In today's digital age, managing finances efficiently is crucial for individuals and businesses alike. One way to streamline your financial transactions is by setting up direct deposit. Cadence Bank, a leading financial institution, offers a convenient direct deposit service that allows you to receive payments quickly and securely. In this article, we will guide you through the easy setup process of Cadence Bank's direct deposit form, ensuring you can take advantage of this service without any hassle.

Having a direct deposit setup can significantly reduce the time it takes to receive payments, making it an essential tool for individuals receiving salaries, benefits, or other regular payments. It's also a convenient option for businesses looking to manage their payroll efficiently. By understanding how to set up Cadence Bank's direct deposit, you can ensure that your financial transactions are processed smoothly and promptly.

Understanding Cadence Bank Direct Deposit

Before we dive into the setup process, it's essential to understand how Cadence Bank's direct deposit service works. Direct deposit is an electronic payment method that allows funds to be transferred directly from the payer's account to the recipient's account. This service is facilitated by the Automated Clearing House (ACH) network, which ensures secure and efficient transactions.

Cadence Bank's direct deposit service is designed to provide users with a convenient and reliable way to manage their financial transactions. With this service, you can receive payments directly into your account, eliminating the need for physical checks or cash. This not only saves time but also reduces the risk of lost or stolen payments.

Benefits of Cadence Bank Direct Deposit

There are several benefits to using Cadence Bank's direct deposit service. Some of the key advantages include:

- Faster Payment Receipt: With direct deposit, you can receive payments up to 2-3 days faster than traditional check payments.

- Increased Security: Direct deposit eliminates the risk of lost or stolen checks, ensuring that your payments are secure and reliable.

- Convenience: Direct deposit allows you to receive payments directly into your account, eliminating the need for physical checks or cash.

- Reduced Administrative Burden: Direct deposit reduces the administrative burden associated with processing and managing physical checks.

Setting Up Cadence Bank Direct Deposit

Setting up Cadence Bank's direct deposit service is a straightforward process that can be completed in a few easy steps. Here's a step-by-step guide to help you get started:

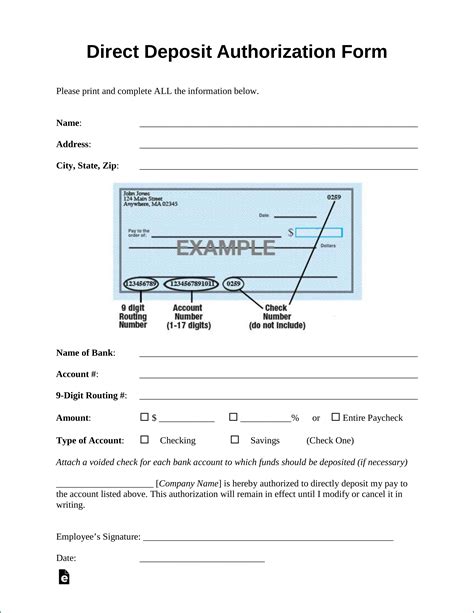

- Obtain a Direct Deposit Form: You can obtain a direct deposit form from Cadence Bank's website or by visiting a local branch.

- Gather Required Information: You will need to provide your account information, including your account number and routing number.

- Fill Out the Form: Complete the direct deposit form by providing the required information.

- Submit the Form: Submit the completed form to Cadence Bank or provide it to your employer/payroll department.

Required Information for Direct Deposit Form

When completing the direct deposit form, you will need to provide the following information:

- Account Number: Your Cadence Bank account number.

- Routing Number: Cadence Bank's routing number (this can be found on the bottom of your checks or on the bank's website).

- Account Type: The type of account you want to deposit funds into (e.g., checking or savings).

Troubleshooting Common Issues

If you encounter any issues while setting up or using Cadence Bank's direct deposit service, here are some troubleshooting tips to help you resolve common problems:

- Incorrect Account Information: Ensure that you have provided the correct account information, including your account number and routing number.

- Insufficient Funds: Ensure that you have sufficient funds in your account to cover any transactions.

- Technical Issues: If you encounter technical issues while submitting the direct deposit form, try clearing your browser cache or contacting Cadence Bank's customer support.

Conclusion

Cadence Bank's direct deposit service provides a convenient and reliable way to manage your financial transactions. By following the easy setup guide outlined in this article, you can take advantage of this service and enjoy faster payment receipt, increased security, and reduced administrative burden. If you have any questions or concerns, don't hesitate to reach out to Cadence Bank's customer support for assistance.

We hope this article has provided you with valuable insights into Cadence Bank's direct deposit service. If you have any further questions or would like to share your experiences with direct deposit, please leave a comment below. Don't forget to share this article with others who may benefit from this information.

What is Cadence Bank's direct deposit service?

+Cadence Bank's direct deposit service is an electronic payment method that allows funds to be transferred directly from the payer's account to the recipient's account.

How do I set up Cadence Bank's direct deposit service?

+To set up Cadence Bank's direct deposit service, you will need to obtain a direct deposit form, gather required information, fill out the form, and submit it to Cadence Bank or provide it to your employer/payroll department.

What are the benefits of using Cadence Bank's direct deposit service?

+The benefits of using Cadence Bank's direct deposit service include faster payment receipt, increased security, convenience, and reduced administrative burden.