviation equipment

- Industrial equipment, such as generators and pumps

- Railroad equipment

- Other equipment not used on public highways

Step 2: Gather Required Documents

To claim your Mo Gas Tax Refund, you will need to gather the following documents:

- Fuel receipts or invoices showing the amount of fuel purchased and the Missouri gas tax paid

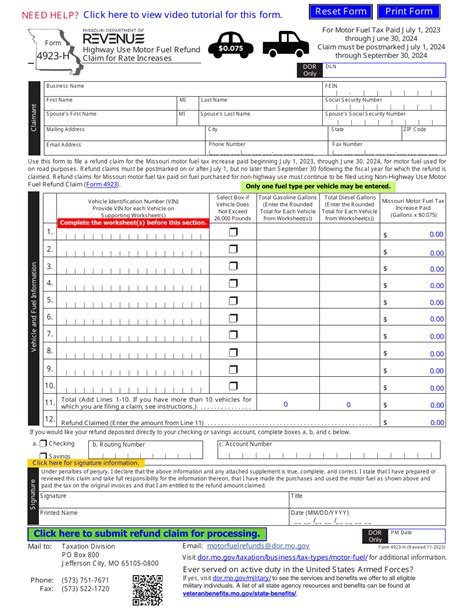

- A copy of your Missouri Gas Tax Refund Form 4923-H

- A copy of your federal income tax return (if applicable)

- Any other supporting documentation, such as a farm exemption certificate or an aviation exemption certificate

Make sure to keep all your documents organized and easily accessible, as you will need to refer to them during the refund process.

Tips for Gathering Documents

- Keep all your fuel receipts and invoices in a designated folder or file.

- Make sure to include all required information on your Missouri Gas Tax Refund Form 4923-H, such as your name, address, and social security number.

- If you are claiming a refund for multiple years, make sure to include all relevant documents for each year.

Step 3: Calculate Your Refund Amount

To calculate your refund amount, you will need to determine the total amount of Missouri gas tax you paid on non-highway fuel usage. You can do this by:

- Reviewing your fuel receipts and invoices to determine the total amount of fuel purchased and the Missouri gas tax paid

- Using a calculator or spreadsheet to calculate the total amount of Missouri gas tax paid

- Consulting the Missouri Department of Revenue's website for guidance on calculating your refund amount

Example of Refund Calculation

Let's say you purchased 1,000 gallons of gasoline for agricultural purposes and paid $0.17 per gallon in Missouri gas tax. Your total Missouri gas tax paid would be:

1,000 gallons x $0.17 per gallon = $170

You would be eligible to claim a refund of $170.

Step 4: Complete and Submit Your Refund Form

Once you have calculated your refund amount, you can complete and submit your Missouri Gas Tax Refund Form 4923-H. Make sure to:

- Fill out the form accurately and completely

- Include all required documentation, such as fuel receipts and invoices

- Submit the form by the deadline, which is typically April 15th of each year

You can submit your refund form by mail or electronically through the Missouri Department of Revenue's website.

Tips for Submitting Your Refund Form

- Make sure to sign and date your refund form

- Include a copy of your federal income tax return (if applicable)

- Keep a copy of your refund form and supporting documentation for your records

Step 5: Follow Up on Your Refund

After submitting your refund form, you can follow up on the status of your refund by:

- Contacting the Missouri Department of Revenue's customer service

- Checking the status of your refund online through the Missouri Department of Revenue's website

- Waiting for your refund check to be mailed to you

If you have any questions or concerns about your refund, don't hesitate to reach out to the Missouri Department of Revenue for assistance.

Tips for Following Up on Your Refund

- Keep a record of your refund submission, including the date and method of submission

- Follow up on your refund status regularly to ensure timely processing

- Contact the Missouri Department of Revenue's customer service if you have any questions or concerns about your refund

By following these 5 steps, you can successfully claim your Mo Gas Tax Refund Form 4923-H and receive the refund you deserve. Remember to stay organized, gather all required documents, and follow up on your refund status to ensure a smooth and efficient process.

What is the deadline for submitting my Mo Gas Tax Refund Form 4923-H?

+The deadline for submitting your Mo Gas Tax Refund Form 4923-H is typically April 15th of each year.

Can I submit my refund form electronically?

+Yes, you can submit your refund form electronically through the Missouri Department of Revenue's website.

How long does it take to process my refund?

+The processing time for refunds can vary, but it typically takes 6-8 weeks for refunds to be processed and mailed.