Understanding the Form 480.6 A: A Comprehensive Guide for Puerto Rico Taxpayers

As a resident of Puerto Rico, it's essential to understand the tax laws and regulations that apply to you. One of the critical tax forms you'll need to familiarize yourself with is the Form 480.6 A, also known as the "Declaration of Income Tax" form. In this article, we'll delve into the world of Puerto Rico taxation, exploring the ins and outs of Form 480.6 A, its importance, and how to complete it accurately.

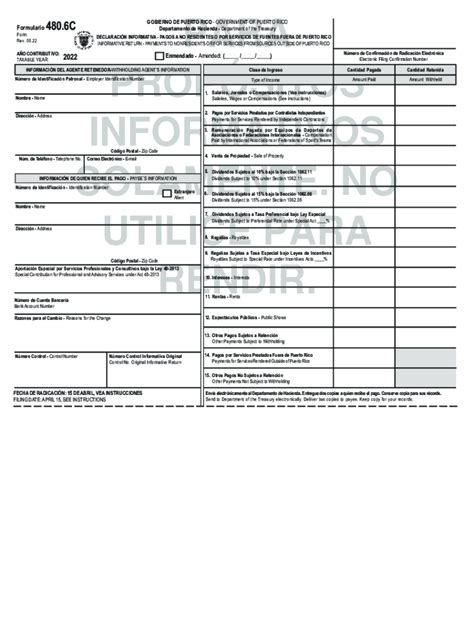

What is Form 480.6 A?

Form 480.6 A is a tax form used by individuals and businesses in Puerto Rico to report their income and pay taxes. The form is filed with the Puerto Rico Treasury Department (Departamento de Hacienda) and is typically due on April 15th of each year. The form is used to report various types of income, including salaries, wages, tips, and self-employment income.

Who Needs to File Form 480.6 A?

Not everyone in Puerto Rico needs to file Form 480.6 A. The form is typically required for individuals and businesses that meet certain income thresholds. For the tax year 2022, the following individuals and businesses are required to file Form 480.6 A:

- Individuals with a gross income of $12,000 or more

- Married couples filing jointly with a gross income of $24,000 or more

- Self-employed individuals with a net profit of $400 or more

- Businesses with a gross income of $50,000 or more

What Information is Required on Form 480.6 A?

Form 480.6 A requires various pieces of information, including:

- Personal identification information, such as name, address, and Social Security number

- Income information, including salaries, wages, tips, and self-employment income

- Deductions and exemptions, such as charitable donations and mortgage interest

- Tax credits, such as the earned income tax credit (EITC)

How to Complete Form 480.6 A

Completing Form 480.6 A can be a daunting task, but with the right guidance, it can be done accurately and efficiently. Here are some steps to follow:

- Gather all necessary documents, including W-2 forms, 1099 forms, and receipts for deductions and exemptions.

- Fill out the personal identification information section accurately.

- Report all income from various sources, including salaries, wages, tips, and self-employment income.

- Claim all eligible deductions and exemptions, such as charitable donations and mortgage interest.

- Calculate tax credits, such as the EITC, and claim them on the form.

- Sign and date the form, and attach all required documentation.

Tips for Filing Form 480.6 A

Here are some tips to keep in mind when filing Form 480.6 A:

- File electronically: The Puerto Rico Treasury Department offers an electronic filing system that makes it easier to file and process tax returns.

- Use tax software: Tax software, such as TurboTax or H&R Block, can help guide you through the filing process and ensure accuracy.

- Seek professional help: If you're unsure about any aspect of the filing process, consider consulting a tax professional.

- File on time: The deadline for filing Form 480.6 A is typically April 15th, so be sure to file on time to avoid penalties and interest.

Common Mistakes to Avoid

When filing Form 480.6 A, it's essential to avoid common mistakes that can delay processing or even result in penalties. Here are some mistakes to avoid:

- Inaccurate personal identification information

- Failure to report all income

- Ineligible deductions and exemptions

- Math errors

- Failure to sign and date the form

Puerto Rico Tax Audits

The Puerto Rico Treasury Department may conduct tax audits to ensure compliance with tax laws and regulations. If you're selected for an audit, it's essential to cooperate fully and provide all required documentation.

Conclusion: Take Control of Your Puerto Rico Taxes

Filing Form 480.6 A can seem like a daunting task, but with the right guidance, you can ensure accuracy and compliance with Puerto Rico tax laws. By understanding the requirements and following the tips outlined in this article, you can take control of your taxes and avoid common mistakes. Remember to file electronically, use tax software, and seek professional help if needed. Don't wait until the last minute – file your Form 480.6 A today and take the first step towards tax compliance.

We hope this article has been informative and helpful. If you have any questions or comments, please feel free to share them below.

What is the deadline for filing Form 480.6 A?

+The deadline for filing Form 480.6 A is typically April 15th of each year.

Who needs to file Form 480.6 A?

+Individuals and businesses that meet certain income thresholds are required to file Form 480.6 A. For the tax year 2022, this includes individuals with a gross income of $12,000 or more, married couples filing jointly with a gross income of $24,000 or more, self-employed individuals with a net profit of $400 or more, and businesses with a gross income of $50,000 or more.

What information is required on Form 480.6 A?

+Form 480.6 A requires various pieces of information, including personal identification information, income information, deductions and exemptions, and tax credits.