Establishing a trust for National Firearms Act (NFA) items can be a daunting task, especially with the numerous forms and regulations involved. Among the various options available, an NFA Form 1 trust stands out as a popular choice for firearms enthusiasts. This type of trust allows individuals to manufacture their own NFA items, such as short-barreled rifles (SBRs) and silencers, without having to obtain prior approval from the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF). In this article, we will explore the five benefits of an NFA Form 1 trust and why it's an attractive option for those interested in creating their own NFA items.

What is an NFA Form 1 Trust?

Before diving into the benefits, it's essential to understand what an NFA Form 1 trust is. An NFA Form 1 trust is a type of trust specifically designed for individuals who want to manufacture their own NFA items. By establishing this trust, individuals can submit a Form 1 application to the ATF, which, if approved, allows them to manufacture the desired NFA item.

Benefit #1: Flexibility and Convenience

One of the primary benefits of an NFA Form 1 trust is the flexibility and convenience it offers. With a trust in place, individuals can manufacture NFA items without having to obtain prior approval from the ATF. This means that if you want to create a new SBR or silencer, you can do so without having to wait for the ATF to process your application. Additionally, a trust allows you to make changes to your NFA items, such as modifying or replacing components, without having to submit a new application.

Benefit #2: Multiple Beneficiaries

Another benefit of an NFA Form 1 trust is that it allows multiple beneficiaries. This means that you can add family members, friends, or business partners to the trust, giving them access to the NFA items. This is particularly useful for families or businesses that want to share ownership of NFA items. By adding multiple beneficiaries, you can ensure that your NFA items are protected and can be transferred to your loved ones in the event of your passing.

Benefit #3: Protection of Assets

An NFA Form 1 trust provides an additional layer of protection for your assets. By placing your NFA items in a trust, you can shield them from creditors, lawsuits, and other financial risks. This is especially important for individuals who have significant assets or who are involved in high-risk activities. By protecting your NFA items, you can ensure that they remain safe and secure, even in the event of financial difficulties.

Benefit #4: Tax Benefits

Establishing an NFA Form 1 trust can also provide tax benefits. By placing your NFA items in a trust, you can avoid paying taxes on the items themselves, as well as any income generated from their sale or transfer. Additionally, a trust can help minimize estate taxes, ensuring that your NFA items are passed down to your beneficiaries without incurring significant tax liabilities.

Benefit #5: Simplified Transfer Process

Finally, an NFA Form 1 trust simplifies the transfer process for your NFA items. When you pass away, your NFA items can be transferred to your beneficiaries without having to go through the ATF's transfer process. This can save your loved ones time, money, and hassle, ensuring that your NFA items are transferred quickly and efficiently.

How to Establish an NFA Form 1 Trust

Establishing an NFA Form 1 trust requires careful planning and execution. Here are the steps to follow:

Step 1: Determine the Type of Trust

The first step is to determine the type of trust you want to establish. You can choose from a variety of trust types, including revocable and irrevocable trusts. It's essential to consult with an attorney to determine the best type of trust for your needs.

Step 2: Draft the Trust Document

Once you've determined the type of trust, you'll need to draft the trust document. This document should include the names of the beneficiaries, the type of NFA items to be included, and the terms of the trust.

Step 3: Obtain an EIN

Next, you'll need to obtain an Employer Identification Number (EIN) from the IRS. This number is required for tax purposes and will be used to identify your trust.

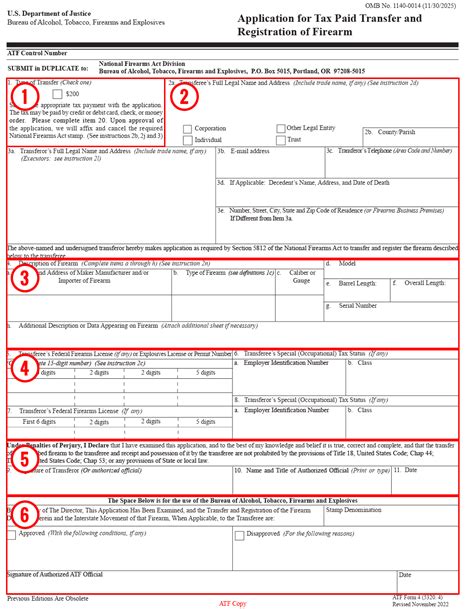

Step 4: Submit the Form 1 Application

Finally, you'll need to submit the Form 1 application to the ATF. This application should include the trust document, the EIN, and other required information.

Conclusion: Is an NFA Form 1 Trust Right for You?

An NFA Form 1 trust offers numerous benefits for individuals who want to manufacture their own NFA items. From flexibility and convenience to protection of assets and tax benefits, a trust can provide peace of mind and ensure that your NFA items are safe and secure. If you're considering establishing an NFA Form 1 trust, it's essential to consult with an attorney to determine the best course of action for your specific needs.

We invite you to share your thoughts and experiences with NFA Form 1 trusts in the comments section below. If you have any questions or concerns, feel free to ask, and we'll do our best to provide a helpful response.

What is the purpose of an NFA Form 1 trust?

+An NFA Form 1 trust allows individuals to manufacture their own NFA items, such as short-barreled rifles (SBRs) and silencers, without having to obtain prior approval from the ATF.

Can I add multiple beneficiaries to an NFA Form 1 trust?

+Do I need an attorney to establish an NFA Form 1 trust?

+While not required, it's highly recommended to consult with an attorney to ensure that your trust is established correctly and meets your specific needs.